- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

There's No Escaping CareCloud, Inc.'s (NASDAQ:CCLD) Muted Revenues

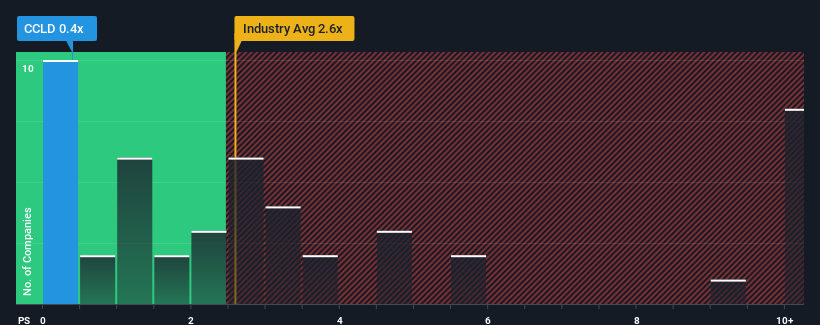

With a price-to-sales (or "P/S") ratio of 0.4x CareCloud, Inc. (NASDAQ:CCLD) may be sending very bullish signals at the moment, given that almost half of all the Healthcare Services companies in the United States have P/S ratios greater than 2.6x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for CareCloud

What Does CareCloud's Recent Performance Look Like?

CareCloud hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think CareCloud's future stacks up against the industry? In that case, our free report is a great place to start.How Is CareCloud's Revenue Growth Trending?

CareCloud's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 87% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is noticeably more attractive.

With this in consideration, its clear as to why CareCloud's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From CareCloud's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of CareCloud's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 3 warning signs we've spotted with CareCloud.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides technology-enabled business solutions, Software-as-a-Service offerings, and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives