- United States

- /

- Oil and Gas

- /

- NYSE:GRNT

Undervalued Small Caps With Insider Activity To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by record highs for the S&P 500 and Nasdaq, small-cap stocks present intriguing opportunities amid broader economic uncertainties such as the ongoing government shutdown. With major indices showing mixed results and gold prices fluctuating, investors are keenly observing sectors that may offer value in these volatile times. In this environment, identifying promising small-cap stocks often involves looking at companies with strong fundamentals and potential insider activity, which can signal confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 31.7x | 2.0x | 38.26% | ★★★★★★ |

| PCB Bancorp | 9.4x | 2.8x | 36.67% | ★★★★★☆ |

| Peoples Bancorp | 10.1x | 1.9x | 44.10% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 27.42% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 41.57% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.46% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 35.73% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.6x | -77.56% | ★★★☆☆☆ |

| Arrow Financial | 14.5x | 3.1x | 21.51% | ★★★☆☆☆ |

| Farmland Partners | 6.9x | 8.4x | -42.56% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

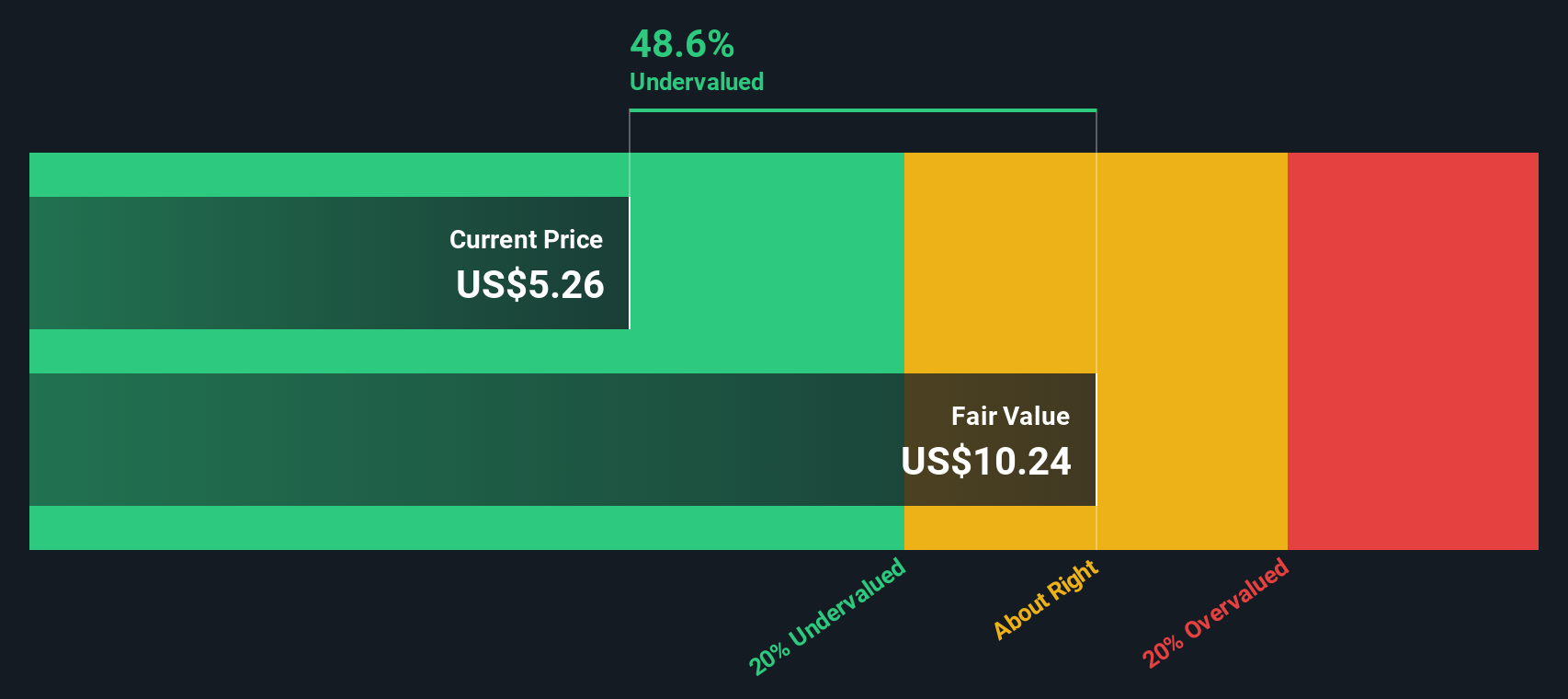

FinWise Bancorp (FINW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FinWise Bancorp operates as a financial institution providing banking services, with a market capitalization of $0.13 billion.

Operations: FinWise Bancorp's revenue primarily stems from its banking operations, with a gross profit margin consistently at 100%. The net income margin has shown variability, reaching as high as 43.09% in early 2022 but declining to around 18.35% by mid-2025. Operating expenses have increased over time, with general and administrative expenses forming a significant portion of these costs.

PE: 18.2x

FinWise Bancorp, a smaller player in the financial sector, is gaining attention after being added to the S&P Global BMI Index on September 21, 2025. The company reported improved second-quarter results with net income rising to US$4.1 million from US$3.18 million a year earlier and earnings per share increasing as well. Despite challenges with high non-performing loans at 7.4% and low allowances at 41%, insider confidence is reflected through recent share purchases this year, hinting at potential growth prospects with forecasted earnings growth of 32.88% annually.

- Navigate through the intricacies of FinWise Bancorp with our comprehensive valuation report here.

Gain insights into FinWise Bancorp's past trends and performance with our Past report.

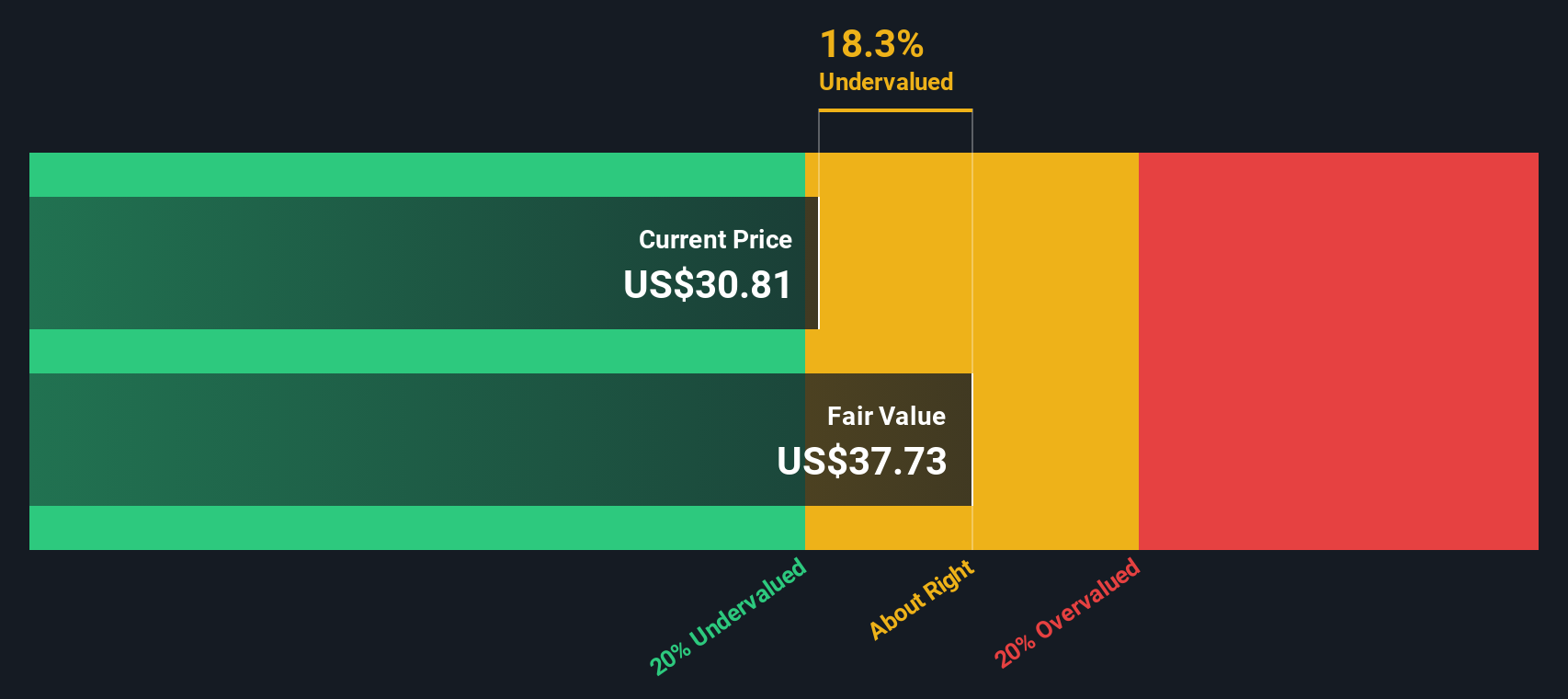

Washington Trust Bancorp (WASH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Washington Trust Bancorp operates as a financial services company providing commercial banking and wealth management services, with a market capitalization of approximately $0.76 billion.

Operations: The company generates revenue primarily from Commercial Banking and Wealth Management Services, with recent figures showing $73.33 million and $40.58 million respectively. Operating expenses have consistently been a significant portion of the revenue, with General & Administrative Expenses alone reaching approximately $122.87 million by mid-2025. The net income margin has shown a downward trend recently, turning negative in late 2024 and early 2025, indicating challenges in profitability despite maintaining a gross profit margin of 100%.

PE: -21.1x

Washington Trust Bancorp, a smaller player in the financial sector, showcases potential for growth with earnings projected to rise by 111.03% annually. Recent insider confidence is evident as they acquired shares between May and June 2025. The company reported net income of US$13.25 million for Q2 2025, up from US$10.82 million the previous year, alongside a completed share buyback of 10,000 shares for US$0.3 million. Strategic leadership changes aim to bolster commercial banking activities further enhancing its appeal in the market segment it serves.

- Unlock comprehensive insights into our analysis of Washington Trust Bancorp stock in this valuation report.

Understand Washington Trust Bancorp's track record by examining our Past report.

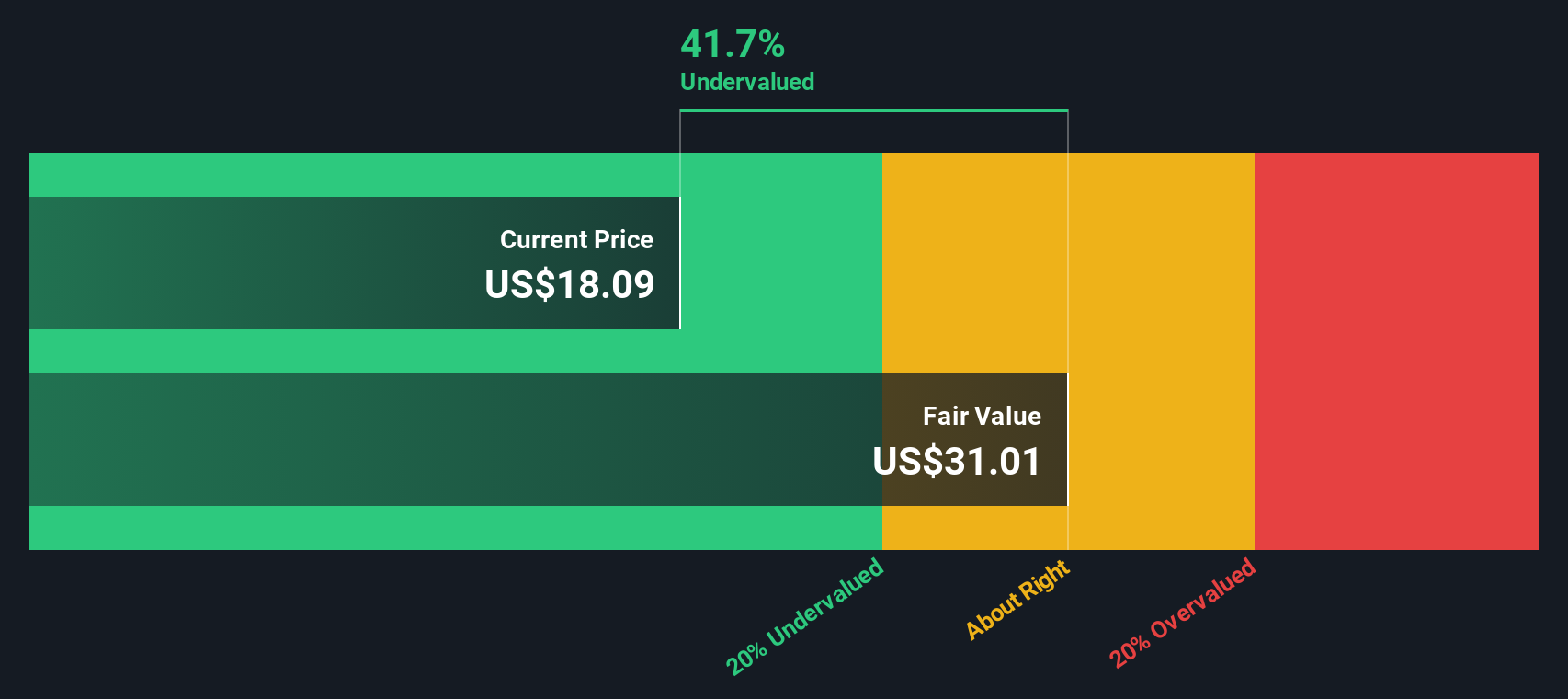

Granite Ridge Resources (GRNT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Granite Ridge Resources is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $1.88 billion.

Operations: Granite Ridge Resources generates revenue primarily from oil and natural gas development, exploration, and production. The company's cost of goods sold (COGS) has been increasing over time, impacting its gross profit margin, which was last reported at 82.98%. Operating expenses include significant depreciation and amortization costs. The net income margin has shown fluctuations with a recent figure of 7.83%.

PE: 22.5x

Granite Ridge Resources, a smaller player in the energy sector, has shown significant earnings growth with net income rising to US$25.08 million for Q2 2025 from US$5.1 million a year ago, and earnings per share jumping to US$0.19 from US$0.04. Despite high debt levels and reliance on external funding, their production surged by 37% year-over-year in Q2 2025. Co-Chairman Matthew Miller's purchase of 41,000 shares for approximately US$250K reflects insider confidence amid these developments.

- Click here to discover the nuances of Granite Ridge Resources with our detailed analytical valuation report.

Explore historical data to track Granite Ridge Resources' performance over time in our Past section.

Make It Happen

- Navigate through the entire inventory of 71 Undervalued US Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRNT

Granite Ridge Resources

Operates as a non-operated oil and natural gas exploration and production company.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success