- United States

- /

- Energy Services

- /

- NYSE:OII

How the New US Navy Contract Could Shape Oceaneering International's (OII) Defense Diversification Strategy

Reviewed by Simply Wall St

- Oceaneering International recently announced that its Marine Services Division of the Aerospace and Defense Technologies segment has been awarded an indefinite-delivery/indefinite-quantity contract by the U.S. Navy for submarine component repairs, with a base value of up to US$86 million over two years and options for three additional years.

- This contract reinforces Oceaneering’s long-standing role in supporting critical Navy operations and highlights the diversification of its business into defense services, an area with less exposure to oil and gas industry cycles.

- We'll explore how this substantial defense contract underpins Oceaneering International’s efforts to diversify revenues and enhance long-term stability.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Oceaneering International Investment Narrative Recap

Oceaneering International appeals to investors who believe in the company’s shift toward defense and aerospace as a pathway to more stable, diversified revenue beyond oil and gas cycles. The recent US$86 million Navy repair contract bolsters this strategy, yet it does not materially change the company’s biggest short-term catalyst: maintaining high day rates and utilization in its core offshore energy business. The largest risk remains a possible decline in capital spending by major oil and gas clients, which could dampen longer-term revenue growth if new offshore projects slow.

The company’s recent follow-on contract win in July 2025 for Virginia Class Submarine equipment, a separate deal worth up to US$33 million, further highlights Oceaneering’s traction in defense-related services. This series of awards supports the near-term catalyst of growing Aerospace and Defense Technologies earnings, but investors should stay alert to how broader spending trends in traditional offshore energy could still impact the company’s outlook.

However, against expanding defense contracts, investors should also consider the potential risks if energy transition efforts continue to constrain the offshore oil and gas project pipeline…

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's outlook anticipates $3.1 billion in revenue and $185.9 million in earnings by 2028. This is based on an expected annual revenue growth rate of 3.8%, but forecasts a decline in earnings by $16.3 million from the current $202.2 million.

Uncover how Oceaneering International's forecasts yield a $21.12 fair value, a 13% downside to its current price.

Exploring Other Perspectives

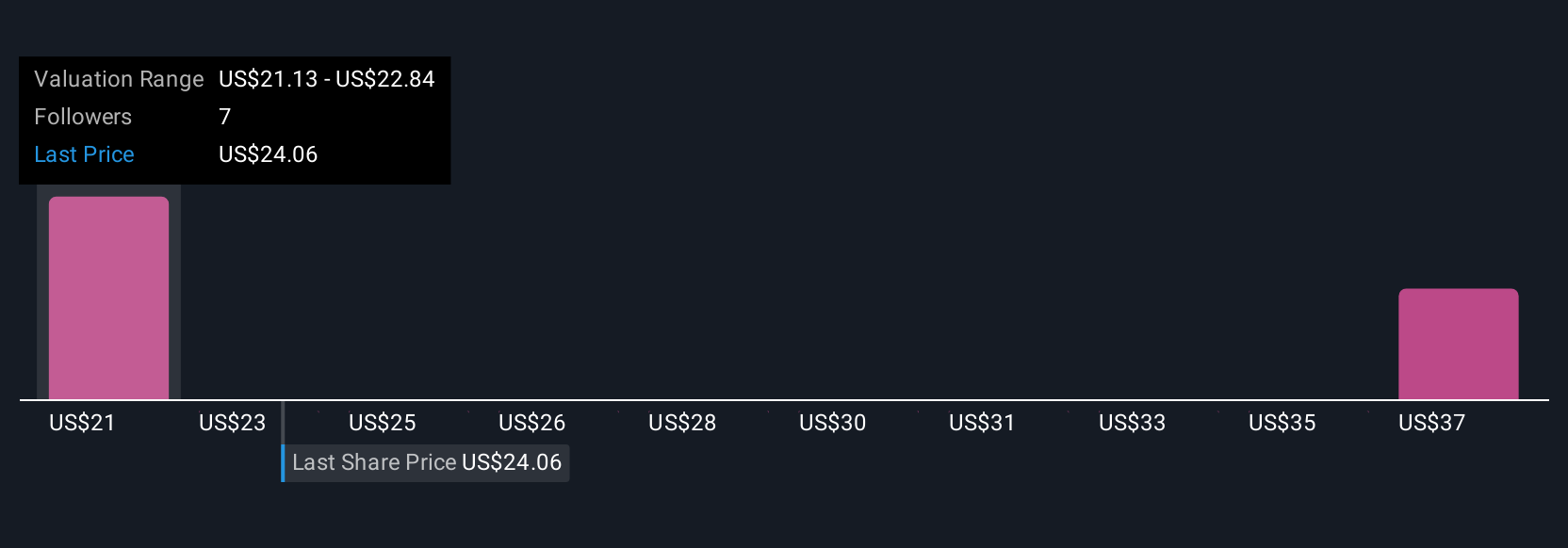

Three independent Simply Wall St Community members estimate a wide fair value range for Oceaneering International, from US$21.13 up to US$38.99 per share. While professional analysts cite concerns around capital flows to oilfield services, some community members see different upside or downside scenarios, highlighting the value of examining multiple viewpoints.

Explore 3 other fair value estimates on Oceaneering International - why the stock might be worth as much as 60% more than the current price!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives