- United States

- /

- Energy Services

- /

- NYSE:LBRT

Is Liberty Energy’s (LBRT) Distributed Power Pivot Quietly Rewriting Its Long-Term Earnings Narrative?

Reviewed by Sasha Jovanovic

- In recent days, UBS initiated coverage on Liberty Energy with a Buy rating, highlighting the company’s expanding distributed power business through Liberty Power Innovations and its planned deployment of 1 GW of capacity by mid-2028.

- What stands out is how multiple analyst upgrades, centered on Liberty’s distributed power and power purchase agreement potential, are reshaping perceptions of its future earnings mix.

- Next, we’ll examine how growing confidence in Liberty’s distributed power offering could influence its investment narrative and long-term earnings balance.

Find companies with promising cash flow potential yet trading below their fair value.

Liberty Energy Investment Narrative Recap

To own Liberty Energy, you need to believe it can gradually offset a softening North American frac market by scaling higher-margin, contracted power solutions. The UBS initiation and broader analyst confidence around Liberty Power Innovations reinforce that possibility in the near term, but they do not remove the risk of weaker completions activity and service pricing pressure weighing on earnings over the next few years.

Against that backdrop, the most relevant recent development is UBS highlighting Liberty’s plan to deploy 1 GW of distributed power capacity by mid 2028, supported by power purchase agreements. That focus ties directly into the key potential catalyst for the stock: a more balanced earnings mix from recurring, power-related revenue that could partially cushion the impact of a slower, capital constrained core completions business.

Yet, beneath the optimism around distributed power, investors should be aware that...

Read the full narrative on Liberty Energy (it's free!)

Liberty Energy's narrative projects $4.3 billion revenue and $41.3 million earnings by 2028. This requires 1.8% yearly revenue growth and a $175.5 million earnings decrease from $216.8 million today.

Uncover how Liberty Energy's forecasts yield a $18.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

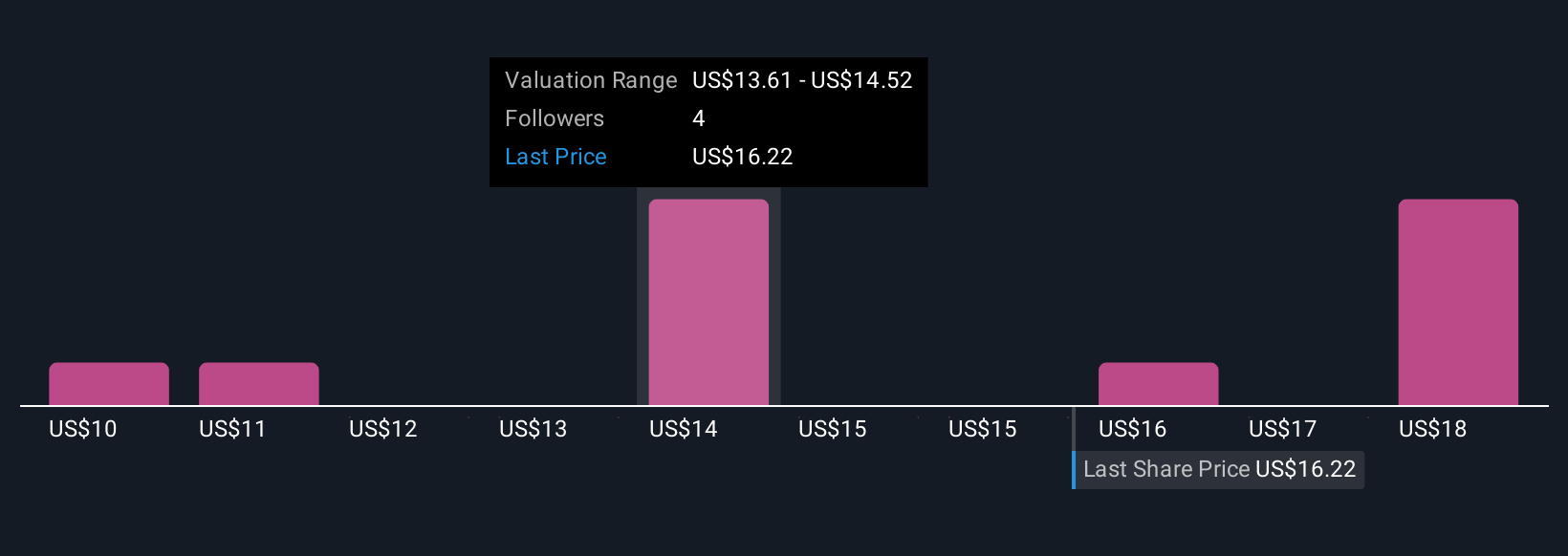

Six fair value estimates from the Simply Wall St Community span roughly US$8.05 to US$19.00 per share, showing how far opinions can stretch. Set that against the risk of softer completions activity and shorter term earnings pressure, and you have good reason to compare several viewpoints before deciding what Liberty’s future might be worth.

Explore 6 other fair value estimates on Liberty Energy - why the stock might be worth less than half the current price!

Build Your Own Liberty Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liberty Energy research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Liberty Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liberty Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026