- United States

- /

- Medical Equipment

- /

- NasdaqGS:ALGN

Align Technology (ALGN): Revisiting Valuation After Thailand Launch of New Invisalign Mandibular Advancement System

Reviewed by Simply Wall St

Align Technology (ALGN) just rolled out its Invisalign System with mandibular advancement and occlusal blocks in Thailand, and that quiet product launch is exactly what has been nudging the stock higher.

See our latest analysis for Align Technology.

Those incremental product wins are starting to show up in the tape, with a 30 day share price return of 19.06 percent and a 90 day gain of 21.09 percent, even though the year to date share price return and one year total shareholder return are both still negative. This suggests that momentum is rebuilding from a beaten down base.

If this kind of innovation has your attention, it could be a good moment to explore other healthcare names using our screener for healthcare stocks to spot your next idea.

But with shares still down sharply over one and five years, yet trading only modestly below analyst targets, is Align now a mispriced growth story in early recovery, or is the market already discounting the next leg of innovation-driven upside?

Most Popular Narrative: 10.6% Undervalued

With Align closing at $164.58 versus a widely followed fair value near $184, the leading narrative frames today’s price as lagging improving fundamentals.

The continued expansion of clinical indications for Invisalign (such as Invisalign First for teens/kids and palate expanders) and the increasing adoption by general practitioner dentists are broadening Align's addressable market, positioning the company for higher long term revenues and double digit earnings growth as these new segments mature.

Curious how steady revenue growth, rising margins, and a tighter share count can still point to potential upside from here? The narrative’s math may surprise you.

Result: Fair Value of $184.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and a shift toward lower priced aligners and traditional braces could pressure volumes and margins, which may challenge this recovery narrative.

Find out about the key risks to this Align Technology narrative.

Another Angle on Valuation

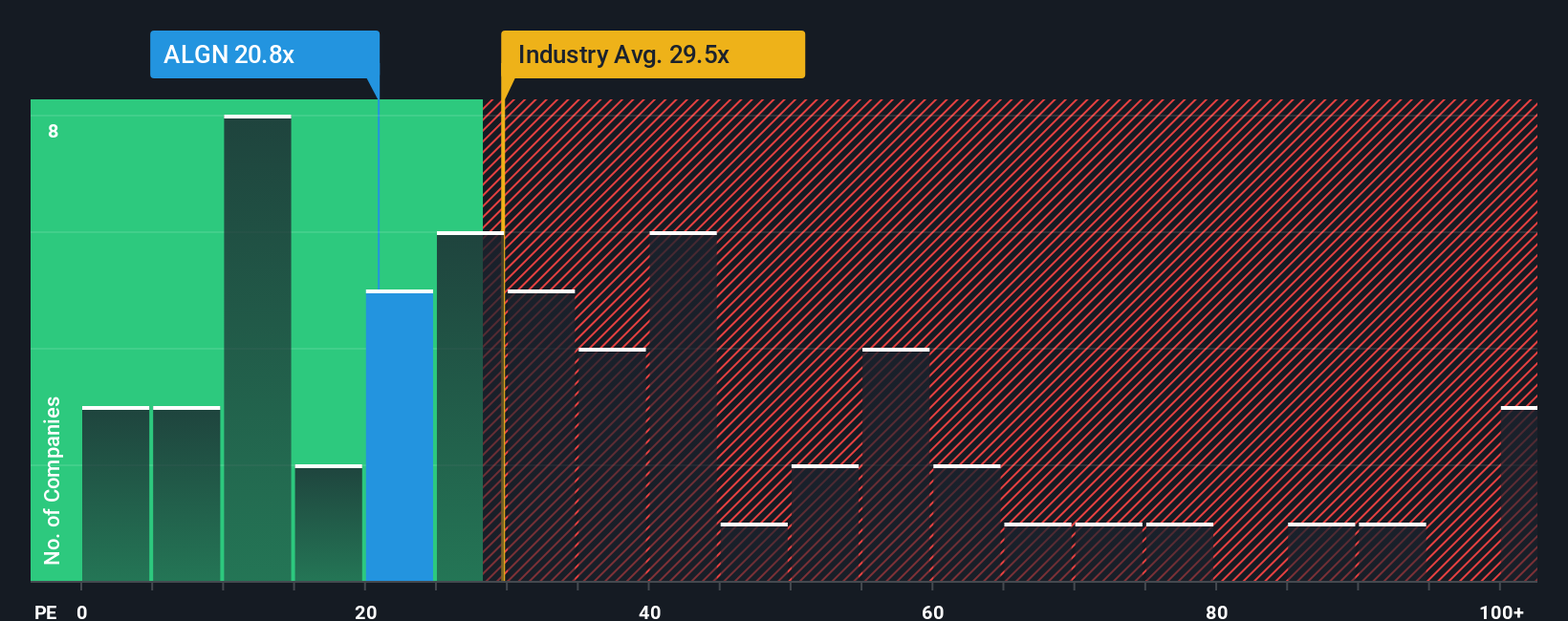

On earnings, Align looks anything but cheap. The shares trade on a price to earnings ratio of 31.2 times, above both the US Medical Equipment industry at 29.5 times and the peer average at 29.6 times, and even above its own 30.7 times fair ratio.

That premium suggests the market is already paying up for a cleaner growth story. This raises a simple question: how much execution risk are investors really being compensated for at this price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Align Technology Narrative

If the conclusions here do not quite match your own view, dive into the numbers yourself and craft a fresh perspective in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Align Technology.

Ready for your next investing move?

Before you move on, lock in your advantage by using the Simply Wall St Screener to uncover focused stock ideas tailored to what you want to own next.

- Capture potential mispricings early by reviewing these 906 undervalued stocks based on cash flows that strong cash flow modeling suggests the market has not fully recognized yet.

- Target powerful secular trends by scanning these 26 AI penny stocks that could benefit most as artificial intelligence reshapes entire industries.

- Strengthen your income strategy by evaluating these 12 dividend stocks with yields > 3% that might boost portfolio yield while still keeping fundamentals in check.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGN

Align Technology

Provides Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026