- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (PSX): Reassessing Valuation After Q3 Earnings Beat and Strong Refining Performance

Reviewed by Simply Wall St

Phillips 66 (PSX) is back in focus after its third quarter numbers topped revenue and earnings expectations, supported by stronger refining margins and record performance in key refining and midstream operations.

See our latest analysis for Phillips 66.

The upbeat Q3 surprise helped extend Phillips 66’s positive trend, with a roughly 20% year to date share price return and a 5 year total shareholder return above 140 percent, suggesting momentum is still broadly intact.

If this refining driven story has caught your eye, it could be worth scanning aerospace and defense stocks for other established players navigating shifting macro and energy linked demand cycles.

Yet with shares already up strongly over three and five years, and analysts still seeing upside from today’s price, is Phillips 66 trading at a discount to its true cash flow power, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 48.8% Undervalued

Compared to the last close of $137.57, the narrative fair value of $268.71 implies that Phillips 66 could be significantly mispriced by the market.

Growth Initiatives: Strategic investments in growth areas such as chemical manufacturing, midstream expansions, or renewable energy can positively impact future profitability. Analysts might point out these efforts as indicators of potential margin expansion.

To see how modest top line assumptions still lead to a striking upside case, supported by leaner margins and a richer future earnings multiple, read on.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker refining margins or prolonged energy demand softness could quickly compress cash flow, challenging the upbeat valuation and delaying any re-rating toward fair value.

Find out about the key risks to this Phillips 66 narrative.

Another View: Rich On Earnings

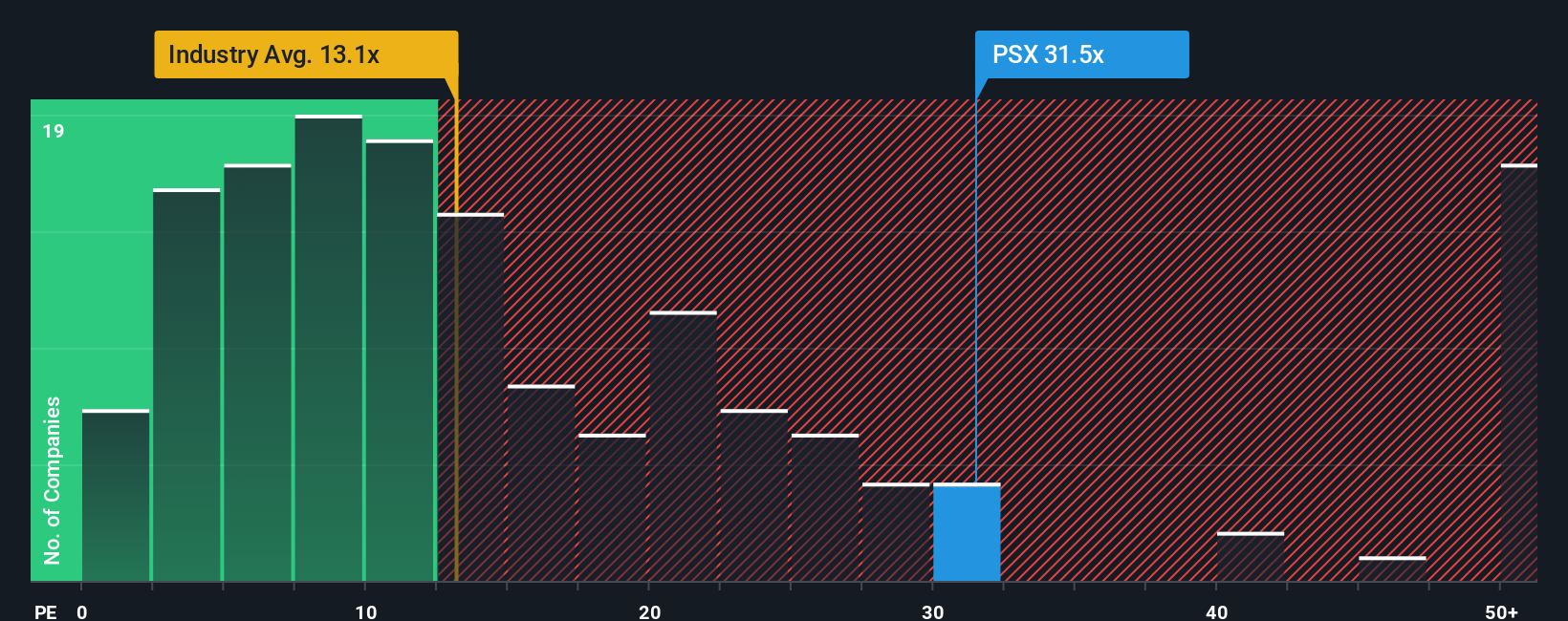

Looked at through its price to earnings ratio, Phillips 66 screens very differently. The shares trade on 37 times earnings, well above the US Oil and Gas industry at 13.6 times, peers at 26.6 times, and even our fair ratio of 25.1 times. This points to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop here, you could miss out on some of the market’s most compelling opportunities, so keep your momentum going and widen your opportunity set now.

- Capture potential mispricings by scanning these 933 undervalued stocks based on cash flows that combine solid fundamentals with attractive cash flow driven valuations before the crowd catches on.

- Ride powerful innovation trends by targeting these 24 AI penny stocks positioned at the intersection of accelerating data, automation, and long term structural demand.

- Secure more dependable portfolio income through these 14 dividend stocks with yields > 3% offering higher yields without abandoning balance sheet strength or earnings quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an integrated downstream energy provider in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026