- United States

- /

- Energy Services

- /

- NYSE:HAL

Halliburton (NYSE:HAL) stock falls 3.3% in past week as one-year earnings and shareholder returns continue downward trend

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Halliburton Company (NYSE:HAL) share price is down 33% in the last year. That's disappointing when you consider the market returned 21%. However, the longer term returns haven't been so bad, with the stock down 26% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 9.1% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Halliburton isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

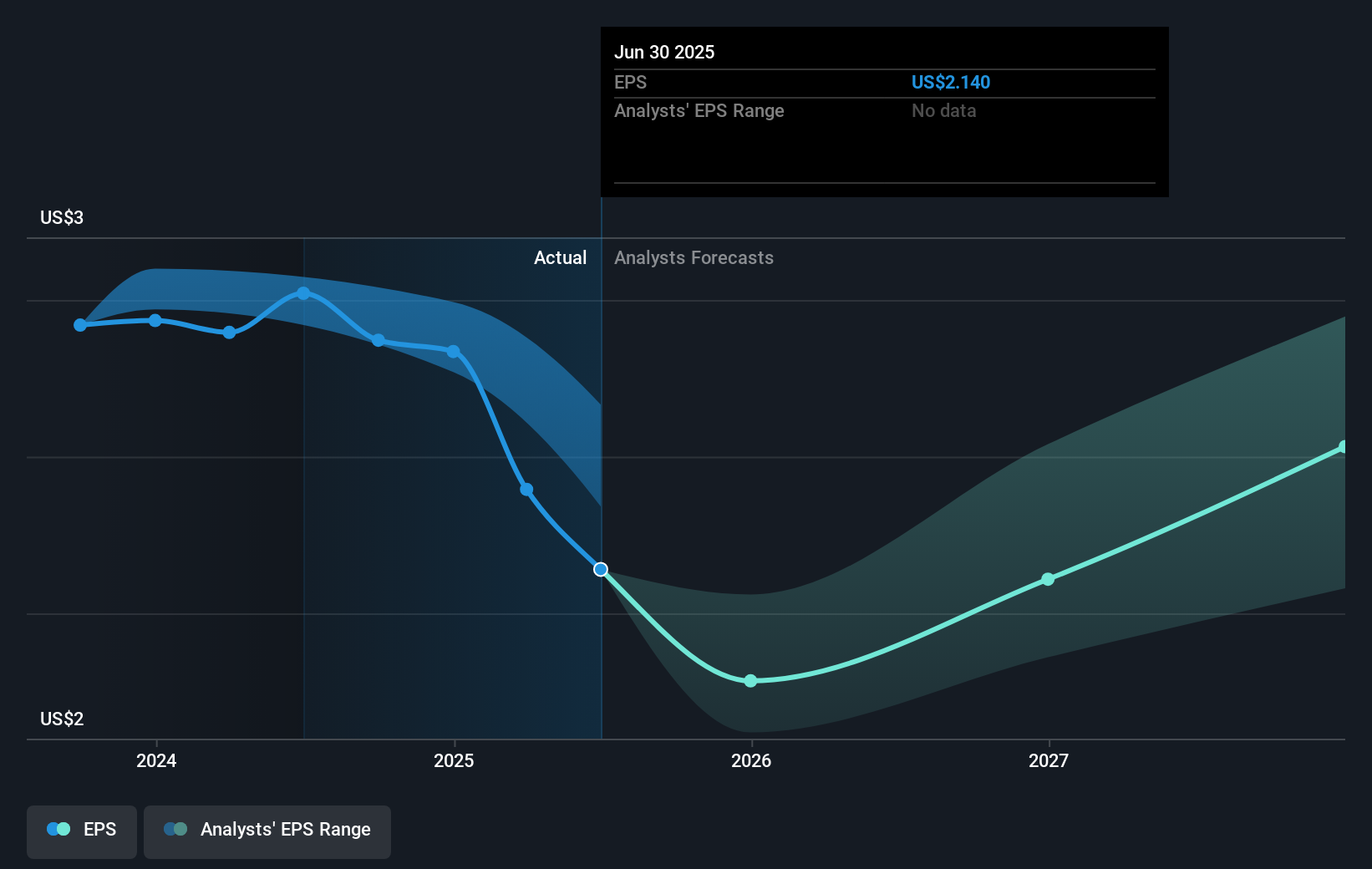

Unfortunately Halliburton reported an EPS drop of 29% for the last year. This proportional reduction in earnings per share isn't far from the 33% decrease in the share price. So it seems that the market sentiment has not changed much, despite the weak results. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Halliburton's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 21% in the last year, Halliburton shareholders lost 31% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Halliburton better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Halliburton .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives