- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (SEI) Q2 2025 Earnings Show Strength Despite 6% Dip Over Last Quarter

Reviewed by Simply Wall St

Solaris Energy Infrastructure (SEI) recently affirmed a dividend payout and posted strong earnings for Q2 2025, yet experienced a 6% decline in share price over the last quarter. This dip contrasts with the broader market's rise, partly driven by the S&P 500 and Nasdaq reaching new highs amid falling PPI data and rate-cut expectations. The absence of confirmed stock buybacks from Solaris and changes in its index constituents—removing it from value benchmarks while adding it to growth benchmarks—may have contributed to the price decline. However, Solaris' positive earnings and dividend might have cushioned the impact against the prevailing market trends.

The recent news of Solaris Energy Infrastructure's dividend payout and strong Q2 2025 earnings might support its longer-term narrative focused on grid resiliency and electrification. However, the absence of stock buybacks and index reclassification may have offset these positives, contributing to the 6% share price decline over the last quarter. Despite this short-term dip, the company's shares have shown a very large total return of 365.74% over the five-year period.

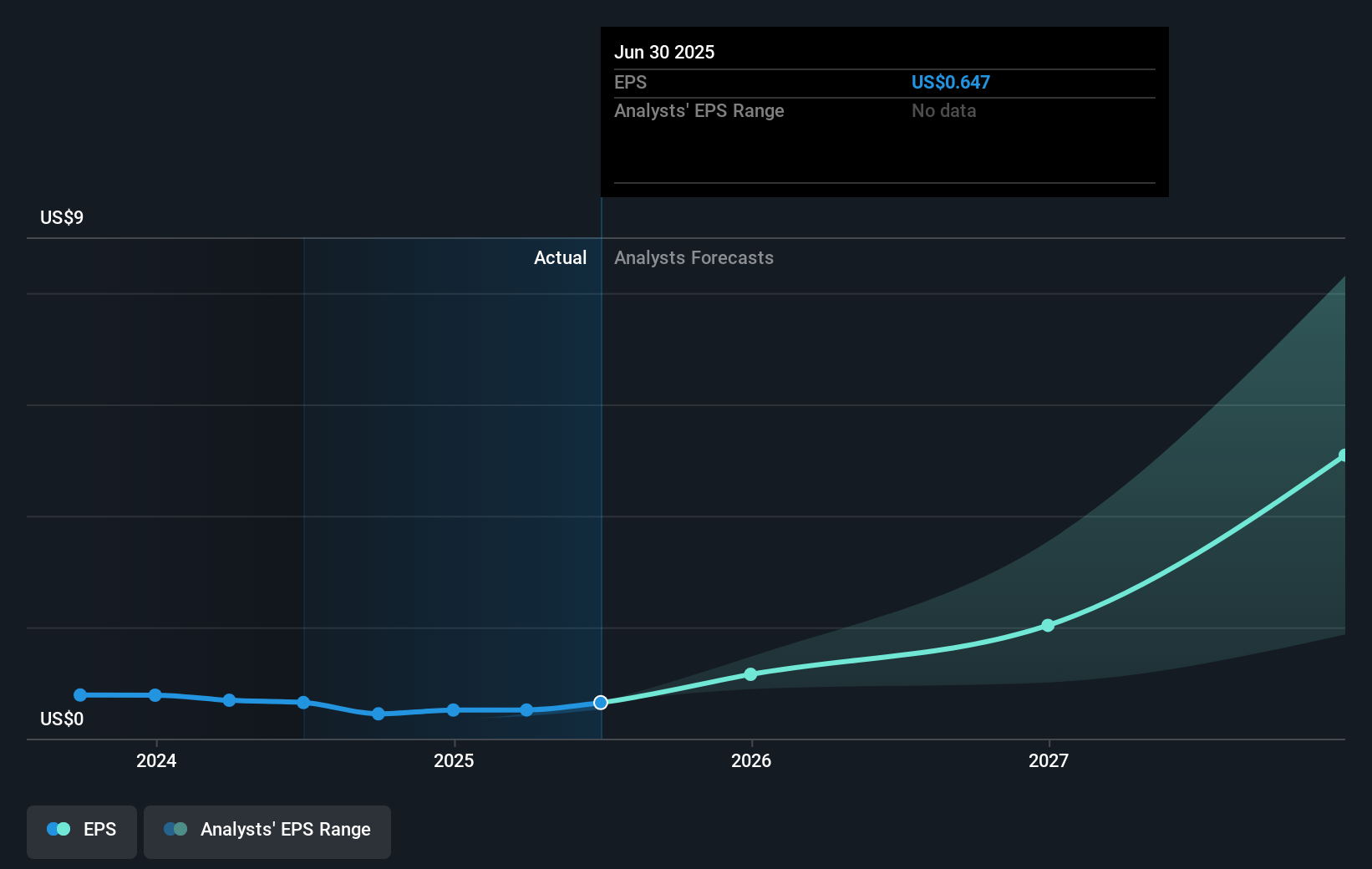

While the company's shares outperformed the US Energy Services industry in the past year, with a significant upward trajectory, the current share price of US$24.92 reflects a substantial discount to the analyst consensus price target of US$45.11. Regarding future outlook, the Q2 2025 earnings report and dividend announcement underline potential revenue and earnings forecast stability, underscoring Solaris's growth catalysts. Analysts continue to anticipate substantial growth, although this relies on factors like the sustained demand for power solutions and the company's ability to navigate sector-specific risks. The recent share price movements indicate a cautious market stance relative to these optimistic forecasts.

Learn about Solaris Energy Infrastructure's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)