- United States

- /

- Oil and Gas

- /

- NYSE:OKE

ONEOK (OKE): Valuing the Stock After Eiger Express Pipeline Commitment Expands Energy Infrastructure Reach

Reviewed by Simply Wall St

Most Popular Narrative: 24.4% Undervalued

According to the most followed narrative, ONEOK is notably undervalued based on future cash flows and projected financial growth. The current price sits well below consensus estimates of intrinsic worth, suggesting opportunity for re-rating as forward targets come into focus.

“Persistent growth in global demand for U.S. natural gas and NGLs, driven by increasing international energy needs and continued coal-to-gas switching, supports long-term volume throughput and higher utilization rates across ONEOK's midstream and export infrastructure. This directly underpins future revenue and EBITDA growth.”

Want to know just how bold the narrative is about ONEOK's upside? This story leans on aggressive top-line expansion, next-level margins, and a profit multiple that rivals industry leaders. Curious about the projections fueling such a steep discount to fair value? Get ready for forecasts that might surprise even optimistic investors.

Result: Fair Value of $96.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, even this optimistic outlook could falter if commodity price volatility persists or if integration challenges from recent acquisitions erode expected synergies.

Find out about the key risks to this ONEOK narrative.Another View: Industry Comparison Tells a Different Story

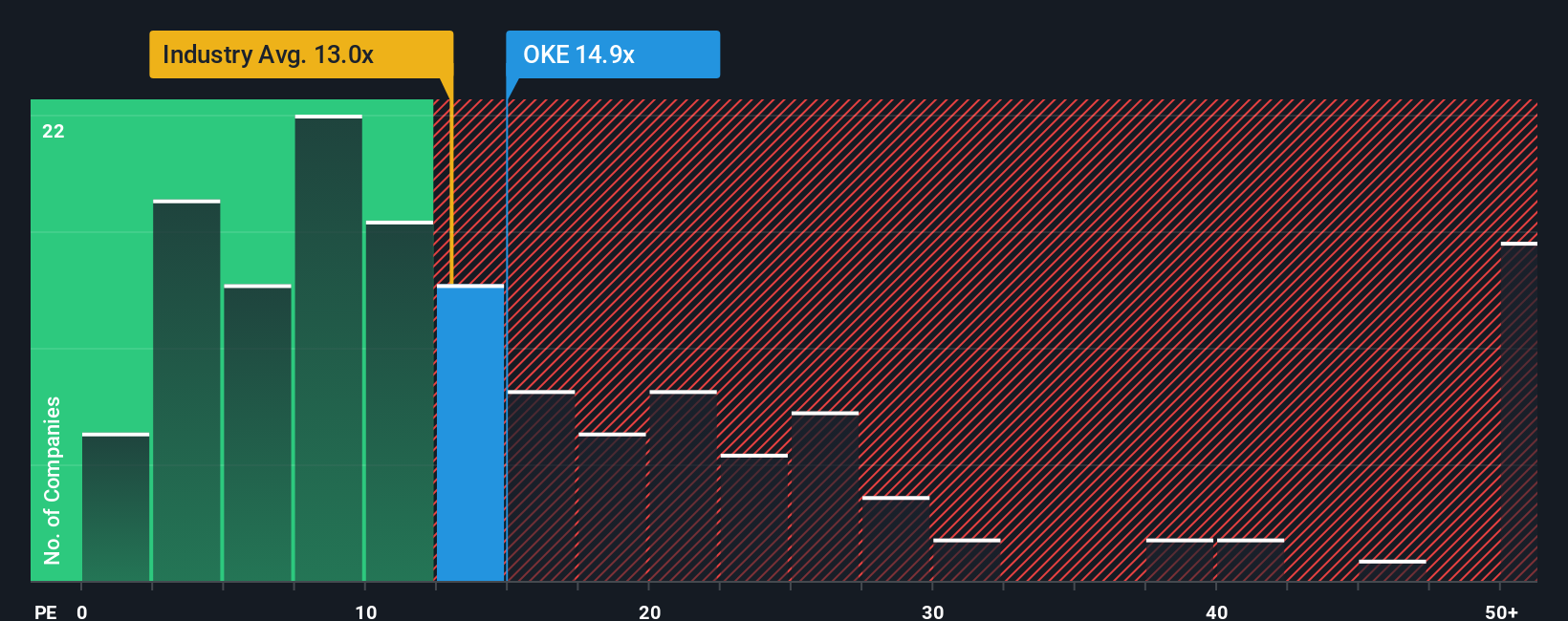

Looking at ONEOK from an industry perspective shows that its current valuation is actually a bit higher than the average for similar companies in oil and gas. Can this premium be justified by its growth pipeline, or has optimism gone too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONEOK Narrative

If these perspectives do not quite fit your outlook or you prefer taking a hands-on approach, you can craft your own narrative analysis in just minutes. Do it your way

A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge and give your portfolio an edge by checking out stocks with untapped potential, strong payouts, and innovative tech you might be overlooking. Smart investors act now rather than waiting for opportunities to pass by.

- Capture the upside of undervalued companies before the crowd catches on by using our undervalued stocks based on cash flows.

- Unlock growth with promising tech firms driving the new era of artificial intelligence in healthcare through our healthcare AI stocks.

- Maximize income and stability by targeting businesses offering yields above 3% with our handy dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)