- United States

- /

- Food

- /

- NasdaqGS:CVGW

Exploring 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are navigating mixed signals as major indices like the S&P 500 face challenges from rising Treasury yields and a recent downgrade of U.S. credit ratings, which has introduced fresh uncertainty into the economic outlook. Amid these fluctuations, small-cap stocks often present unique opportunities for growth and resilience, making them potential gems for investors seeking to diversify their portfolios in a volatile environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

We'll examine a selection from our screener results.

PrimeEnergy Resources (NasdaqCM:PNRG)

Simply Wall St Value Rating: ★★★★☆☆

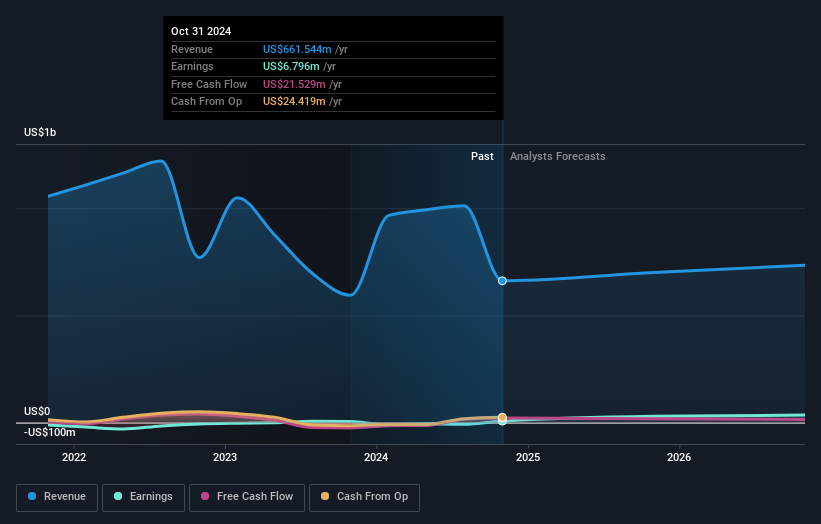

Overview: PrimeEnergy Resources Corporation, with a market cap of $310.26 million, operates through its subsidiaries to acquire, develop, and produce oil and natural gas properties in the United States.

Operations: PrimeEnergy Resources generates revenue primarily from its oil and gas exploration, development, operation, and servicing activities, amounting to $234.08 million.

PrimeEnergy Resources, a compact player in the energy sector, has shown impressive growth with earnings surging by 97% over the past year, outpacing the broader oil and gas industry. The company boasts a favorable price-to-earnings ratio of 5.6x compared to the US market's 18.1x, suggesting potential value for investors. Its net debt to equity ratio stands at a satisfactory 0.7%, reflecting strong financial health alongside well-covered interest payments at 44.6x EBIT coverage. However, recent delays in SEC filings might raise eyebrows about operational transparency amidst significant insider selling observed recently.

- Navigate through the intricacies of PrimeEnergy Resources with our comprehensive health report here.

Explore historical data to track PrimeEnergy Resources' performance over time in our Past section.

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering various banking services to individual and corporate clients, with a market capitalization of approximately $656.27 million.

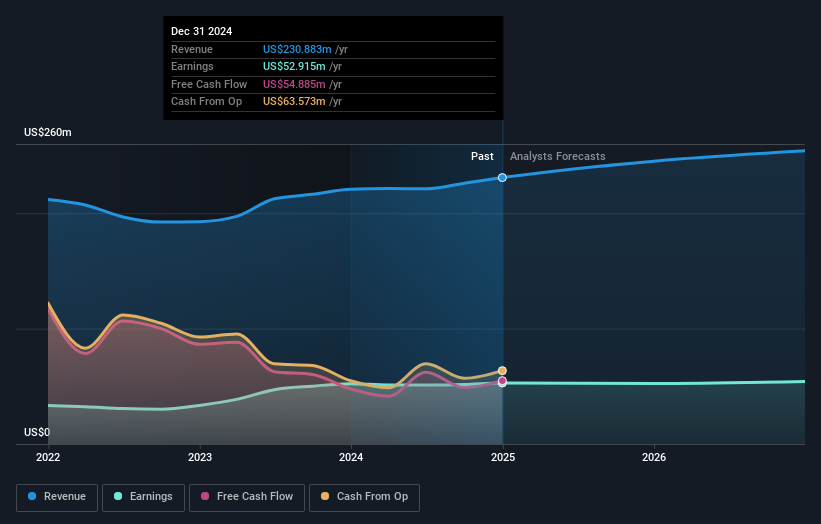

Operations: Capital City Bank Group generates revenue primarily from its commercial banking segment, which reported $236.04 million.

Capital City Bank Group, a financial institution with total assets of US$4.5 billion and equity of US$512.6 million, showcases robust financial health. With deposits totaling US$3.8 billion and loans at US$2.6 billion, it maintains a net interest margin of 4.1%. The bank's allowance for bad loans stands at 692%, reflecting prudent risk management with non-performing loans at just 0.2%. Earnings grew by 12% last year, surpassing the industry average of 5%, although future earnings are projected to decrease slightly by an average of 2.2% annually over the next three years due to anticipated challenges in revenue growth.

Calavo Growers (NasdaqGS:CVGW)

Simply Wall St Value Rating: ★★★★★★

Overview: Calavo Growers, Inc. is a company that markets and distributes avocados and other perishable foods to various retail and wholesale customers globally, with a market capitalization of approximately $479.80 million.

Operations: Calavo generates revenue primarily through its Fresh segment, contributing $624.39 million, and its Prepared segment, adding $63.93 million.

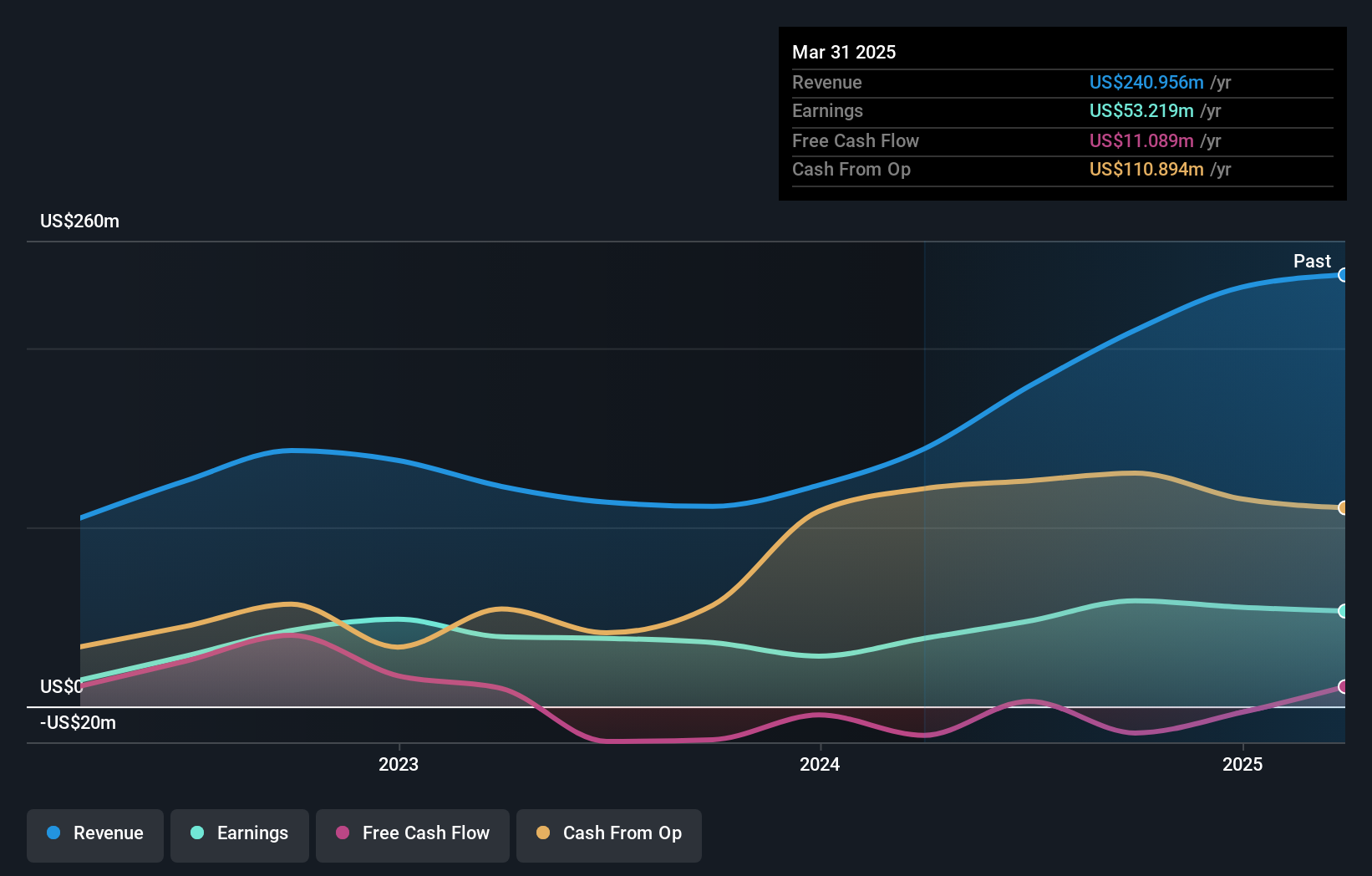

Calavo Growers, a nimble player in the food industry, has shown impressive earnings growth of 390.9% over the past year, outpacing the sector's -5.9%. With no debt on its books now compared to a 9.6% debt-to-equity ratio five years ago, it stands on solid financial ground. The company recently reported first-quarter sales of US$154 million and net income of US$4.42 million, marking a significant turnaround from last year's loss of US$6.27 million. Additionally, Calavo announced a share repurchase program worth up to US$25 million and declared a quarterly dividend of $0.20 per share for investors.

- Click here to discover the nuances of Calavo Growers with our detailed analytical health report.

Understand Calavo Growers' track record by examining our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 281 US Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVGW

Calavo Growers

Calavo Growers, Inc. markets and distributes avocados, prepared avocados, and other perishable foods to retail grocery, foodservice, club stores, mass merchandisers, food distributors, and wholesale customers worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives