- United States

- /

- Energy Services

- /

- NYSE:WHD

Has Cactus Stock Fallen Too Far After Middle East Expansion News?

Reviewed by Bailey Pemberton

Trying to decide if Cactus is a hidden gem or simply a good stock going through a tough patch? You are not alone. After all, watching the share price slide by 5.9% over the last week and more than 12% for the past month can make any investor pause. Year-to-date, Cactus is down nearly 40%, and over the past year, it is down an eye-opening 41.9%. That sounds tough, but here is a detail you should not miss: if you zoom out to the last five years, the stock has actually gained 99.6%. Swings like these are often linked to shifts in sector sentiment and broader market uncertainty, which tend to hit even fundamentally sound companies like Cactus.

Despite the volatility, Cactus scores a 6 on our valuation checklist, indicating it appears undervalued across all six major valuation methods we use. While recent price moves might raise questions about underlying risks, such a strong value score strongly suggests that there could be more to the story than surface-level declines. Let us break down exactly how that value score comes together using different approaches, and at the end, we will share a perspective that goes beyond just checking boxes.

Why Cactus is lagging behind its peers

Approach 1: Cactus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach helps determine what the business is truly worth if you were to own all its future cash earnings right now.

For Cactus, the DCF uses the 2 Stage Free Cash Flow to Equity model. According to recent data, the company generated $233.7 million in free cash flow over the last twelve months. Analysts expect free cash flow to reach $304 million by 2027, with steady extrapolated growth over the following decade. By 2035, Simply Wall St estimates projected free cash flow of about $451.6 million, reflecting a consistent, if modest, annual growth rate.

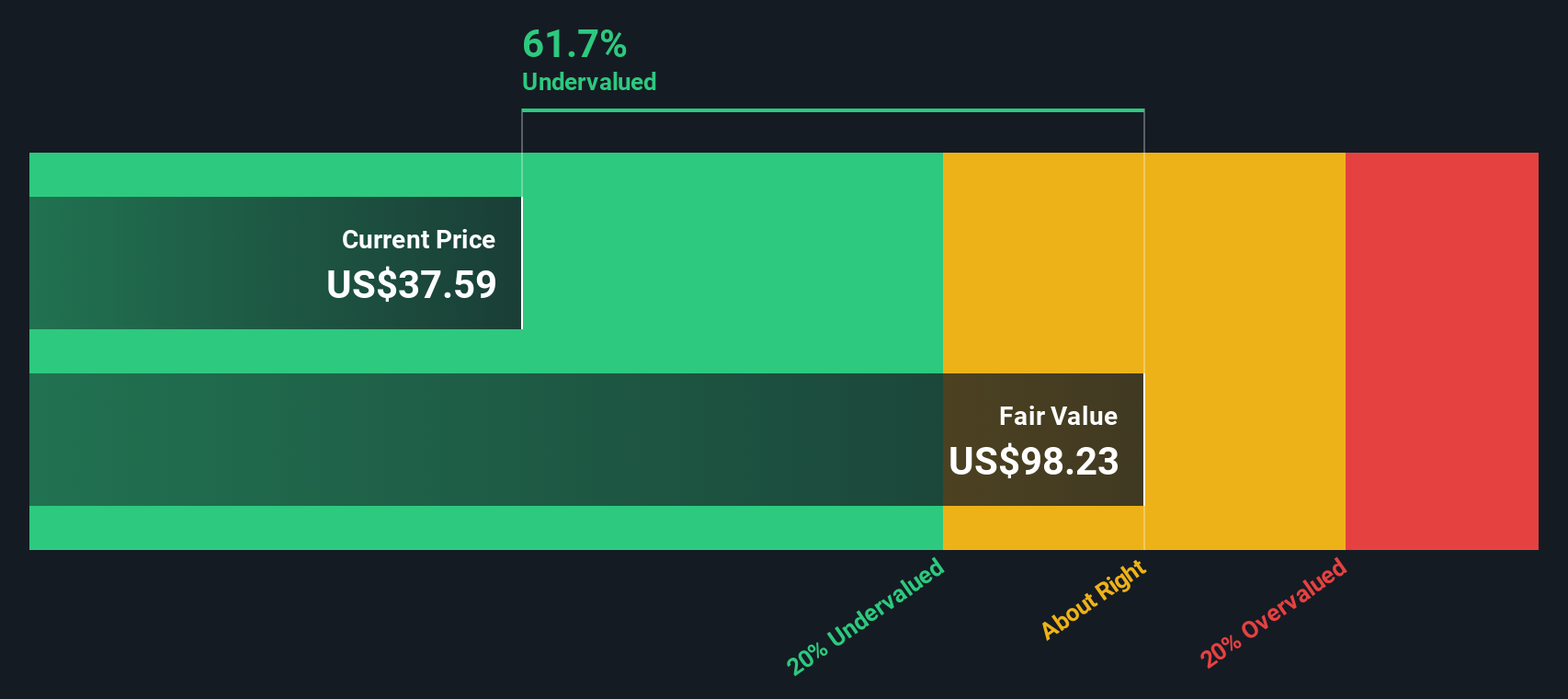

All these cash flows are discounted to their present value, resulting in an estimated intrinsic value of $98.14 per share. This is 63.4% higher than the current share price, signaling the stock may be significantly undervalued on a pure cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cactus is undervalued by 63.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Cactus Price vs Earnings

The price-to-earnings (PE) ratio is a popular way to value profitable companies like Cactus because it measures how much investors are willing to pay today for each dollar of earnings. For established business models with consistent profitability, the PE ratio helps investors gauge whether a stock is cheap or expensive relative to its earnings power.

When looking at what counts as a "normal" or "fair" PE ratio, expectations for future growth and the perceived riskiness of the business come into play. Higher growth prospects or lower risks usually justify a higher PE, while slower growth or bigger uncertainties mean investors want a lower multiple.

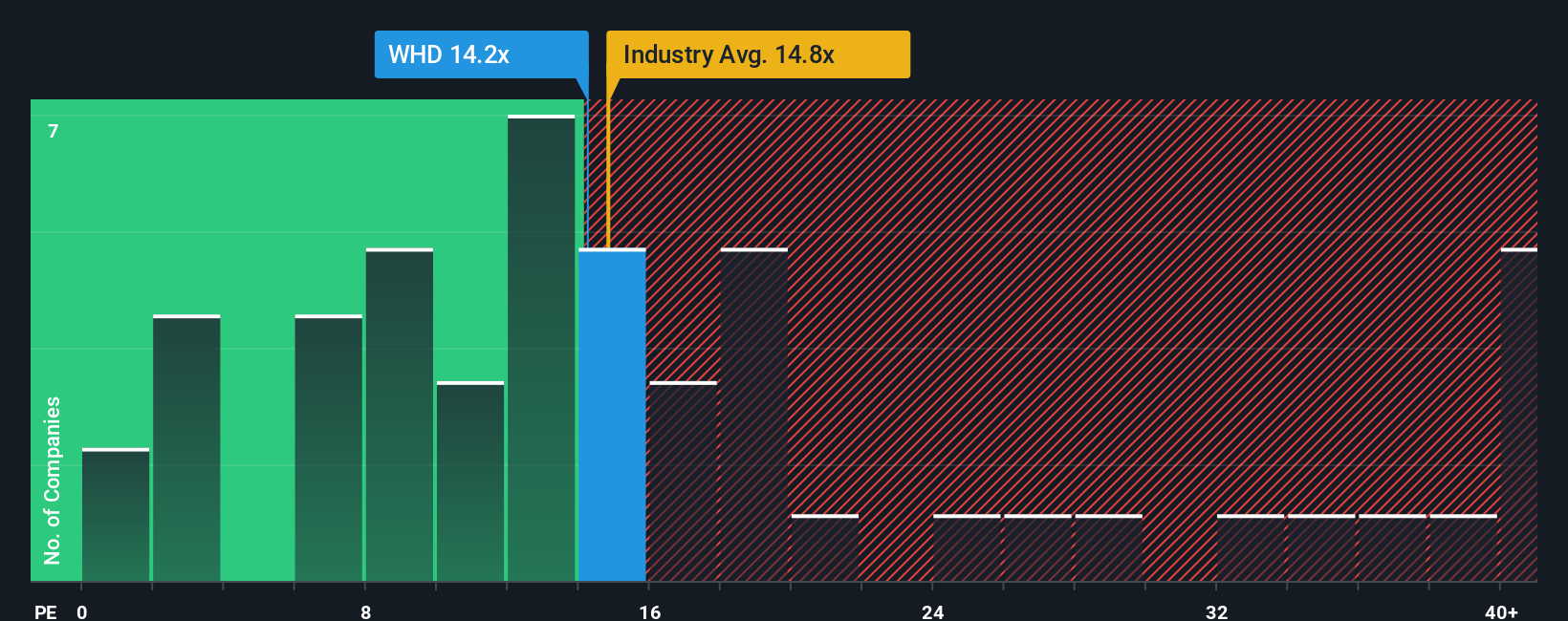

Cactus currently trades at a PE ratio of 13.6x. This is just below the Energy Services industry average of 14.5x and well below the average among its peers, which stands at 40.1x. However, rather than only comparing to industry or peers, Simply Wall St calculates a "Fair Ratio" for each stock. For Cactus, our proprietary Fair PE Ratio is 16.9x, which blends in expected earnings growth, profit margins, industry dynamics, company size, and risk levels.

The Fair Ratio gives a more complete valuation signal compared to simple peer averages because it adjusts for the unique qualities of Cactus rather than applying a one-size-fits-all benchmark. This nuanced approach means investors get a clearer picture of whether the stock is genuinely being overlooked or if the market is already factoring in all the key positives and negatives.

Since Cactus’s PE ratio is meaningfully lower than its Fair Ratio, this suggests the stock is undervalued on earnings-based metrics right now.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cactus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are an innovative and user-friendly approach to investing, allowing you to share and explore the story behind your assumptions about a company's future: your perspective on its potential revenue, earnings, margins, and ultimately, fair value.

A Narrative links the unique story and catalysts you see in a company directly to a financial forecast and a fair value, helping you cut through the noise and clarify your thesis. On Simply Wall St’s Community page, investors can access Narratives with ease. Millions already do, to check what others believe, compare scenarios, and build confidence in their own decisions.

Narratives make it simple to see if you think Cactus’ fair value is above or below today’s price, guiding you on when it might be wise to buy, hold, or sell. Best of all, Narratives update automatically as new information, news, or earnings arrive, so your view always stays current.

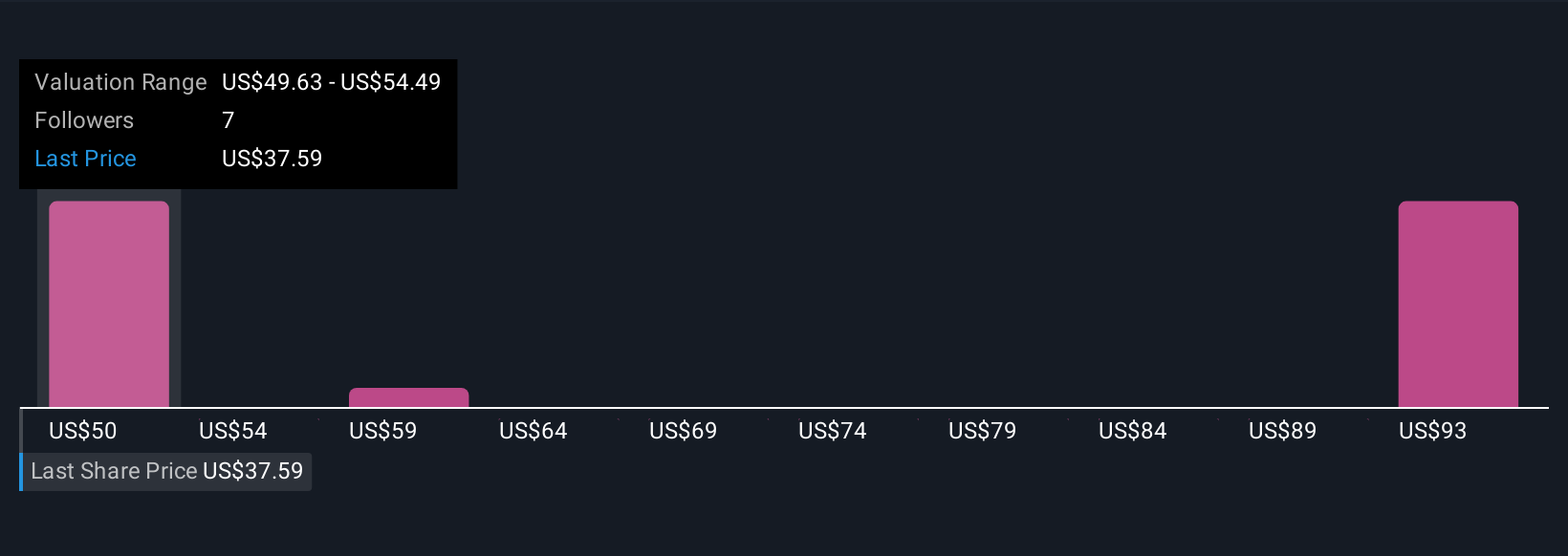

For example, one investor might see new Middle East business fueling a price target of $56.00 for Cactus, while another, worried about margin risks, believes $39.00 is more realistic.

Do you think there's more to the story for Cactus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHD

Cactus

Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion