- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Is Marathon Petroleum Still Attractive After a 6% Weekly Pullback in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Marathon Petroleum stock? You are definitely not alone. It has been a fascinating ride for this energy giant, with prices moving sharply both up and down over the past year. After closing at $180.89 most recently, Marathon Petroleum has impressed with a 27.8% gain so far this year, on top of a remarkable 85.7% return over the past three years and a staggering 608.6% jump in five years. There has been some turbulence along the way, though, with a pullback of -6.3% just this past week that has some investors pausing to reconsider risk and reward. Still, that kind of long-term performance has made Marathon Petroleum hard to ignore, even as markets adjust to shifting oil prices, global energy policies, and changing demand at home.

But is the stock a great buy right now, or are things getting a little overheated? That is where valuation comes in. When we score Marathon Petroleum across six classic checks for undervaluation, it gets a 3 out of 6, meaning it passes about half of the usual tests for being a bargain. In the sections ahead, we will dig into what these valuation approaches really show, and more importantly, why the usual numbers might not tell the full story. Stick around, because by the end, you will see there is a smarter way to think about Marathon Petroleum’s true value.

Approach 1: Marathon Petroleum Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s value. This approach gives investors a sense of what a company is really worth, based on the cash it is expected to generate.

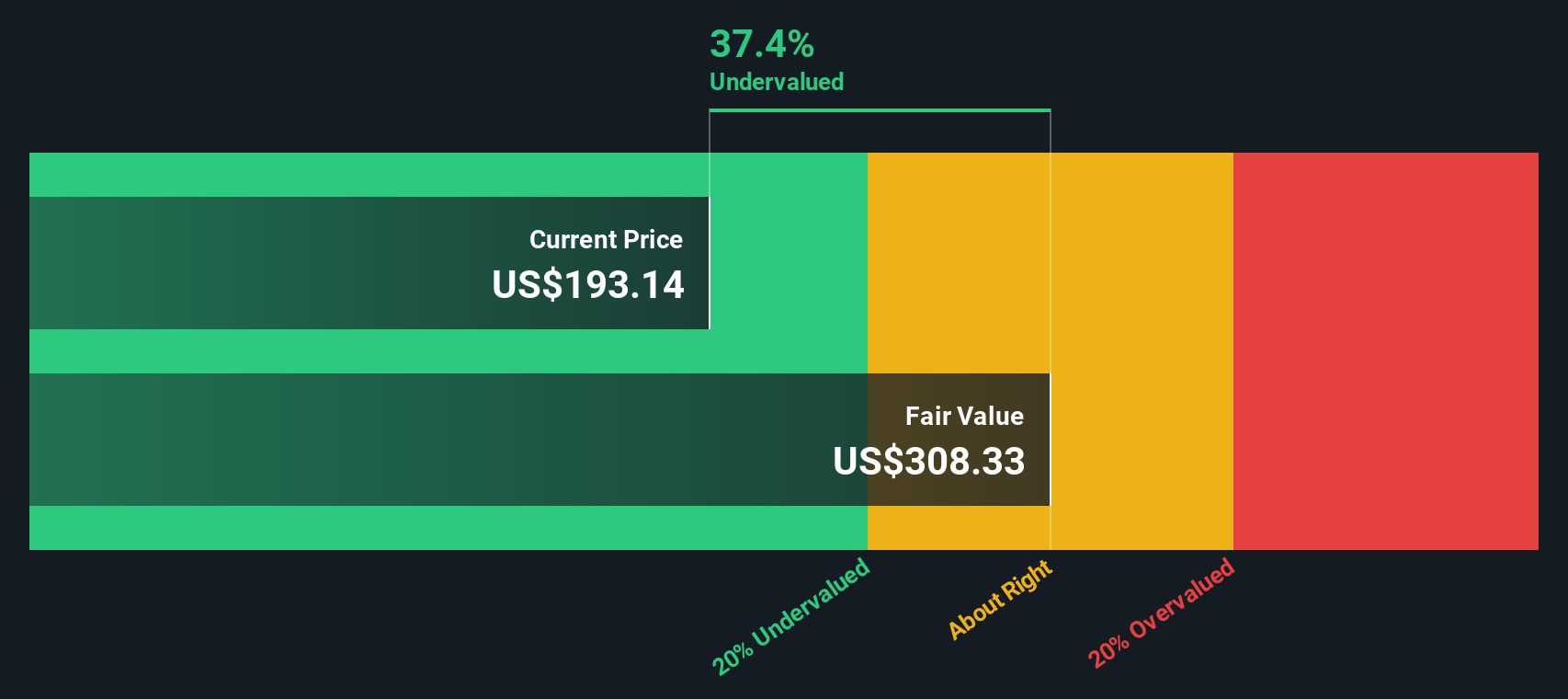

For Marathon Petroleum, the most recent reported Free Cash Flow stands at $4.27 billion. Analyst estimates suggest that annual Free Cash Flow could grow, reaching about $5.13 billion in 2028. For the years beyond, the projection extends out to 2035, with Simply Wall St using their own methodologies because of limited coverage by analysts after 2028. These forward-looking numbers help capture both analyst expectations and expert extrapolations.

According to the calculations, the intrinsic value per share from this DCF model stands at $301.80. With the stock recently closing at $180.89, this indicates a discount of about 40.1 percent compared to what the model considers fair value. In summary, the DCF model currently identifies Marathon Petroleum as significantly undervalued based on core cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marathon Petroleum is undervalued by 40.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Marathon Petroleum Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Marathon Petroleum, as it directly links a company’s share price to its earnings and helps investors gauge how much they are paying for each dollar of profit. A higher PE ratio often suggests expectations for stronger future growth, whereas a lower ratio can reflect perceived risks or cyclical downturns. What counts as a “normal” or “fair” PE ratio depends on several factors including industry growth prospects, the company’s risk profile, and profitability relative to its peers.

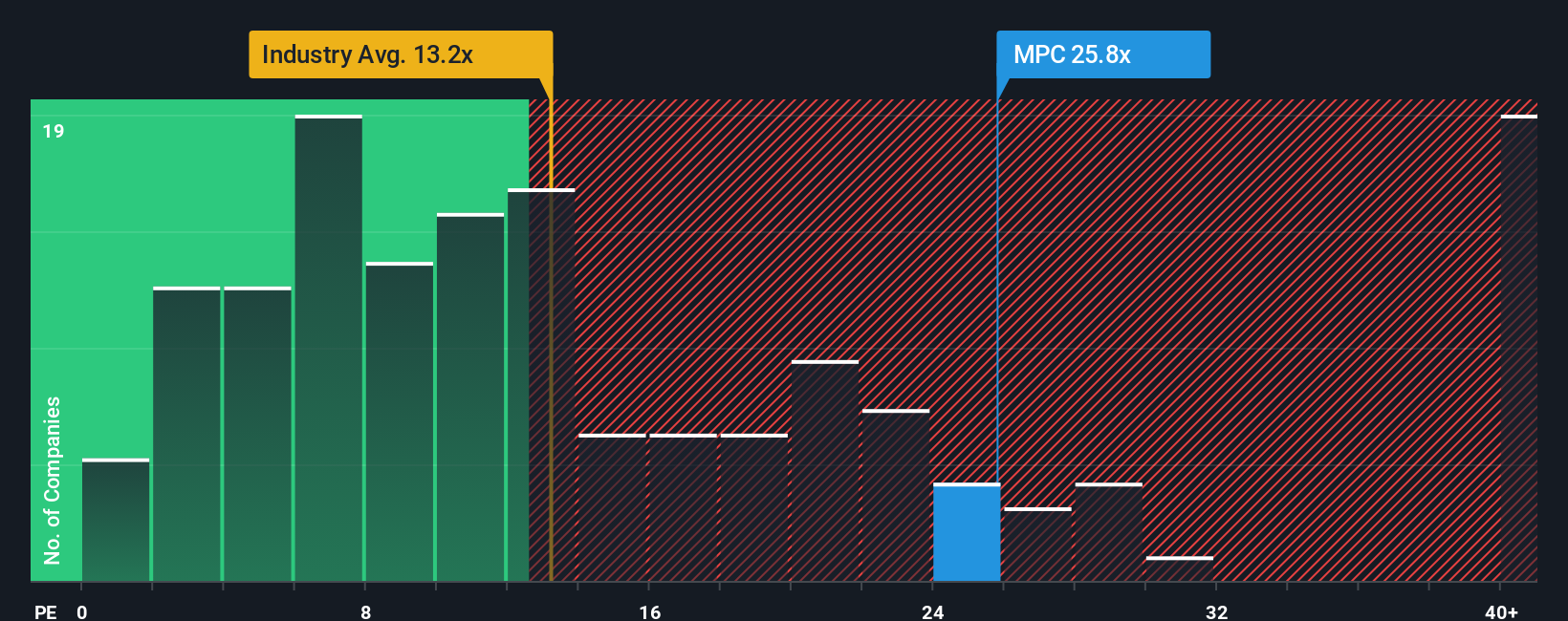

Marathon Petroleum currently trades at a PE ratio of 25.8x. This is well above the oil and gas industry average of 13.2x, but actually below the peer group average of 35.3x. While these comparisons provide context, they do not always capture the unique profile of a business like Marathon, including its recent growth rates, market cap, and profit margins.

This is where Simply Wall St’s concept of a “Fair Ratio” comes in. Instead of relying solely on peer or industry multiples, the Fair Ratio customizes a benchmark multiple based on Marathon’s specific attributes such as projected earnings growth, relative size, risk factors, and profitability. For Marathon, the Fair Ratio is calculated at 20.9x, which is somewhat below its current market PE. This suggests investors are paying a moderate premium for recent outperformance and profit momentum, but the difference is not extreme.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marathon Petroleum Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, an innovative tool that allows you to shape and evaluate your own perspective about Marathon Petroleum by connecting its story with financial forecasts and fair value estimates.

A Narrative is simply the investment story you believe about a company, matched with your assumptions about future revenue, earnings, and margins. It helps you clearly articulate your reasoning and see how it shapes a calculated fair value.

With Narratives, you do not have to sift through spreadsheets or guess whether the stock is cheap or expensive. Simply Wall St’s platform makes it easy for anyone to build, update, and share their Narrative on the Community page, empowering millions of investors to make smarter, more informed decisions.

When the facts change, your Narrative does too. Whether it is new earnings, news, or shifts in the market, these tools keep your view and fair value up to date so you can quickly compare your estimate to the current market price and decide if it is time to buy or sell.

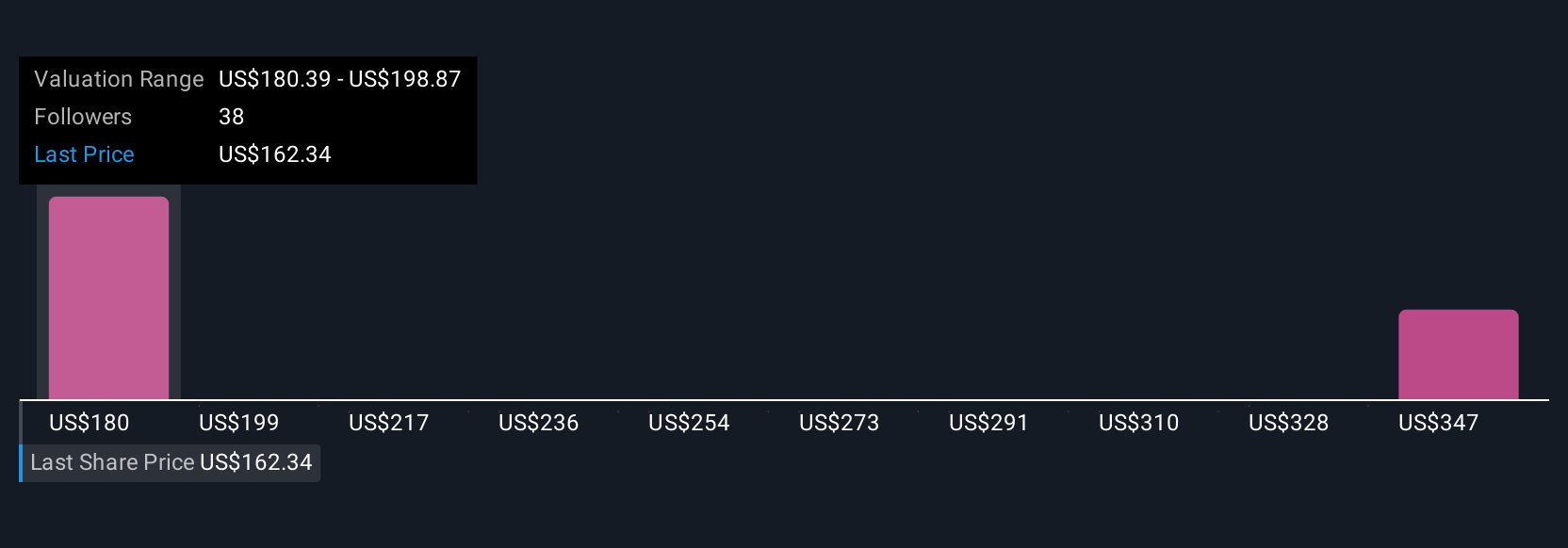

For example, among real Narratives for Marathon Petroleum, some investors see a bright future and set fair value at $206 per share, while others take a more cautious stance around $142. This demonstrates how different perspectives, grounded in real-world forecasts, lead to different buy and sell signals.

Do you think there's more to the story for Marathon Petroleum? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives