- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Marathon Petroleum (NYSE:MPC) Faces Investor Proposal As Shares Dip 10% Over One Month

Reviewed by Simply Wall St

Marathon Petroleum (NYSE:MPC) is navigating significant investor scrutiny after receiving a shareholder proposal from activist investor John Chevedden advocating for simpler voting regulations in the company's governance structure. This activism is taking place against a broader backdrop of market volatility fueled by tariff announcements, which saw the Dow and the S&P 500 fall sharply. In the last month, Marathon's share price declined 10%, within a market environment where overall energy sector concerns were heightened by falling oil prices and widespread economic uncertainty, contributing to the company's broader price movement.

Over the last five years, Marathon Petroleum has delivered a very large total shareholder return of approximately 455%, a testament to its efforts in enhancing margins and shareholder value. This remarkable growth was partially driven by strategic capital investments in its Galveston Bay and Los Angeles refineries. By optimizing production to high-value fuels and expanding its renewable diesel segment, the company aimed to elevate its competitive positioning and profitability.

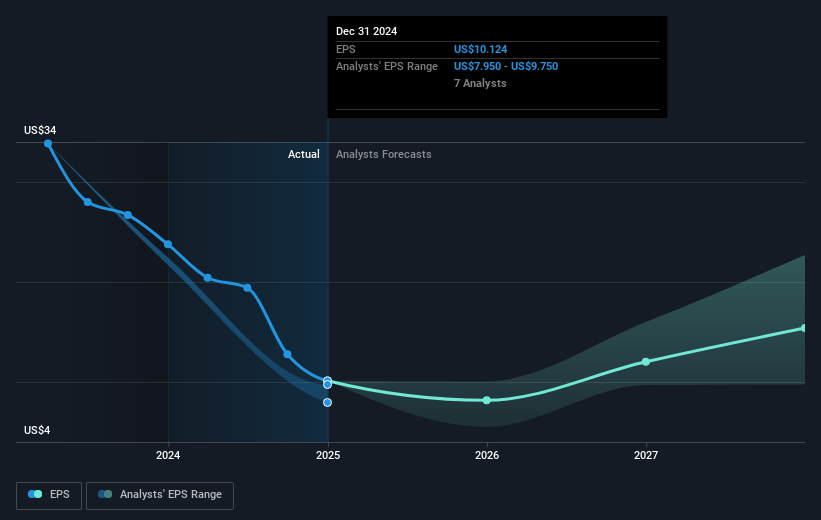

Despite these longer-term gains, the past year has seen challenges. Marathon Petroleum underperformed both the broader US market and the oil and gas industry, which experienced respective returns of 3.3% and a decline of 7.5%. This recent underperformance came amid global economic shifts, regulatory hurdles, and falling revenue in 2024, as sales dropped to US$138.86 billion from US$148.38 billion the previous year, impacting net income and profit margins. Nonetheless, its disciplined investment focus and buyback initiatives, which rose to US$50.1 billion, have been instrumental in its historic profitability trajectory.

Jump into the full analysis health report here for a deeper understanding of Marathon Petroleum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Marathon Petroleum, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives