- United States

- /

- Beverage

- /

- NYSE:STZ

Shareholders have faith in loss-making Constellation Brands (NYSE:STZ) as stock climbs 4.8% in past week, taking three-year gain to 37%

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make better returns by buying undervalued shares. Notably, the Constellation Brands, Inc. (NYSE:STZ) share price has gained 31% in three years, which is better than the average market return. In contrast, the stock is actually down 0.7% in the last year, suggesting a lack of positive momentum.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Constellation Brands

Constellation Brands isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Constellation Brands saw its revenue grow at 5.2% per year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably broadly reflected in the share price, which is up 10%, per year over 3 years. Ultimately, the important thing is whether the company is trending to profitability. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

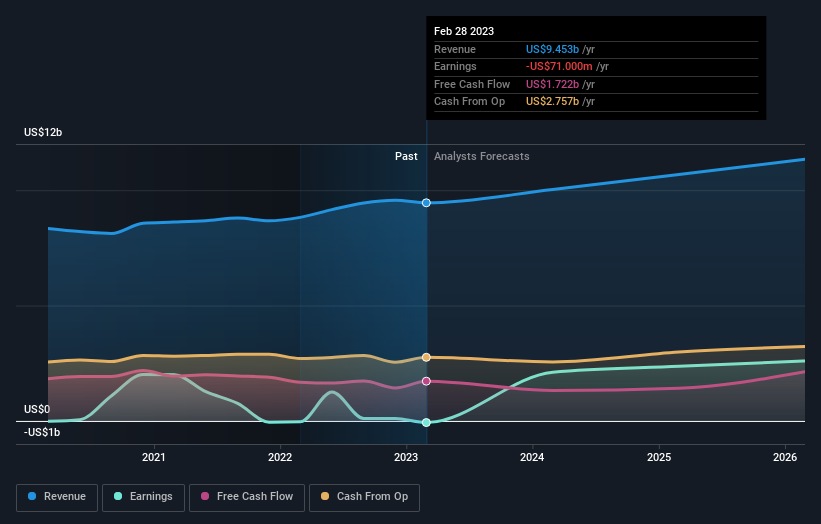

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Constellation Brands is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Constellation Brands stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Constellation Brands' TSR for the last 3 years was 37%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Constellation Brands shareholders are up 0.7% for the year (even including dividends). But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 3% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Constellation Brands better, we need to consider many other factors. For instance, we've identified 2 warning signs for Constellation Brands that you should be aware of.

We will like Constellation Brands better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Constellation Brands, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives