- United States

- /

- Banks

- /

- NasdaqGS:CCB

Top Growth Companies With Insider Stake In July 2025

Reviewed by Simply Wall St

As the S&P 500 reaches new heights amid optimism surrounding trade deals and corporate earnings, investors are keeping a close eye on growth companies with substantial insider ownership. In this environment of record-breaking indices, stocks with high insider stakes can be particularly appealing due to their potential alignment of interests between company executives and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 45.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Let's dive into some prime choices out of the screener.

Mama's Creations (MAMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mama's Creations, Inc., along with its subsidiaries, manufactures and markets fresh deli-prepared foods in the United States and has a market cap of $343.39 million.

Operations: The company generates revenue from its food processing segment, which amounts to $128.75 million.

Insider Ownership: 10.3%

Mama's Creations has been added to the Russell 2000 Growth-Defensive Index, signaling its growing market presence. The company reported strong earnings growth with Q1 net income rising from US$0.553 million to US$1.24 million year-over-year, although profit margins decreased from 5.2% to 3.4%. Forecasted annual earnings growth of over 45% suggests robust potential despite insider trading data being unavailable for recent months and revenue growth projections trailing behind earnings expectations.

- Click to explore a detailed breakdown of our findings in Mama's Creations' earnings growth report.

- According our valuation report, there's an indication that Mama's Creations' share price might be on the expensive side.

Vital Farms (VITL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vital Farms, Inc. is a U.S.-based food company that packages, markets, and distributes shell eggs, butter, and other products with a market cap of $1.67 billion.

Operations: Vital Farms generates revenue of $620.57 million from its eggs and butter segments in the United States.

Insider Ownership: 17.2%

Vital Farms is experiencing substantial growth, with earnings projected to grow at 20.6% annually, outpacing the US market. However, its Return on Equity is forecasted to remain low at 19.5%. Recent expansions include surpassing 500 family farms and significant investments in production facilities expected to boost revenue capacity by US$350 million. Despite being dropped from several Russell indexes, analyst consensus suggests a potential stock price increase of 22.2%, indicating positive market sentiment despite challenges.

- Navigate through the intricacies of Vital Farms with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Vital Farms' share price might be too optimistic.

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.53 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: Coastal Community Bank generates revenue through its CCBX segment with $222.52 million, the Community Bank segment contributing $84.07 million, and the Treasury & Administration segment adding $15.57 million.

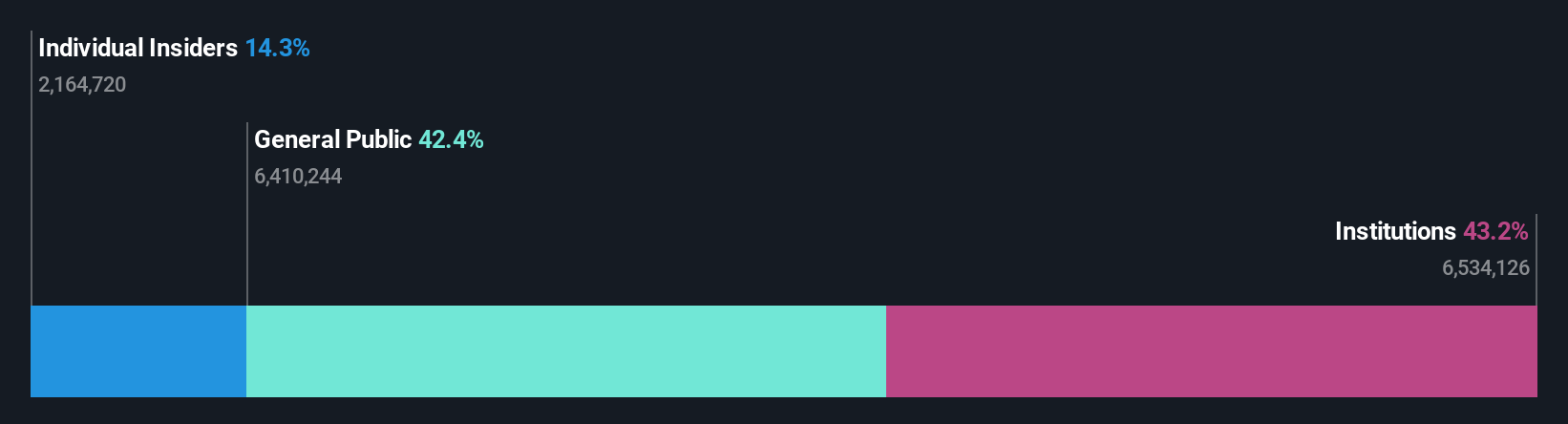

Insider Ownership: 14.4%

Coastal Financial's earnings are forecast to grow significantly at 48.2% annually, surpassing the US market's growth rate. Despite being dropped from multiple Russell indexes in June 2025, the company remains undervalued by 22.9% compared to its estimated fair value. Recent changes include an auditor transition to Baker Tilly and a CFO departure planned for October 2025. First-quarter results showed net interest income of US$76.06 million and net income of US$9.73 million, indicating robust financial performance.

- Unlock comprehensive insights into our analysis of Coastal Financial stock in this growth report.

- Our expertly prepared valuation report Coastal Financial implies its share price may be too high.

Taking Advantage

- Click here to access our complete index of 187 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives