- United States

- /

- Oil and Gas

- /

- NYSE:TPL

Here's Why Texas Pacific Land (NYSE:TPL) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Texas Pacific Land (NYSE:TPL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Texas Pacific Land with the means to add long-term value to shareholders.

Check out our latest analysis for Texas Pacific Land

Texas Pacific Land's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Texas Pacific Land has managed to grow EPS by 32% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

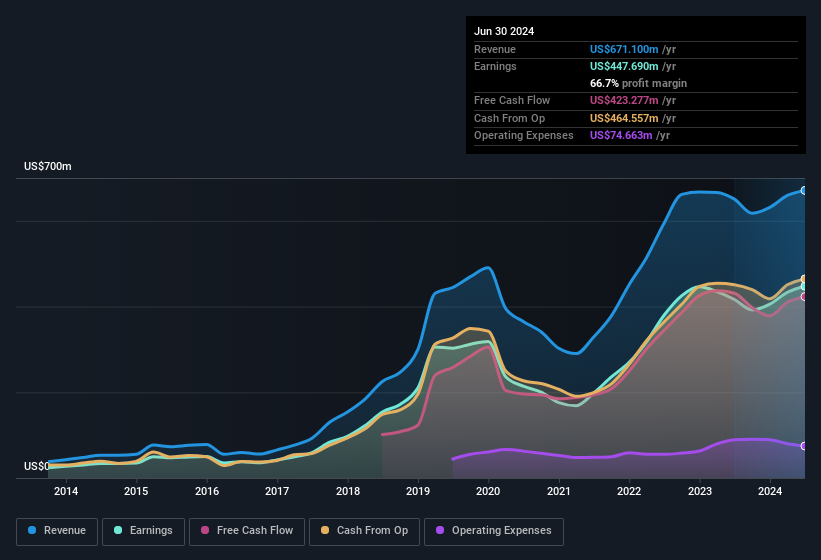

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Texas Pacific Land maintained stable EBIT margins over the last year, all while growing revenue 3.1% to US$671m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Texas Pacific Land's balance sheet strength, before getting too excited.

Are Texas Pacific Land Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold US$185k worth of shares. But that's far less than the US$1.1m insiders spent purchasing stock. This adds to the interest in Texas Pacific Land because it suggests that those who understand the company best, are optimistic. We also note that it was the Independent Director, Robert Roosa, who made the biggest single acquisition, paying US$492k for shares at about US$550 each.

Along with the insider buying, another encouraging sign for Texas Pacific Land is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$23m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Texas Pacific Land's CEO, Tyler Glover, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Texas Pacific Land, with market caps over US$8.0b, is around US$13m.

Texas Pacific Land's CEO took home a total compensation package of US$6.1m in the year prior to December 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Texas Pacific Land Deserve A Spot On Your Watchlist?

For growth investors, Texas Pacific Land's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Of course, just because Texas Pacific Land is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Keen growth investors love to see insider activity. Thankfully, Texas Pacific Land isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives