- United States

- /

- Oil and Gas

- /

- NYSE:HESM

Hess Midstream's (NYSE:HESM) investors will be pleased with their strong 148% return over the last five years

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market. But Hess Midstream LP (NYSE:HESM) has fallen short of that second goal, with a share price rise of 66% over five years, which is below the market return. But if you include dividends then the return is market-beating. Zooming in, the stock is up a respectable 16% in the last year.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Hess Midstream

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

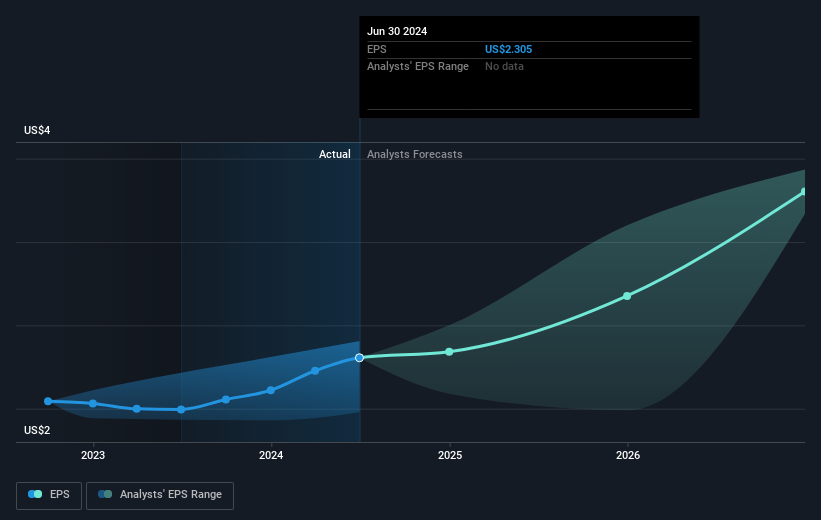

Over half a decade, Hess Midstream managed to grow its earnings per share at 7.9% a year. This EPS growth is slower than the share price growth of 11% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Hess Midstream has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Hess Midstream will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hess Midstream the TSR over the last 5 years was 148%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Hess Midstream provided a TSR of 26% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 20% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Hess Midstream better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Hess Midstream .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Hess Midstream, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hess Midstream might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HESM

Hess Midstream

Owns, operates, develops, and acquires midstream assets and provide fee-based services to Hess and third-party customers in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives