- United States

- /

- Oil and Gas

- /

- NYSE:PSX

How Recent Oil Market Moves Could Impact the Value of Phillips 66 in 2025

Reviewed by Bailey Pemberton

If you’re eyeing Phillips 66 right now and debating whether to hold tight, buy in, or maybe trim your position, you’re definitely not alone. This stock has seen its fair share of action, with a five-year return of 223%. While the last week saw a slight dip of -1.2%, Phillips 66 is still up a robust 14.4% year-to-date, showing some impressive staying power despite recent market volatility. Over the past year, shares have inched up 3.3%, and if you zoom out to three years, the gain jumps to an attention-grabbing 51.8%.

The story behind these price movements is a mix of steady long-term growth and the market’s shifting perspective on energy sector risks and opportunities. Recent activity in oil prices and moves toward refining capacity expansion have contributed to renewed interest in refinery stocks, giving investors new reasons to reassess Phillips 66’s upside potential. While there haven’t been any blockbuster news events moving the needle dramatically, the underlying industry trends remain supportive. This could be a sign of more to come.

When it comes to valuation, Phillips 66 currently earns a value score of 3 out of 6. This means it checks the “undervalued” box in half of the key methods analysts commonly watch. But before you make your next move, let’s break down which approaches say the stock is cheap, and why a more thoughtful, nuanced take on valuation could give you a real edge over headline-chasing traders.

Approach 1: Phillips 66 Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation method that estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach gives investors a sense of what the business is truly worth based on its earning power, not just recent price trends.

For Phillips 66, analysts estimate current free cash flow at approximately $1.4 billion, with strong expectations for growth in the coming years. According to available projections, free cash flow is expected to rise to about $7.2 billion by 2029. While analyst coverage typically extends out five years, later estimates are modeled using conservative long-term growth rates. These projections together form the core of the DCF calculation and anchor the valuation outcome.

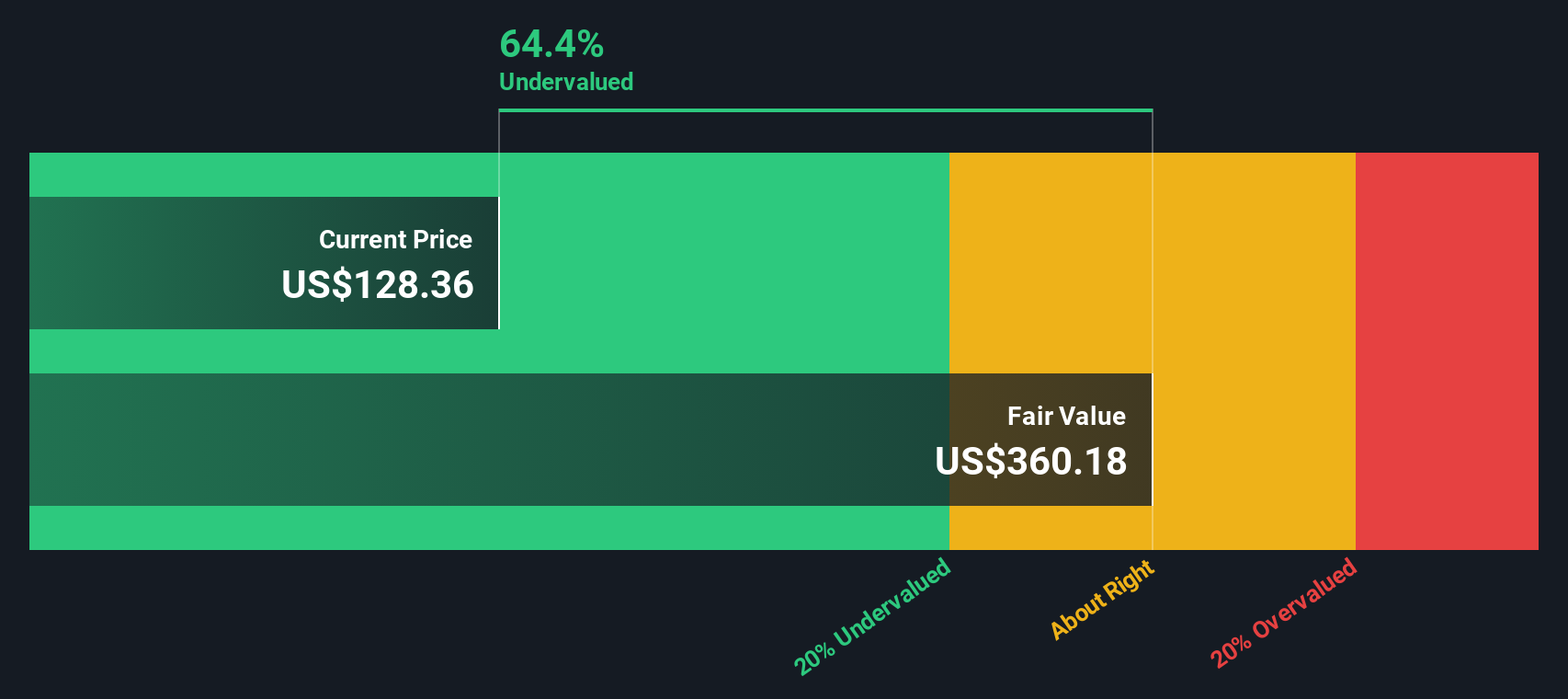

With these cash flow projections used in a 2 Stage Free Cash Flow to Equity model, the DCF analysis arrives at an intrinsic value per share of $360.91. This figure is 63.7% higher than the current market price, suggesting that based on these cash flow estimates, Phillips 66 stock may be significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phillips 66 is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Phillips 66 Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies like Phillips 66, since it provides a snapshot of how much investors are paying for each dollar of current earnings. This multiple is especially useful for comparing companies of similar size and profitability within the same industry.

Deciding what a "fair" PE ratio should be depends on several factors. Companies with higher expected growth, more stable earnings, and lower risk typically deserve a higher PE. In contrast, slower growers or those with greater risks often trade at lower multiples.

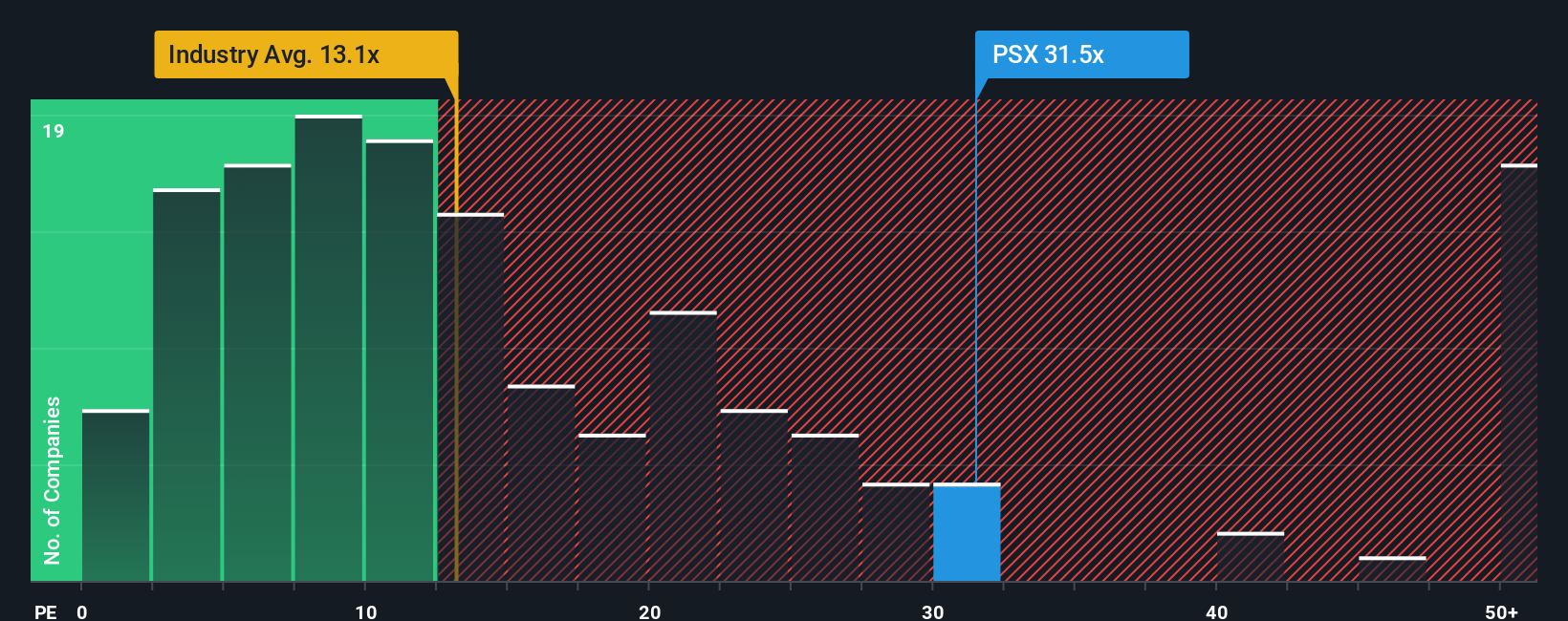

Phillips 66 currently has a PE ratio of 30.96x. Compared to the Oil and Gas industry average of 13.00x and a peer group average of 32.49x, Phillips 66 appears to be valued at a premium to the broader industry, but sits just below its peers. This raises the question, what should its “normal” multiple really be?

That is where Simply Wall St’s proprietary Fair Ratio comes in. This metric goes beyond simple comparisons and considers Phillips 66’s own growth profile, profit margins, size, and risk factors to pinpoint a fitting multiple. For Phillips 66, the Fair Ratio is calculated at 21.95x, which is notably lower than its current PE.

Unlike basic industry or peer comparisons, the Fair Ratio delivers a tailored benchmark so investors can assess whether the stock is genuinely mispriced, not just out of sync with the pack.

With the current PE significantly above the Fair Ratio, Phillips 66 trades at a premium based on what its fundamentals and industry positioning suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phillips 66 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal take on a stock; it is the story you believe about Phillips 66’s future, backed up by your assumptions on revenue, margins, and fair value. Narratives connect what is happening in the real world with concrete forecasts and a target price, allowing you to clearly see if the current share price is too high or low for your outlook.

On Simply Wall St’s Community page, you will find Narratives in action. They are used by millions of investors who want to go beyond one-size-fits-all analysis, and they are incredibly easy to create, update, and compare. Because Narratives automatically adjust as new news or earnings come in, your insights stay relevant even as the market changes.

For example, some investors see Phillips 66’s fair value as high as $269 per share, assuming margin improvements and growth opportunities, while others estimate as low as $127, anticipating market headwinds and modest profit margins. With Narratives, you can quickly compare your view to others and decide more confidently when to buy, hold, or sell based on your own understanding of the company’s future.

Do you think there's more to the story for Phillips 66? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives