- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Keurig Dr Pepper (KDP) Reaffirms 2025 Earnings Guidance For Mid-Single-Digit Sales Growth

Reviewed by Simply Wall St

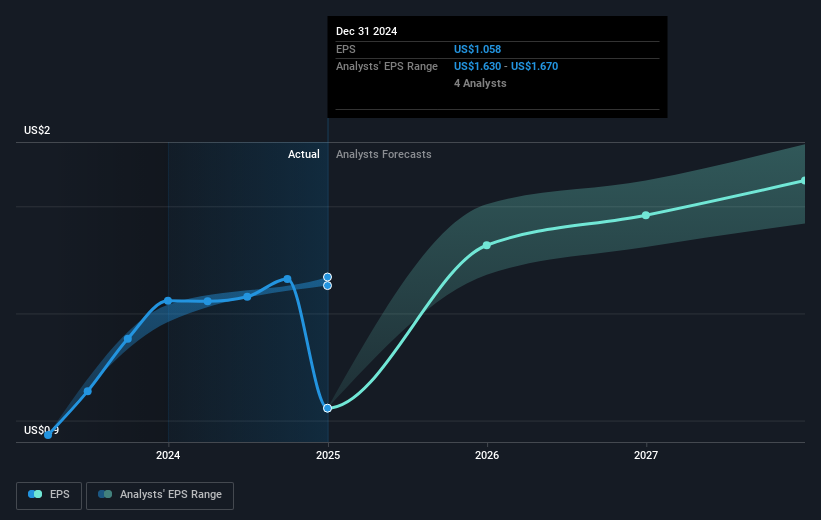

Keurig Dr Pepper (KDP) reaffirmed its earnings guidance for fiscal year 2025, projecting mid-single-digit net sales growth. This affirmation suggests confidence in achieving steady demand for its products, aligning with market expectations in the consumer beverage sector. Over the past week, KDP's share price remained relatively flat, moving less than 1%, while the broader market rose 1.7%. The company’s guidance likely added weight to the broader market movements, although it did not significantly affect KDP’s share price. The company's stability and projected growth continue to support investor confidence amid a rising market environment.

The recent affirmation of Keurig Dr Pepper's earnings guidance for fiscal year 2025 could bolster investor confidence in line with market expectations within the consumer beverage sector. This guidance suggests potential stability in revenue and earnings forecasts, which might mitigate concerns over pressures in the coffee segment. However, the company's current earnings and performance metrics reveal a complex picture. While analysts foresee growth, ongoing challenges in coffee sales and cost management remain factors to watch.

Over the past five years, Keurig Dr Pepper's total returns, including dividends, have delivered a 20.55% increase. When evaluating performance relative to the recent 1-year market returns of 17.7%, the company's results appear less favorable. Despite these returns, the company's share price has underperformed against the broader US market both in one-year and potentially longer-term contexts.

As of now, the share price at US$33.50 is below the consensus price target of US$38.35, representing a potential upside. The reaffirmed guidance could contribute positively towards reaching this target, assuming the projected revenue growth from iconic and new beverage brands, alongside energy platform integration, is realized. The reaffirmation provides an insight into the company’s potential revenue resilience, but translating this into heightened earnings performance will depend on effective cost management and tackling challenges in the coffee segment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives