- United States

- /

- Beverage

- /

- NYSE:KO

Will Coca-Cola's (KO) Mini Cans and Sugar Shift Redefine Its Brand and Shareholder Strategy?

Reviewed by Sasha Jovanovic

- In early October 2025, Coca-Cola announced the rollout of 7.5‑oz mini cans and a cane-sugar sweetened Coke in the U.S., along with a US$6 billion share buyback program and updates on regulatory challenges abroad.

- The company's focus on smaller, lower-calorie beverage options and shareholder returns highlights how it is adapting to changing consumer preferences while managing evolving market risks.

- We'll explore how Coca-Cola's new mini cans and cane-sugar Coke shape its investment narrative amid consumer health trends.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coca-Cola Investment Narrative Recap

To be a Coca-Cola shareholder, you need confidence in the company’s global brand, its ability to adapt to changing consumer trends, and the predictability of its dividend and earnings. The introduction of mini cans and cane-sugar Coke addresses health-conscious consumers, but, in the short term, the main catalyst remains upcoming Q3 2025 earnings, while regulatory risks abroad, such as antitrust probes and soda taxes, still pose potential headwinds. At this stage, these announcements do not appear likely to materially shift either dynamic.

The most relevant recent announcement is Coca-Cola’s new US$6 billion share buyback program, which reinforces management’s ongoing focus on shareholder returns. In context of upcoming earnings and product launches, this continued capital commitment may remain in investors' sights as they evaluate near-term catalysts and overall return potential for the stock.

On the flip side, investors should be aware that increased regulatory scrutiny in key international markets could have deeper effects on future revenue than...

Read the full narrative on Coca-Cola (it's free!)

Coca-Cola's outlook anticipates $55.1 billion in revenue and $14.8 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.4% and an increase in earnings of $2.6 billion from the current $12.2 billion.

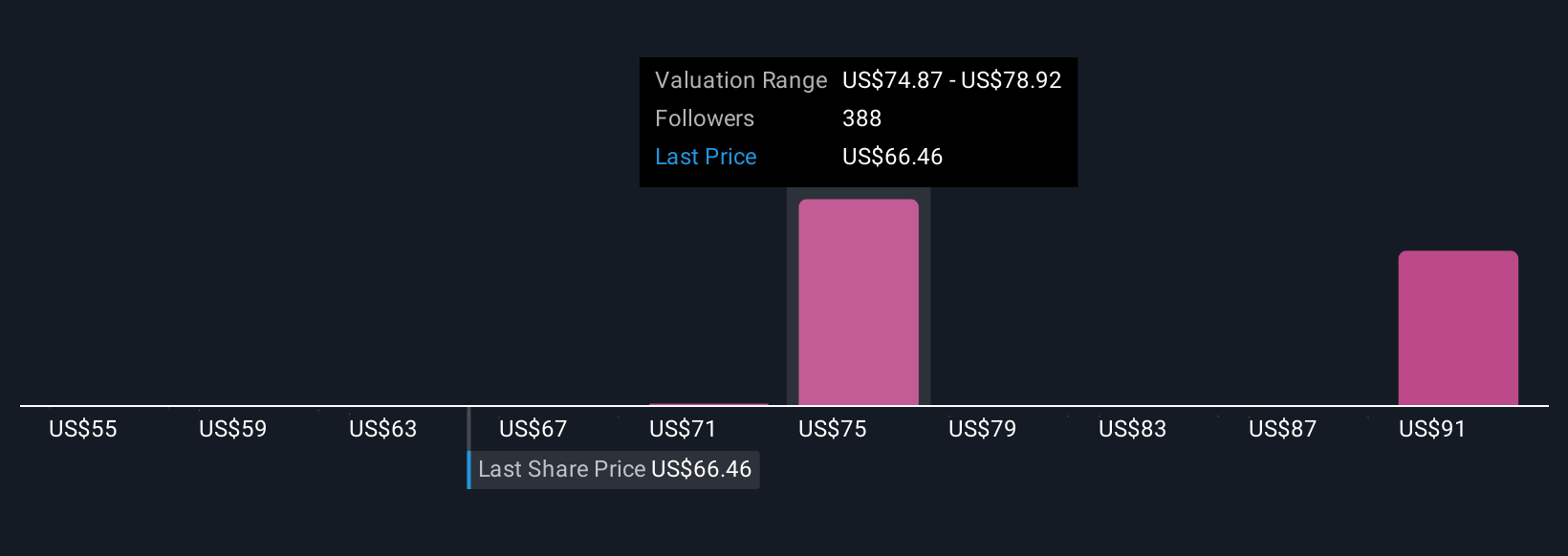

Uncover how Coca-Cola's forecasts yield a $77.79 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Estimates from 27 Simply Wall St Community members put Coca-Cola’s fair value anywhere from US$54.61 to US$93.40 per share. With many watching regulatory action and shifting health preferences worldwide, you’ll find plenty of alternative viewpoints worth considering.

Explore 27 other fair value estimates on Coca-Cola - why the stock might be worth as much as 40% more than the current price!

Build Your Own Coca-Cola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Coca-Cola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives