- United States

- /

- Energy Services

- /

- NYSE:XPRO

The Price Is Right For Expro Group Holdings N.V. (NYSE:XPRO) Even After Diving 32%

The Expro Group Holdings N.V. (NYSE:XPRO) share price has fared very poorly over the last month, falling by a substantial 32%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

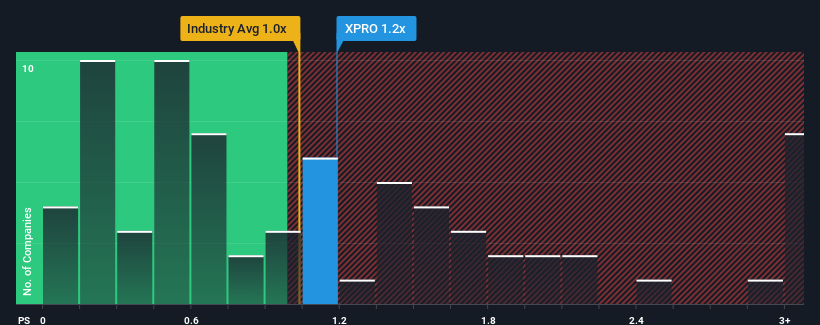

In spite of the heavy fall in price, it's still not a stretch to say that Expro Group Holdings' price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Energy Services industry in the United States, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Expro Group Holdings

How Has Expro Group Holdings Performed Recently?

Expro Group Holdings could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Expro Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Expro Group Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Expro Group Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Pleasingly, revenue has also lifted 116% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.4% per annum as estimated by the six analysts watching the company. With the industry predicted to deliver 10% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Expro Group Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Expro Group Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Expro Group Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Plus, you should also learn about these 2 warning signs we've spotted with Expro Group Holdings.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives