- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Occidental Petroleum (OXY) Reports Drop in Q2 Earnings with US$458 Million Net Income

Reviewed by Simply Wall St

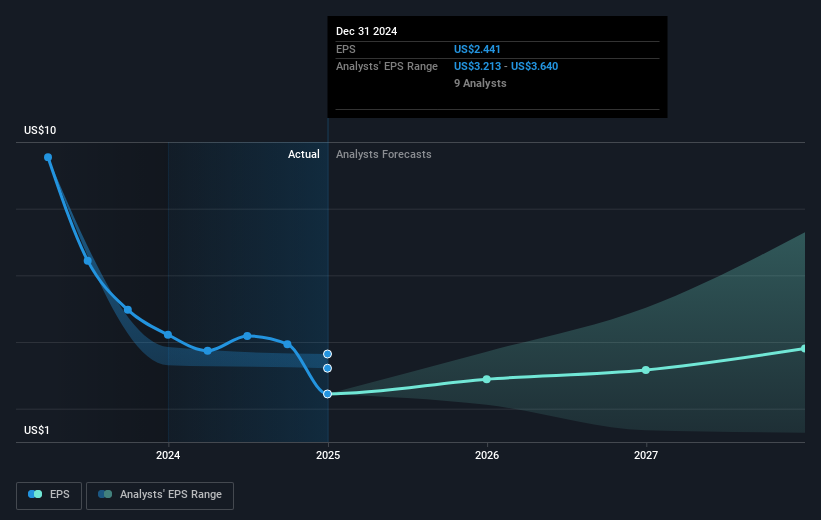

Occidental Petroleum (OXY) recently reported its second-quarter results, highlighting a decline in both net income and earnings per share compared to the same period last year. Despite this, the company's sales and revenue figures for the first half of 2025 increased, suggesting some resilience. During the last quarter, OXY's stock experienced a 3% price increase, reflecting broader market movements as investors digested various earnings while monitoring tariff developments. Occidental's addition to the Russell Midcap indices and commitment to CO2 capture initiatives through new partnerships may have balanced the mixed earnings performance, contributing to its overall market traction.

Occidental Petroleum's recent earnings report, indicating a decline in net income and earnings per share, could affect the company's narrative of future growth and operational efficiency. Despite these challenges, Occidental's commitment to increasing production efficiency and CO2 capture initiatives through the STRATOS project suggests a proactive approach to securing future revenue streams. This aligns with revenue and earnings forecasts, with projections signaling a rise in profit margins over the coming years. However, the volatility in oil prices and capital expenditures could pose significant challenges to these forecasts.

Over the past five years, Occidental's shareholders have experienced a substantial total return of 199.68%. This return highlights the company's ability to deliver long-term value despite recent earnings volatility. When compared to the broader U.S. Oil and Gas industry, Occidental underperformed over the past year, with the industry showing a modest return of 0.1%. Such performance underscores the importance of focusing on long-term strategic initiatives amidst market fluctuations.

The current share price of US$42.54, reflecting a 3% increase last quarter, stands in stark contrast to the consensus analyst price target of US$50.13. This target anticipates improved future earnings, implying potential for share price appreciation if forecasts are met. Investors may need to consider the forecasted growth and share price discount when evaluating the alignment of their expectations with market optimism.

Evaluate Occidental Petroleum's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)