- United States

- /

- Energy Services

- /

- NYSE:WHD

Why Cactus (WHD) Is Down 11.1% After Missing Q2 Earnings and Revenue Expectations and What's Next

Reviewed by Sasha Jovanovic

- Cactus Inc recently reported its Q2 2025 earnings, with both earnings per share and revenue falling short of analyst expectations, prompting investor concern over its near-term financial outlook.

- This earnings miss has drawn renewed attention to the company's ability to manage costs and sustain growth amid ongoing industry headwinds and changing demand dynamics.

- We’ll explore how the recent Q2 earnings shortfall shapes Cactus Inc’s investment narrative and points to potential challenges ahead.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Cactus Investment Narrative Recap

To be a shareholder in Cactus Inc, you need to believe the company can leverage its expanded pressure control offering and international growth opportunities to counteract ongoing volatility in US drilling activity and rising input costs. The recent Q2 earnings miss may weigh on sentiment, but does not fundamentally alter the importance of successful integration of the Baker Hughes Surface Pressure Control joint venture, which remains the key short-term catalyst. The principal risk remains demand softness in core US markets, which could continue to pressure revenue and margins.

Among the company’s recent announcements, the June partnership with Baker Hughes stands out as most relevant. This joint venture is designed to broaden Cactus’ reach in surface pressure control products, increasing its exposure to international energy spending cycles and enhancing its geographic diversification at a time of weaker domestic market activity.

However, with sentiment shifting, investors should be aware that if pricing pressure continues to build due to customer capital discipline, then...

Read the full narrative on Cactus (it's free!)

Cactus' outlook suggests revenues of $1.7 billion and earnings of $232.7 million by 2028. This is based on analysts' assumptions of 15.3% annual revenue growth and an increase in earnings of about $51.5 million from the current $181.2 million.

Uncover how Cactus' forecasts yield a $49.62 fair value, a 49% upside to its current price.

Exploring Other Perspectives

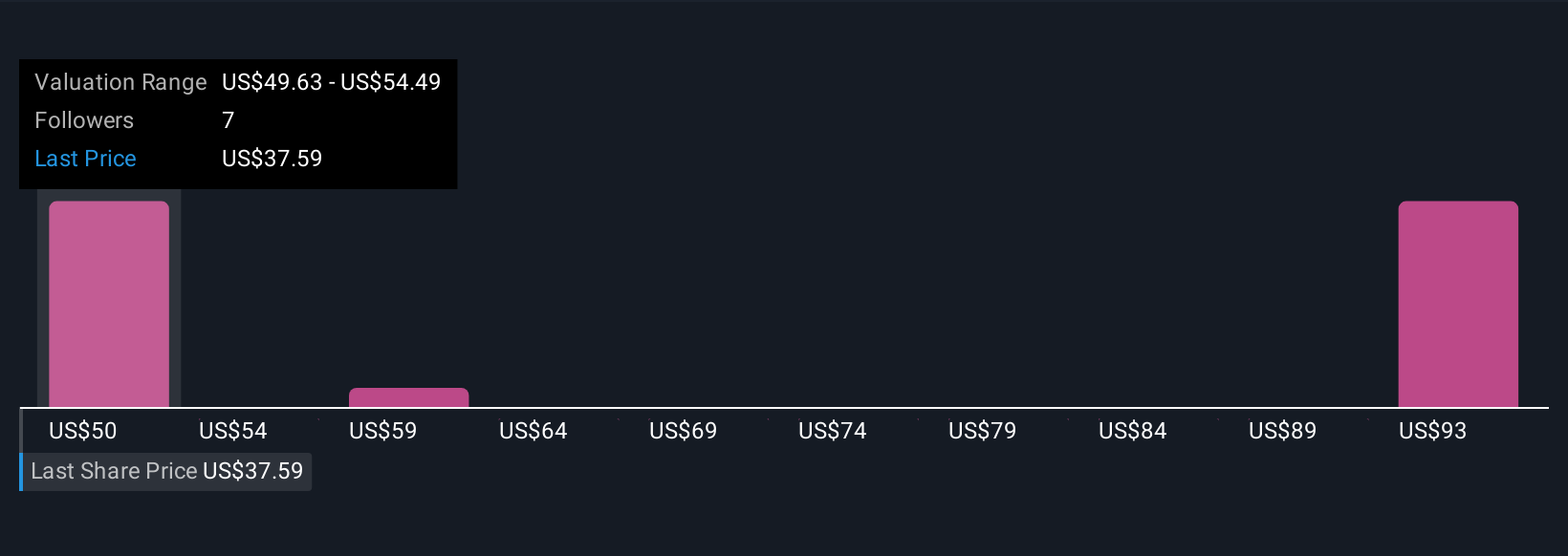

Three individual fair value estimates from the Simply Wall St Community range from US$49.63 to US$98.08 per share, pointing to very different signals versus today’s US$33.78 price. With recent earnings misses and demand uncertainty, it is clear that views on the company’s potential can vary widely, be sure to consider several viewpoints.

Explore 3 other fair value estimates on Cactus - why the stock might be worth over 2x more than the current price!

Build Your Own Cactus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cactus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cactus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cactus' overall financial health at a glance.

No Opportunity In Cactus?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHD

Cactus

Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives