- United States

- /

- Oil and Gas

- /

- NYSE:OKE

A Look at ONEOK's Valuation Following Eiger Express Pipeline Expansion Decision

Reviewed by Simply Wall St

If you have been tracking ONEOK (OKE), you probably took notice this week when the company and its partners committed to constructing the Eiger Express Pipeline. This is not just another infrastructure announcement; it signals a major move in expanding natural gas transportation from the Permian Basin to key Gulf Coast markets. With firm long-term transportation agreements already in place, ONEOK appears to be focusing on high-demand energy corridors, a strategy that could influence its growth story for years to come.

This announcement comes during a year that has been anything but smooth for ONEOK’s stock. Over the past year, shares have dropped around 12%, and they are sitting lower for the year to date, reflecting cautious sentiment even as the broader sector shifts toward growth investments. Yet, when viewed over a longer term, ONEOK's return profile appears stronger, showing nearly 50% gains over three years and almost tripling over the last five. This pipeline project now joins recent efforts to build up natural gas infrastructure, aiming to restore some momentum and reassure investors about the company’s long-range outlook.

After such a mixed year in the market, is ONEOK now trading at a steep discount, or is the market already pricing in all this future growth?

Most Popular Narrative: 22% Undervalued

According to the community narrative, ONEOK is seen as significantly undervalued based on a blend of future earnings, margins, and revenue growth assumptions. Analysts anticipate strong performance driven by the company's expanding infrastructure and strategic foothold in key export markets.

Persistent growth in global demand for U.S. natural gas and NGLs, driven by increasing international energy needs and continued coal-to-gas switching, supports long-term volume throughput and higher utilization rates across ONEOK's midstream and export infrastructure. This directly underpins future revenue and EBITDA growth.

What underpins this bullish outlook? There is a big story about where profits, margins, and valuation are expected to go. The narrative teases a sharp divergence from today's numbers and banks on global energy shifts. Want to uncover which key financial forecasts push ONEOK's fair value so far above its current share price? You'll need to look closer to see exactly what this consensus is betting on and why those who agree say this stock is set for a powerful rerating.

Result: Fair Value of $97.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, earnings remain vulnerable to commodity price swings and integration risks from recent acquisitions. These factors could limit upside if industry conditions worsen. Find out about the key risks to this ONEOK narrative.Another View: Putting the DCF Model to the Test

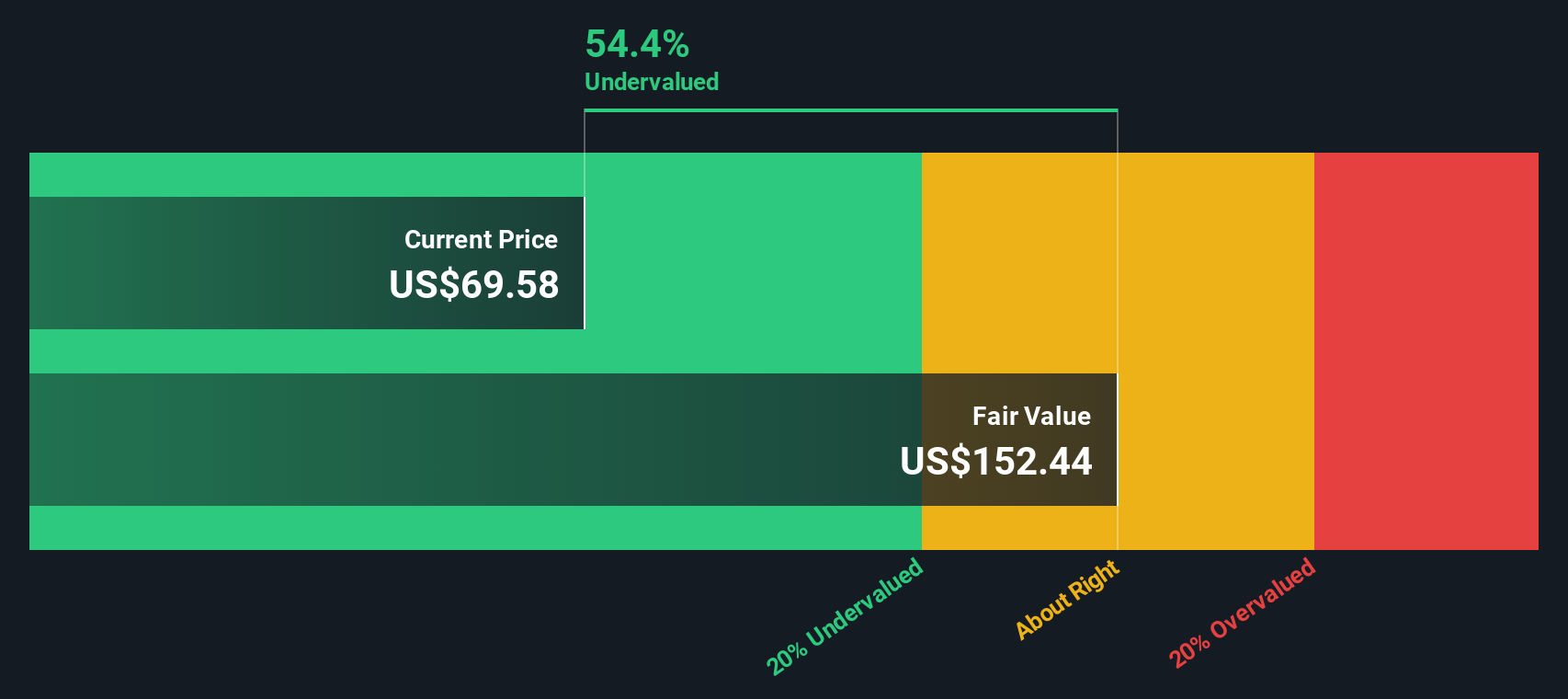

Taking a different approach, the SWS DCF model also suggests a significant gap between today's share price and its estimate of ONEOK's worth. However, is this cash-flow-based optimism justified, or does it overlook key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ONEOK for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ONEOK Narrative

Keep in mind, if you have your own perspective or want to dig into the numbers yourself, you can assemble your own narrative in just a few minutes with Do it your way.

A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at ONEOK when you could be one step ahead with promising opportunities across the market? Let Simply Wall Street make your next smart investing move effortless. Miss this, and you might overlook tomorrow’s winners hiding in plain sight. Check out these powerful screens to start your search:

- Uncover income potential by tapping into dividend stocks with yields above 3% through our handpicked analysis at dividend stocks with yields > 3%.

- Seize tomorrow’s breakthroughs by targeting AI-powered companies set to transform industries with our selection at AI penny stocks.

- Find high-value gems by screening for stocks trading beneath their cash flow potential using our proven approach at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)