- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (SEI): Assessing Valuation After Fresh Bullish Calls From Morgan Stanley, Piper Sandler and Barclays

Reviewed by Simply Wall St

Morgan Stanley’s new Overweight rating on Solaris Energy Infrastructure (SEI), together with recent target bumps from Piper Sandler and Barclays, puts fresh attention on how this data center power specialist might perform through 2028.

See our latest analysis for Solaris Energy Infrastructure.

The upbeat analyst coverage lands just as SEI cools off from a sharp run, with a 1 day share price return of negative 14.81 percent following a 90 day share price return of 43.07 percent and a powerful 5 year total shareholder return of 540.92 percent. This suggests long term momentum is still very much intact despite near term volatility.

If SEI’s surge has you rethinking what could grow next, this might be a good moment to explore fast growing stocks with high insider ownership for other high conviction ideas beyond the data center power theme.

With Solaris now trading about 40 percent below consensus targets while reporting rapid revenue and earnings growth, investors face a key question: Is this still an undervalued data center power enabler, or is future growth already priced in?

Most Popular Narrative: 28.7% Undervalued

With Solaris shares last closing at $46.07 against a narrative fair value of $64.60, the story hinges on whether aggressive growth can hold.

The accelerating demand for grid resiliency, electrification of industries, and AI driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions, positioning the company for significant revenue growth as delivery of new capacity ramps through 2026 and beyond.

Curious how this capacity ramp translates into future profits and an elevated earnings multiple, and why growth expectations look more like a high flying software name than a traditional energy contractor? Explore the narrative to see the specific revenue, margin, and earnings assumptions that underpin this ambitious fair value path.

Result: Fair Value of $64.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish path could wobble if data center contract wins slip or growth normalizes as one-off Power Solutions tailwinds fade.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another Angle on Valuation

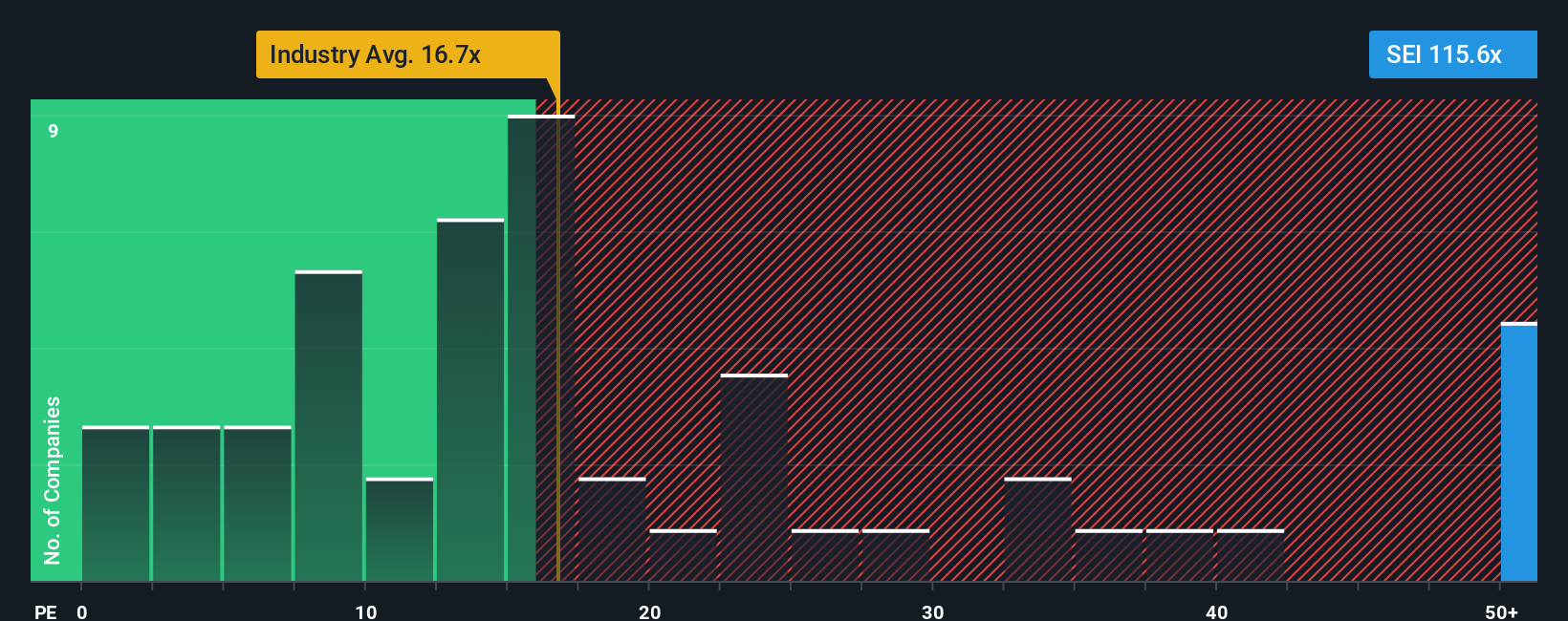

On simple price to earnings maths, Solaris looks less forgiving. The stock trades on about 61.9 times earnings, more than triple the US Energy Services industry at 18.4 times and well above a 25.4 times fair ratio, which leaves far less room for execution slip ups than the narrative suggests.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market’s next move leaves you watching from the sidelines, use the Simply Wall Street Screener to line up your next wave of opportunities today.

- Capture early stage potential with these 3613 penny stocks with strong financials that balance speculative upside with underlying financial strength.

- Target structural growth by focusing on these 26 AI penny stocks positioned at the heart of intelligent automation and next generation software demand.

- Lock in quality at sensible prices through these 908 undervalued stocks based on cash flows that screen for strong cash flows trading at compelling valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)