- United States

- /

- Beverage

- /

- NYSE:KOF

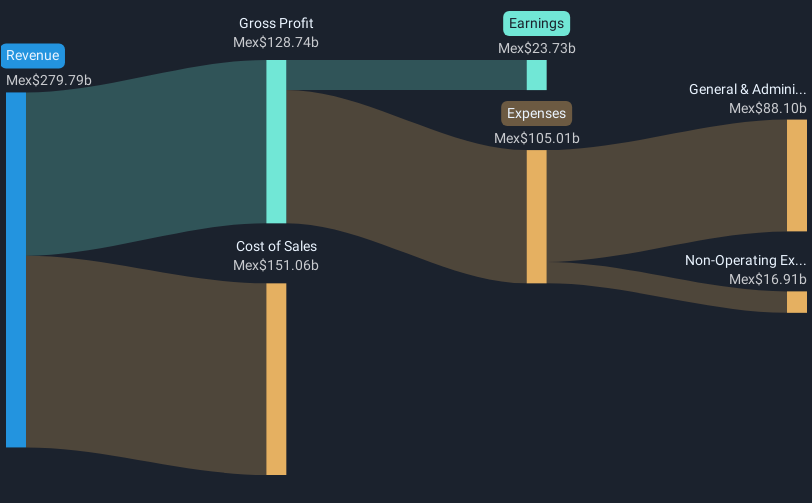

Coca-Cola FEMSA. de (NYSE:KOF) Reports 4% Sales Increase with MXN 23,729 Million Net Income for 2024

Reviewed by Simply Wall St

Coca-Cola FEMSA, S.A.B. de C.V. (NYSE:KOF) recently reported strong fourth-quarter and full-year financial results for 2024, marked by significant growth in sales and net income. Over the past month, the company's stock has risen 12.43%, potentially influenced by the robust earnings announcement. This financial performance underscores Coca-Cola FEMSA's operational strength within the beverage sector. Despite broader market challenges, such as the Dow Jones Industrial Average experiencing a 1.6% weekly decline due to healthcare sector pressures stemming from regulatory concerns, Coca-Cola FEMSA's resilience stands out. The beverage company's trajectory contrasts with the downtrend in several major stocks, including those in the tech sector, which have recently faced declines. Coca-Cola FEMSA's performance could also reflect robust market expectations, with earnings anticipated to grow by 14% per annum in coming years. Such factors contribute to the company's strong market positioning, setting it apart in a flat broader market landscape.

Take a closer look at Coca-Cola FEMSA. de's potential here.

Over the last five years, Coca-Cola FEMSA, S.A.B. de C.V. (NYSE: KOF) achieved a total shareholder return of 82.04%, reflecting the company's consistent growth amid varying market conditions. Notably, KOF's stock underperformed the US Beverage industry over the past year, which saw a 5.1% decline, highlighting a deviation from its longer-term success. Factors contributing to KOF's robust five-year performance include a 16% annual earnings growth rate, underscoring the company's capacity to enhance its profitability. Strategic moves like dividend increases, with a significant proposal in March 2024, also played a pivotal role in bolstering shareholder value.

Regular dividend payouts, including payments of US$1.49 in October 2023 and additional dividends in subsequent quarters, provided steady income to investors. KOF's operational resilience was evident despite temporary disruptions like the May 2024 floods in Brazil, which had no material financial impact. The company's stock has often traded below its fair value estimate (US$147.83), suggesting attractive investment potential over the examined period.

- Unlock the insights behind Coca-Cola FEMSA. de's valuation and discover its true investment potential

- Discover the key vulnerabilities in Coca-Cola FEMSA. de's business with our detailed risk assessment.

- Is Coca-Cola FEMSA. de part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives