- United States

- /

- Food

- /

- NYSE:MKC

McCormick (MKC): Exploring Whether Recent Share Price Weakness Has Created a Value Opportunity

Reviewed by Simply Wall St

McCormick (MKC) has quietly underperformed the broader market over the past year, even as its revenue and profit kept growing. That gap between fundamentals and share price is exactly what makes the stock interesting now.

See our latest analysis for McCormick.

After sliding earlier in the year, McCormick’s recent 1 week share price return of 3.94 percent suggests sentiment may be stabilizing, even though the 1 year total shareholder return remains a weak negative.

If that shift in momentum has you rethinking your watchlist, it could be a good time to explore fast growing stocks with high insider ownership for other potentially mispriced opportunities.

With McCormick’s earnings still growing but the share price lagging and trading below analyst targets, the key question now is simple: is this a rare value entry point or is the market already pricing in future growth?

Most Popular Narrative: 14.3% Undervalued

With McCormick last closing at $65.94 against a most-followed fair value of $76.92, the narrative frames today’s price as a discounted entry to future growth.

Robust supply chain digitalization and continuous cost-reduction programs (CCI), combined with McCormick's ability to locally manufacture most of its products and mitigate tariff/commodity cost headwinds, are expected to drive operating margin expansion and limit downside risks to earnings.

Curious how steady mid single digit growth, rising margins, and a richer earnings multiple can still add up to undervaluation for a mature food company? The most popular narrative lays out a detailed pathway where volume gains, premium products, and disciplined cost controls all converge into higher future earnings power than the market is currently pricing in. Want to see which specific earnings and margin assumptions are doing the heavy lifting in that $76.92 fair value calculation, and how a higher future multiple ties it all together? Read on to unpack the full story behind those projections.

Result: Fair Value of $76.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on manageable input costs and resilient demand, and persistent commodity inflation or weaker Flavor Solutions volumes could quickly undermine the margin recovery story.

Find out about the key risks to this McCormick narrative.

Another Angle on Valuation

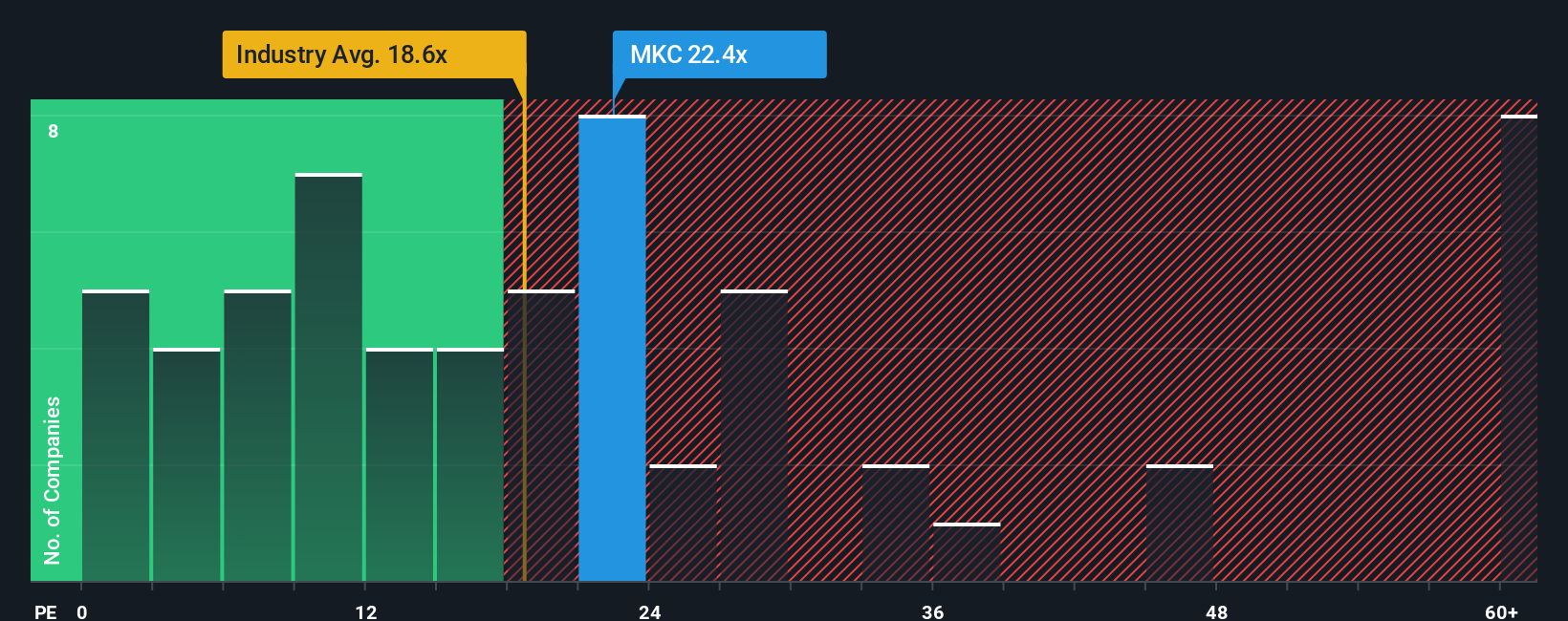

While narratives and analyst targets point to upside, earnings multiples tell a more cautious story. McCormick trades at about 22.7 times earnings, richer than both the US Food industry at 21.3 times and its own 18.2 times fair ratio. This implies less margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If you want to dig into the numbers yourself or challenge this view, you can build a personalized McCormick thesis in just minutes: Do it your way.

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning fresh ideas from the Simply Wall St screener, tailored to very different strategies.

- Target growth at a sensible price with these 905 undervalued stocks based on cash flows that already show strong cash flow support for their valuations.

- Capitalize on innovation by reviewing these 25 AI penny stocks riding the surge in real world artificial intelligence adoption.

- Boost your income potential through these 12 dividend stocks with yields > 3% that may deliver attractive yields without compromising fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026