- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Is Now The Time To Put Kinetik Holdings (NYSE:KNTK) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kinetik Holdings (NYSE:KNTK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kinetik Holdings with the means to add long-term value to shareholders.

View our latest analysis for Kinetik Holdings

How Fast Is Kinetik Holdings Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is awe-striking that Kinetik Holdings' EPS went from US$1.56 to US$4.92 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

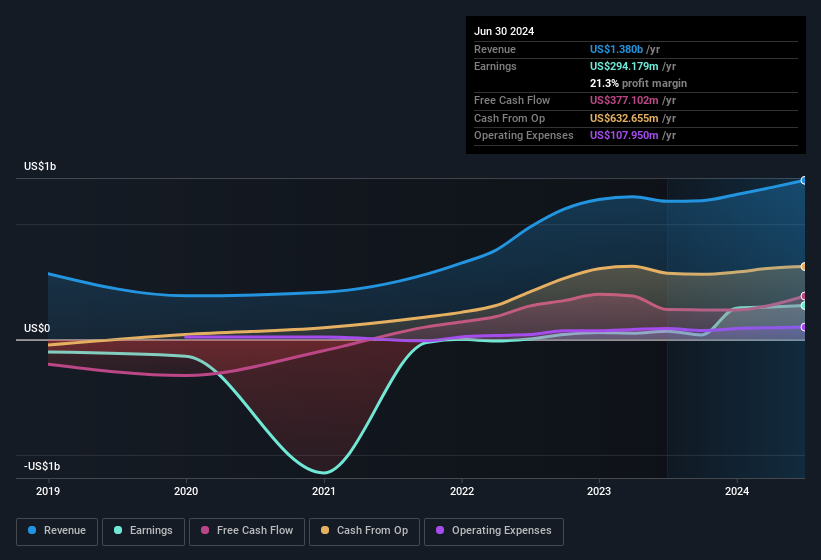

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Kinetik Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$1.4b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Kinetik Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Kinetik Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth US$1.5m) this was overshadowed by a mountain of buying, totalling US$2.5m in just one year. This bodes well for Kinetik Holdings as it highlights the fact that those who are important to the company having a lot of faith in its future. Zooming in, we can see that the biggest insider purchase was by Independent Director Kevin McCarthy for US$1m worth of shares, at about US$31.50 per share.

The good news, alongside the insider buying, for Kinetik Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$229m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Kinetik Holdings' CEO, Jamie Welch, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Kinetik Holdings with market caps between US$4.0b and US$12b is about US$8.4m.

Kinetik Holdings' CEO took home a total compensation package of US$2.3m in the year prior to December 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Kinetik Holdings Worth Keeping An Eye On?

Kinetik Holdings' earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Kinetik Holdings deserves timely attention. However, before you get too excited we've discovered 5 warning signs for Kinetik Holdings (2 are a bit unpleasant!) that you should be aware of.

The good news is that Kinetik Holdings is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KNTK

Kinetik Holdings

Operates as a midstream company in the Texas Delaware Basin.

Good value with proven track record.