- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Elliott Seeks Board Change At Phillips 66 (NYSE:PSX) Backed By Proxy Firms

Reviewed by Simply Wall St

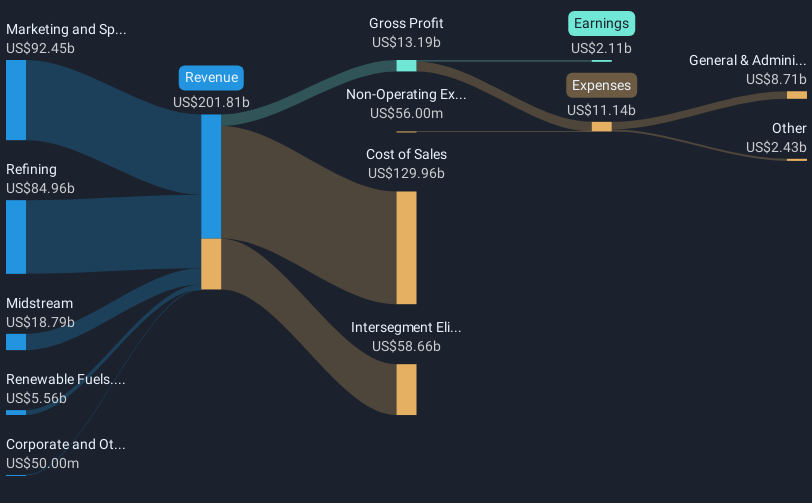

Phillips 66 (NYSE:PSX) is navigating a period marked by investor activism from Elliott Investment Management, with significant support from proxy advisory firms ISS, Glass Lewis, and Egan-Jones for changes to the board. This comes ahead of the upcoming shareholder meeting, adding to the tension. Despite these internal challenges, the company's share price saw a notable increase of 29% over the past month, suggesting that these events weighed into perceptions of its value. However, with the broader market also rising 4% over the last week, it’s likely these developments added weight to the momentum rather than opposing it.

The news involving Phillips 66's investor activism could potentially impact the company's strategic focus and decision-making process, which might influence the narrative around its pursuit of transformational growth and operational upgrades. This scenario could affect revenue and earnings forecasts, with analyst predictions already considering a revenue decline of 3.8% per year over the next three years. Despite the recent share price increase of 29% in the past month, this movement needs to be assessed against the consensus price target of approximately $129.75, indicating a possible increase from the current share price of $105.39. The market appears cautiously optimistic, factoring in both internal company changes and broader market trends.

Over a longer time frame, Phillips 66's total shareholder return, including share price appreciation and dividends, stands at 103.32% over the past five years. When considering its performance relative to the industry, it underperformed the US Oil and Gas industry's return of 5.7% decline over the past year. This contrast highlights the complexity of factors influencing its performance, and how recent developments might weigh in on future market value. The ongoing board-level changes could bring fresh perspectives geared toward addressing these challenges, potentially aligning the company more closely with market expectations and its financial strategy objectives as outlined by management and analysts.

Take a closer look at Phillips 66's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Phillips 66, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives