Last Update 22 Oct 25

Fair value Decreased 0.28%Coca-Cola's analyst consensus price target has been modestly increased from $78 to around $80 per share. Analysts cite continued strong quarterly performance and expectations for resilient organic sales growth, despite some international volume softness.

Analyst Commentary

Analysts have provided diverse perspectives on Coca-Cola's outlook following its recent quarterly results. While some are increasingly optimistic due to continued strong performance, others are starting to moderate expectations given emerging headwinds from international markets. The following summarizes current prevailing viewpoints:

Bullish Takeaways- Bullish analysts have increased price targets, citing Coca-Cola’s consistent ability to deliver quarterly beats despite challenging macroeconomic conditions.

- Recent performance demonstrates resilient organic sales growth, with limited impact from global volume pressures. This positions Coca-Cola as a relative outperformer among large-cap peers.

- There is anticipation that the company may prevail in its ongoing tax case, which could serve as a potential catalyst for improved future valuation.

- Strong brand positioning and effective price/mix strategies are viewed as supporting continued mid-single-digit organic growth. This reinforces Coca-Cola’s scarcity value in a competitive sector.

- Bearish analysts are cautious regarding international softness, suggesting that organic sales growth might trend toward the lower end of management’s guidance.

- Volume trends in important overseas markets could limit near-term outperformance, which has prompted some to revise down organic sales projections for upcoming periods.

- Foreign exchange tailwinds previously anticipated for future years are now expected to be only slight and may weigh on earnings estimates.

- Despite maintaining favorable ratings, several analysts have trimmed their price targets because of these execution and macro risks.

What's in the News

- Coca-Cola is considering taking its Indian bottling unit, Hindustan Coca-Cola Beverages, public in an IPO that may raise $1 billion and value the unit at $10 billion (Bloomberg).

- The company is exploring a potential sale of Costa Coffee and has initiated discussions with potential bidders, including private equity firms (Reuters).

- Coca-Cola Starlight, the space-inspired beverage, is making a return as an exclusive offering in collaboration with Jack in the Box. It will be available as part of a limited-time meal (Company announcement).

- Coca-Cola has completed a recent share buyback tranche, repurchasing over 1.1 million shares for $81 million. This contributes to a multiyear repurchase program totaling more than $4.8 billion (Company report).

Valuation Changes

- Fair value has decreased slightly from $77.79 to $77.57 per share, reflecting a modest downward adjustment.

- The discount rate remains unchanged at 6.78%.

- The revenue growth projection has edged down from 5.36% to 5.31%.

- The net profit margin has improved, rising from 26.88% to 27.28%.

- The future P/E ratio has declined from 27.46x to 26.64x, suggesting a slightly less expensive valuation.

Key Takeaways

- Growth in emerging markets, digital platforms, and value-added dairy is expected to drive increased revenue and margin expansion for Coca-Cola.

- Sustainability initiatives, asset-light strategy, and e-commerce investments strengthen brand equity, operational efficiency, and long-term earning potential.

- Growing health trends, regulatory uncertainty, rising competition, supply chain vulnerabilities, and cost inflation threaten Coca-Cola's traditional categories, profitability, and adaptability in key global markets.

Catalysts

About Coca-Cola- A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

- Increasing per-capita beverage consumption in emerging markets, especially Africa, the Middle East, and Asia, fueled by urbanization and a rising middle class, is expected to drive long-term revenue growth as Coca-Cola deepens penetration through targeted marketing, digital platforms, and expanding outlet coverage. (Impacts: revenue)

- Coca-Cola's ongoing investments in sustainable packaging, water stewardship, and digital innovation (e.g., connected packaging, refillables, AI-powered pricing tools) are anticipated to enhance brand equity, consumer loyalty, and regulatory resilience, supporting both future revenue and net margins.

- The ramp-up of U.S. fairlife capacity in 2026 and strong performance in value-added dairy internationally positions Coca-Cola to capture more share of fast-growing, high-margin dairy and functional beverage segments, accelerating both top-line growth and margin expansion.

- The global refranchising and asset-light model, coupled with marketing transformation and disciplined cost management, is expanding operating margins and improving earnings stability, with near-term productivity gains expected to be reinvested for future growth.

- Coca-Cola's robust direct-to-consumer and e-commerce initiatives, including scaled digital ordering in India and Mexico, are building direct relationships with consumers and enabling more agile, data-driven execution, which should enhance both revenue and long-term margin opportunities.

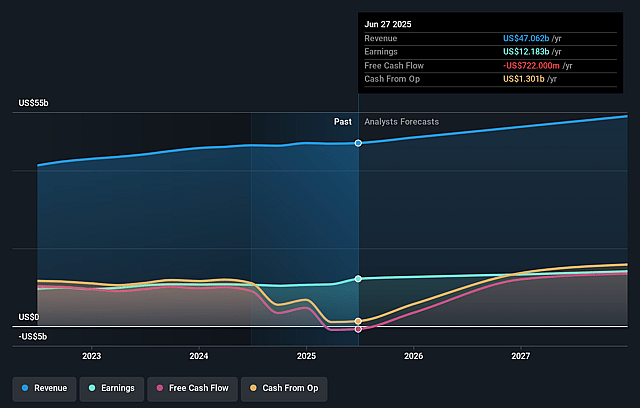

Coca-Cola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coca-Cola's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.9% today to 26.9% in 3 years time.

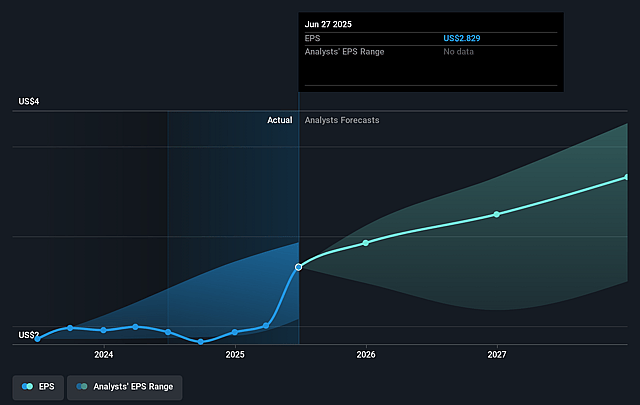

- Analysts expect earnings to reach $14.8 billion (and earnings per share of $3.5) by about September 2028, up from $12.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $11.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, up from 24.0x today. This future PE is greater than the current PE for the US Beverage industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Coca-Cola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing global consumer shifts toward health consciousness and potential regulatory actions related to sugar-sweetened beverages remain a risk, as Coca-Cola's core carbonated soft drinks (CSDs) continue to face volume challenges and heightened scrutiny; this could limit long-term top-line growth and put pressure on revenue.

- The company's continued dependence on refranchised bottlers may limit its ability to rapidly adapt to evolving consumer preferences and market dynamics, particularly in emerging categories like health/wellness and ready-to-drink, which could impact earnings growth if nimble competitors seize market share.

- Intensifying competition from both large beverage companies and smaller, niche brands-especially in fast-growing health-oriented and functional beverage categories, such as protein drinks-could fragment shelf space and require higher marketing and innovation spend, likely impacting net margins and profit sustainability.

- Volatility in global macroeconomic conditions, coupled with climate impacts (e.g., adverse weather in key markets, water scarcity), has already weighed on volume performance in critical regions (like India, Mexico, and ASEAN countries); increased operational disruptions or required sustainability investments could erode margins and earnings reliability over time.

- Persistent input cost inflation and commodity price volatility (including packaging and agricultural products) present a risk to sustaining recent margin gains, especially if competitive pressures limit Coca-Cola's ability to pass on higher costs to consumers without adversely affecting volume and revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $78.704 for Coca-Cola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $55.1 billion, earnings will come to $14.8 billion, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $67.86, the analyst price target of $78.7 is 13.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.