- United States

- /

- Healthtech

- /

- NasdaqGS:CERT

Exploring High Growth Tech Stocks in January 2025

Reviewed by Simply Wall St

The United States market has shown robust performance with a 3.8% climb over the past week and a substantial 24% increase over the last year, while earnings are anticipated to grow by 15% annually in the coming years. In this context of strong market momentum, identifying high growth tech stocks involves looking for companies with innovative technologies and scalable business models that can capitalize on these favorable economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 55.24% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.66% | ★★★★★★ |

| Blueprint Medicines | 23.25% | 55.27% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Rhythm Pharmaceuticals (NasdaqGM:RYTM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in therapies for rare neuroendocrine diseases, with a market cap of $3.35 billion.

Operations: Rhythm Pharmaceuticals generates revenue primarily through the development and commercialization of therapies for patients with rare diseases, amounting to $112.53 million.

Rhythm Pharmaceuticals is demonstrating robust potential in the high-growth biotech sector, with a forecasted revenue increase of 40.5% per year and an anticipated profit growth of 59.7% annually over the next three years. The company's strategic focus on rare genetic disorders related to obesity is evidenced by their significant R&D investment, which aligns with recent FDA approvals expanding the use of their flagship drug, IMCIVREE®, for younger patients. These regulatory milestones not only enhance Rhythm's market position but also underscore its commitment to addressing unmet medical needs through targeted therapies, setting a precedent in precision medicine for obesity management linked to specific genetic markers.

Veracyte (NasdaqGM:VCYT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Veracyte, Inc. is a diagnostics company that operates both in the United States and internationally, with a market capitalization of approximately $3.14 billion.

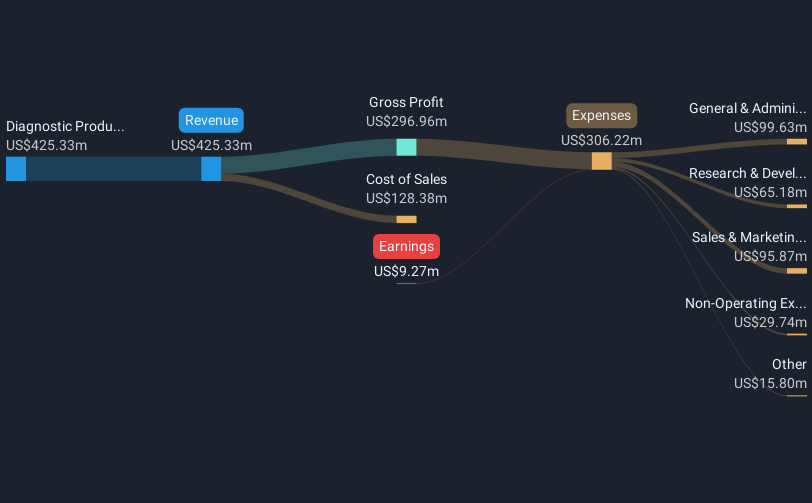

Operations: The company generates revenue primarily from its diagnostic products, amounting to $425.33 million.

Veracyte showcases a promising trajectory in the tech sector, with its revenue expected to climb by 9% annually, outpacing the broader U.S. market's growth. This increase is particularly noteworthy given the company's recent transition to profitability, with earnings projected to surge by 46.2% each year. A significant pivot in their financial health was marked by a net income of $15.16 million this quarter, a stark contrast to last year’s loss of $29.62 million over the same period. Furthermore, Veracyte has raised its full-year revenue guidance for 2024 to between $442 million and $445 million, reflecting an optimistic outlook fueled by robust testing revenue growth anticipated at around 28%. These figures underscore Veracyte’s recovery and potential within high-growth tech environments, driven by strategic expansions and enhanced operational efficiencies.

- Click to explore a detailed breakdown of our findings in Veracyte's health report.

Gain insights into Veracyte's past trends and performance with our Past report.

Certara (NasdaqGS:CERT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Certara, Inc. offers software and technology-enabled services for biosimulation in drug discovery, research, regulatory submissions, and market access globally, with a market cap of approximately $1.88 billion.

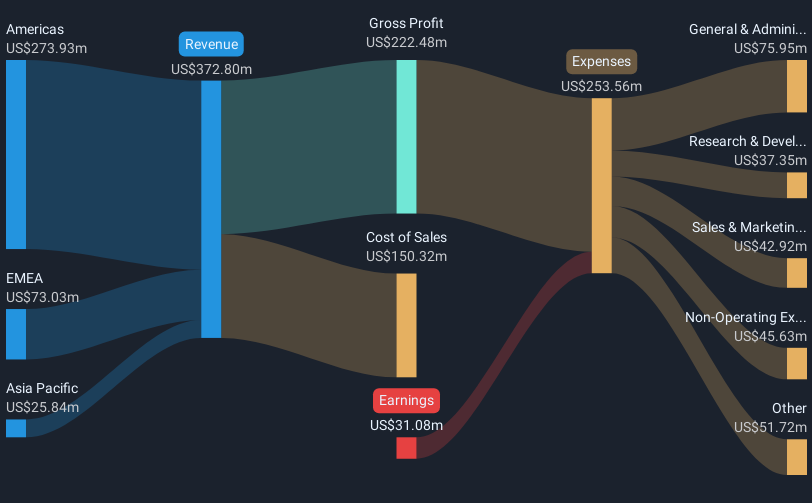

Operations: Certara generates revenue primarily through its healthcare software segment, which contributed $372.80 million. The company's operations focus on providing biosimulation solutions for drug discovery and regulatory processes.

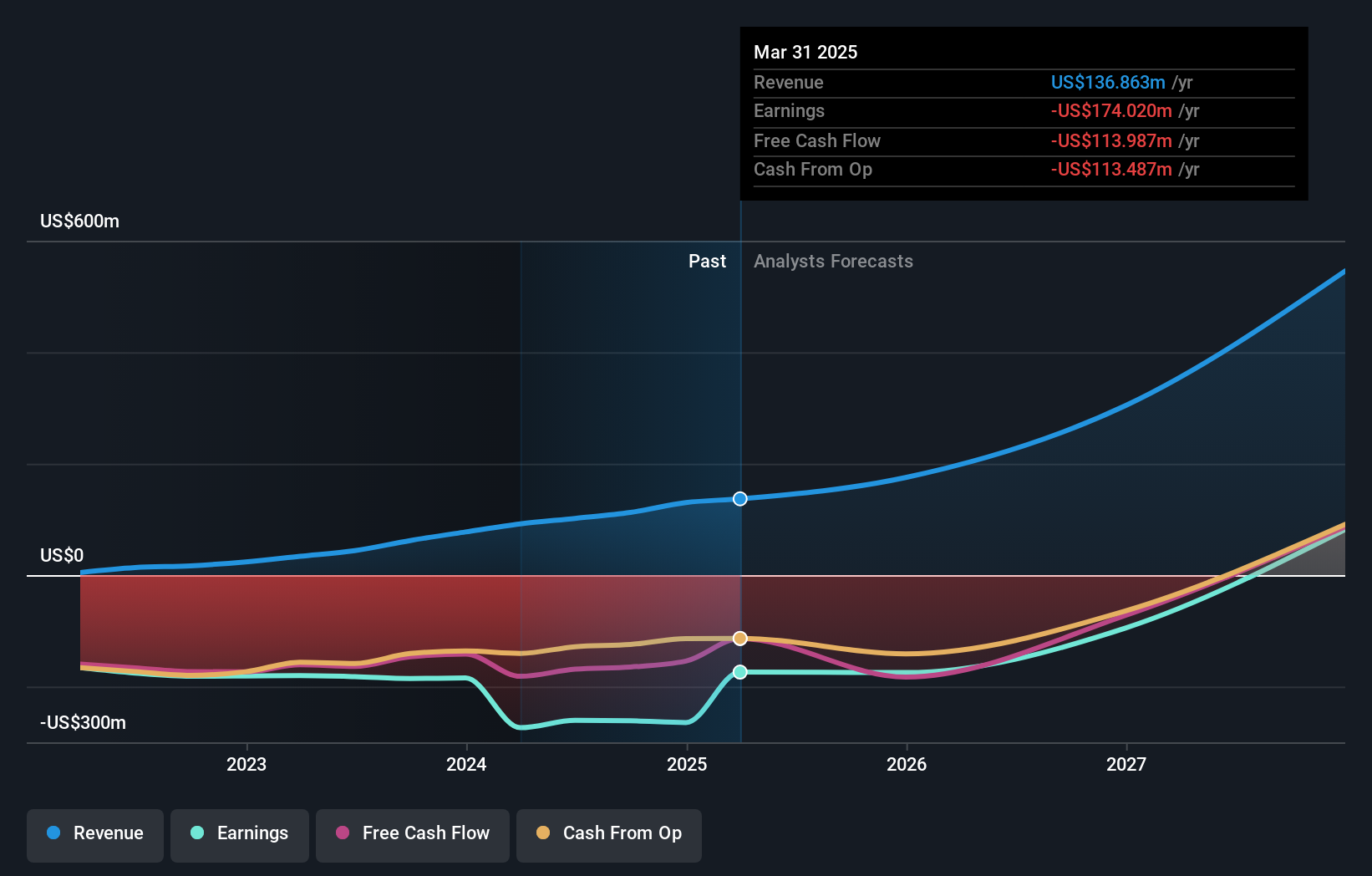

Certara, navigating through a challenging landscape, recently projected an uptick in revenue to $384.4 million for 2024, marking an 8% increase year-over-year. This growth is complemented by a significant reduction in net loss to $1.37 million in Q3 from a substantial $48.97 million the previous year, reflecting improved operational efficiency and cost management. The company's engagement at key industry events like the J.P. Morgan Healthcare Conference underscores its active role in the biotechnology sector's evolution, positioning it as a resilient player amidst tech-oriented peers striving for profitability and market adaptation.

- Unlock comprehensive insights into our analysis of Certara stock in this health report.

Assess Certara's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 229 US High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CERT

Certara

Provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives