- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (NYSE:VLO) Sees 1% Quarterly Dip As Executive Leadership Shifts

Reviewed by Simply Wall St

Valero Energy (NYSE:VLO) recently announced an executive change as Robert A. Profusek retires from the Board, with H. Paulett Eberhart stepping in as the new independent Lead Director. This leadership update occurred alongside a 1% decline in Valero's stock in the last quarter, possibly influenced by broader market volatility, including a 5.6% drop in the past week, largely due to heightened trade tensions causing a global stock sell-off. Additionally, Valero's financial performance, with reduced sales and earnings reported for the last fiscal year, might have had an impact on its overall shareholder return.

Buy, Hold or Sell Valero Energy? View our complete analysis and fair value estimate and you decide.

Over a five-year period, Valero Energy achieved a total shareholder return of 181.51%. This impressive gain reflects several factors influencing its stock performance. The company's commitment to shareholder returns through robust payout strategies, including dividend increases and considerable share buybacks, has likely boosted investor confidence. Additionally, Valero's progress in sustainable fuel projects such as the DGD sustainable aviation fuel initiative highlights its focus on future growth and revenue enhancement.

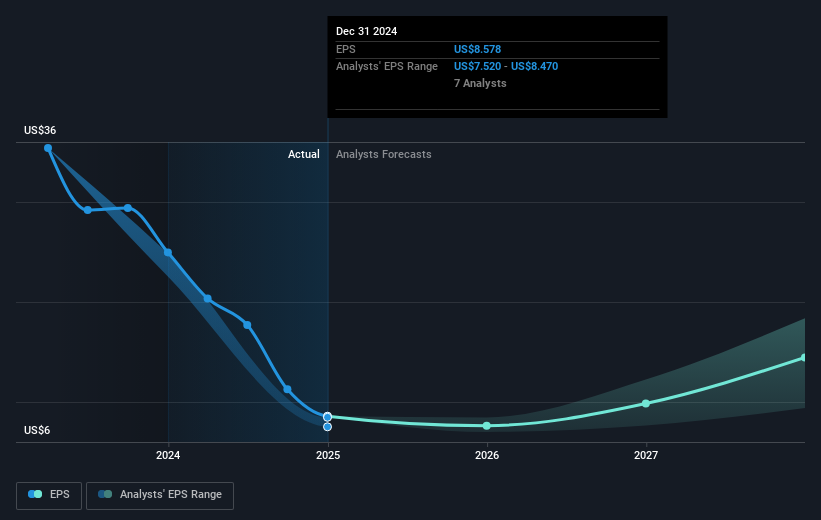

The company's operational success in processing heavy sour crude, amid global demand changes, underscores its ability to secure economic crude oils. However, challenges emerged with a significant decline in net income—from US$8.84 billion in 2023 to US$2.77 billion in 2024—amid weak refining margins. Despite these hurdles in recent years, Valero's long-term performance remains robust compared to both broader market indices and the US Oil and Gas industry over the past year.

Understand Valero Energy's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Valero Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives