- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC) Rises 12.3% After $204M Equity Raise to Fund New US Refinery Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early October 2025, Uranium Energy Corp completed a follow-on equity offering, raising approximately US$203.8 million through the sale of 15.5 million common shares, with proceeds aimed at accelerating the development of a new uranium refining and conversion facility in the United States.

- This substantial capital raise was managed by Goldman Sachs and marks a significant step as the company seeks to advance the domestic nuclear fuel supply chain amid renewed government support.

- We'll explore how this major investment in refining capabilities could reshape Uranium Energy Corp's investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Uranium Energy's Investment Narrative?

To own Uranium Energy today, you need conviction in the long-term revival of nuclear energy and the company’s evolving position within America’s nuclear supply chain. The recent US$203.8 million equity raise is a pivotal move, aiming to accelerate the buildout of a domestic uranium refining and conversion facility, a project that aligns closely with new federal policy support. In the short term, this infusion of capital stands to bolster confidence in Uranium Energy’s rollout ambitions, making operational milestones the key near-term catalyst, rather than commodity price swings alone. It also strengthens the balance sheet, which could help absorb ongoing losses as the company continues to be unprofitable, with net losses widening over the past year. However, the rapid increase in share count may put pressure on per-share metrics, and profitability timelines remain a critical risk that could influence the company’s valuation and share performance going forward.

But, unlike the optimism about new investments, dilution risk is something investors need to keep in mind.

Exploring Other Perspectives

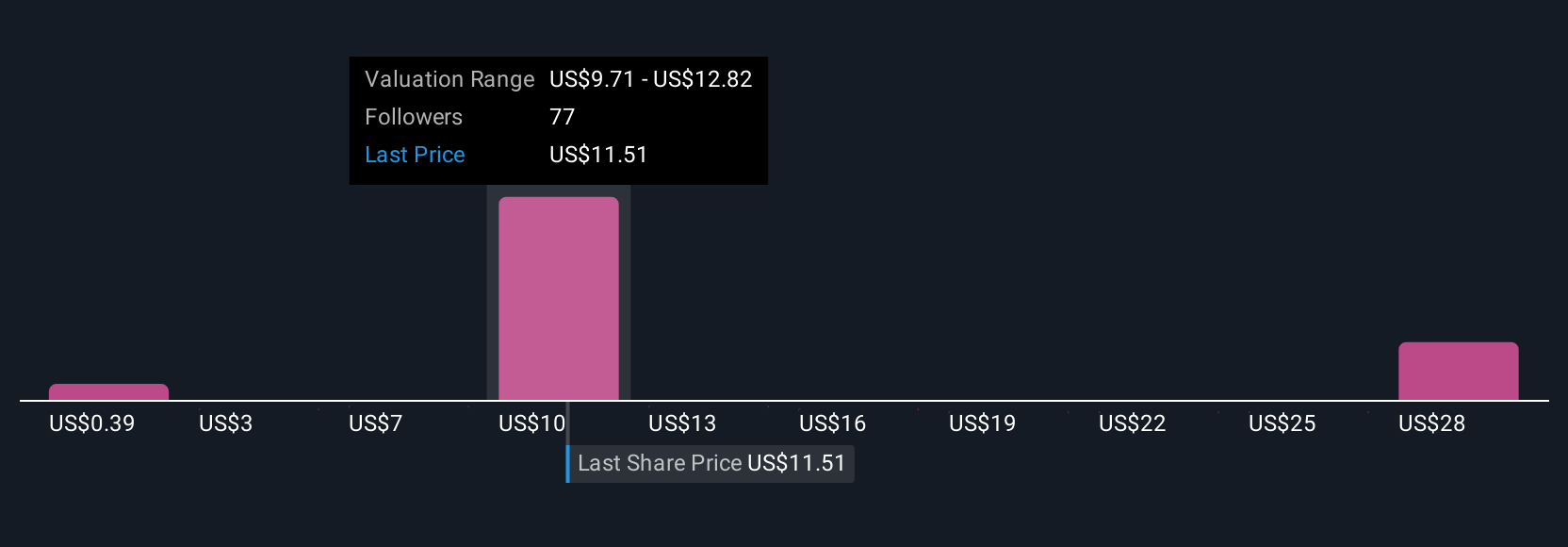

Explore 25 other fair value estimates on Uranium Energy - why the stock might be worth as much as $15.25!

Build Your Own Uranium Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Uranium Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uranium Energy's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives