- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

FLEX LNG (NYSE:FLNG) Valuation: Assessing the Stock After Its Latest Ex-Dividend Milestone

Reviewed by Simply Wall St

Flex LNG (NYSE:FLNG) has just reached an important milestone for investors, with its shares now trading ex-dividend after the company declared a USD 0.75 per share payout. This event, while anticipated by those following the company’s dividend schedule, often triggers reactions among traders looking to capture or reposition around dividend payments. The move signals Flex LNG’s ongoing commitment to returning capital to its shareholders, and it could reshape short-term sentiment as markets absorb who will or will not be receiving this latest payout.

Looking at the bigger picture, Flex LNG has posted a 15% total return over the past year, adding to its solid five-year track record. The stock’s 6% climb year-to-date and nearly 10% gain over the past three months suggest a gradual build-up in positive momentum. Along with the dividend, recent annual results highlighted growing net income and steady revenue expansion, factors that many income-focused investors watch closely in shipping and energy stocks like this one.

With shares having handed back some gains in the days before going ex-dividend, some investors may be asking whether this is a chance to consider Flex LNG at a more attractive price, or if the market has already factored in the company’s steady dividend growth story.

Most Popular Narrative: 7.5% Overvalued

According to the prevailing consensus, FLEX LNG trades at a premium to its estimated fair value. This narrative weighs future earnings growth, profit margins, and risk factors to deliver its valuation view.

The ongoing global shift to decarbonization and energy diversification, especially in Europe replacing Russian gas with LNG, is sustaining strong demand for LNG shipping and longer-duration contracts. This supports high utilization rates and premium charter day rates for FLEX LNG’s fleet, likely lifting future revenue and margin prospects.

Curious what stands behind this bold price call? Analysts are not just guessing; they are betting on dramatic improvements in core financials and a future profit multiple that could surprise even optimists. What exactly drives the sharp divergence from today's market price? The next section unpacks the projections and critical assumptions that fuel this premium valuation.

Result: Fair Value of $24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a surge in new LNG vessel deliveries or persistent weak demand in key growth markets could quickly challenge FLEX LNG’s bullish outlook.

Find out about the key risks to this FLEX LNG narrative.Another View: Discounted Cash Flow Perspective

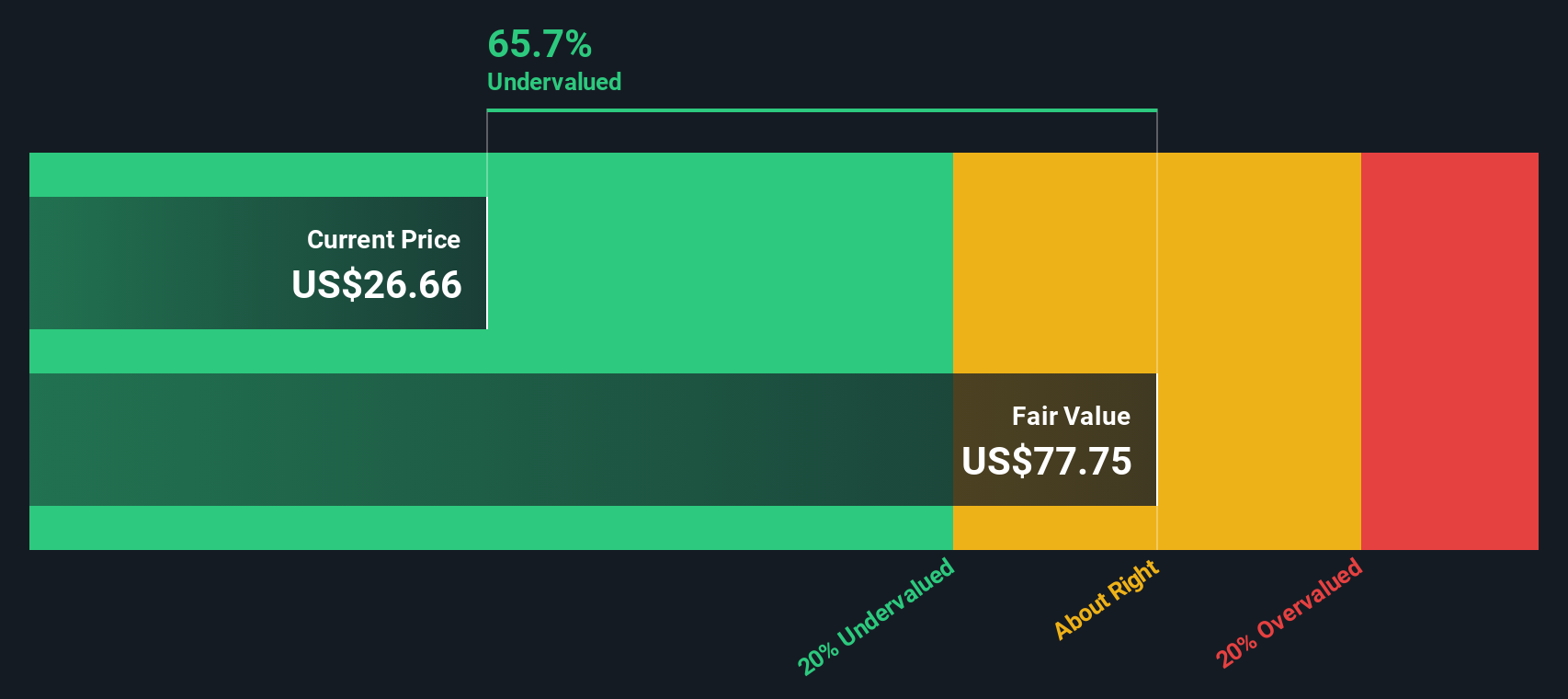

Switching lenses, our SWS DCF model paints a very different picture and suggests FLEX LNG may be undervalued. Unlike the analyst consensus based on future earnings multiples, the DCF approach questions whether current prices fully reflect the company’s long-term cash flow potential. Could this alternative point to hidden value or simply highlight methodological gaps?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FLEX LNG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FLEX LNG Narrative

If you think there is more to the story, or would rather dive into the details on your own, you can shape your own perspective in just a few minutes by using Do it your way.

A great starting point for your FLEX LNG research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock your next winning opportunity by using the Simply Wall Street Screener. Make your money work harder with targeted strategies and industries on the edge of growth.

- Pinpoint tomorrow’s leaders in AI technology by tapping into AI penny stocks to uncover companies driving innovation in automation and intelligent solutions.

- Build wealth with stocks boasting sustainable, above-average income by using dividend stocks with yields > 3%, and find companies delivering impressive yields in any market climate.

- Find underappreciated gems trading at attractive valuations with undervalued stocks based on cash flows, and take advantage of market mispricings before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)