- United States

- /

- Food

- /

- NYSE:INGR

What Ingredion (INGR)'s Zacks Rank Upgrade Means for Shareholders

Reviewed by Simply Wall St

- Ingredion was recently upgraded to a Zacks Rank #2 (Buy) following a series of positive earnings estimate revisions, reflecting improved business fundamentals.

- This upgrade highlights the company's inclusion among the top 20% of Zacks-covered stocks in terms of upward earnings estimate changes.

- We'll explore how the recent earnings estimate upgrades may reinforce Ingredion's investment narrative around growth in clean label and specialty ingredients.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ingredion Investment Narrative Recap

To be a shareholder in Ingredion, you need to believe in its ability to capture accelerating demand for clean label and specialty ingredients, while managing ongoing pressures in legacy product lines and volatile emerging markets. The Zacks Rank #2 (Buy) upgrade, fueled by rising earnings estimates, may aid sentiment, but does not materially offset near-term risks from commodity price deflation and ongoing currency and trade uncertainties shaping the most critical catalysts and headwinds right now.

Among recent announcements, Ingredion’s May 2025 guidance reiterated that while growth in Texture & Healthful Solutions is expected to support results, flat net sales and a cautious outlook for operating income reflect both the positive effects of specialty growth and lingering risks from tariff and macroeconomic factors. These details directly speak to the critical balance the company must maintain between its high-margin specialty segments and ongoing external challenges.

By contrast, investors should also be aware that persistent currency volatility in major LATAM markets poses...

Read the full narrative on Ingredion (it's free!)

Ingredion's outlook anticipates $7.8 billion in revenue and $696.0 million in earnings by 2028. This scenario assumes a 2.0% annual revenue growth rate and a modest $20.0 million earnings increase from the current earnings of $676.0 million.

Uncover how Ingredion's forecasts yield a $148.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

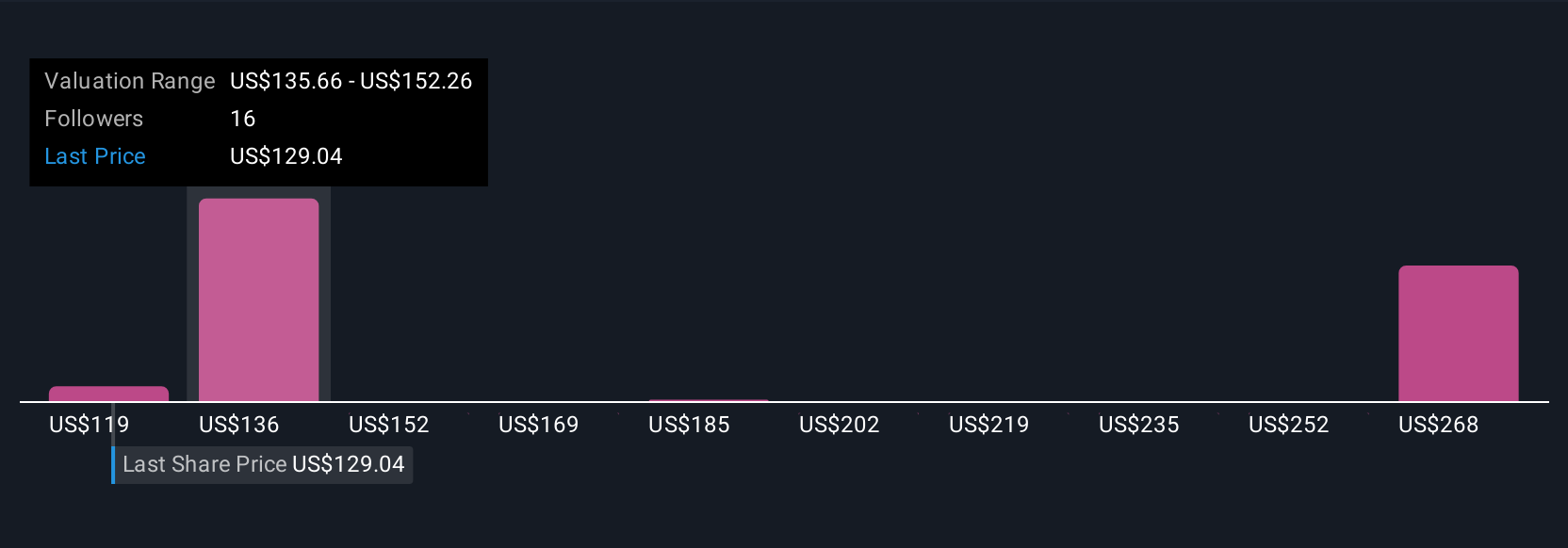

Five fair value estimates from the Simply Wall St Community range from US$119.06 to US$285.06 per share, showing a wide span of expectations. While participant views are diverse, ongoing pressure from commodity cost deflation may be front of mind for many as you compare these perspectives further.

Explore 5 other fair value estimates on Ingredion - why the stock might be worth over 2x more than the current price!

Build Your Own Ingredion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingredion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingredion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingredion's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives