- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

United States Undervalued Small Caps With Insider Action In October 2024

Reviewed by Simply Wall St

The United States market has shown resilience, remaining flat over the last week while achieving a notable 33% increase over the past year, with earnings projected to grow by 15% annually. In this context, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking to navigate these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Citizens & Northern | 12.3x | 2.8x | 45.88% | ★★★★☆☆ |

| MYR Group | 34.5x | 0.5x | 41.84% | ★★★★☆☆ |

| Franklin Financial Services | 9.7x | 1.9x | 39.65% | ★★★★☆☆ |

| German American Bancorp | 13.6x | 4.5x | 48.33% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -108.71% | ★★★☆☆☆ |

| HighPeak Energy | 12.6x | 1.6x | 32.64% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -59.94% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -92.12% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -231.02% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

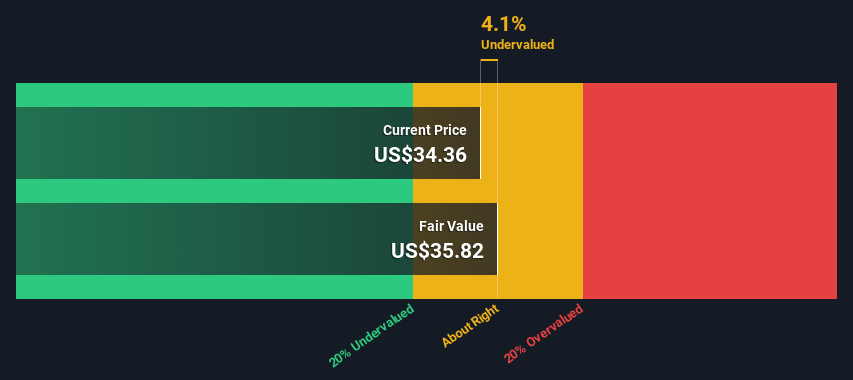

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas, with a market capitalization of approximately $2.04 billion.

Operations: HighPeak Energy generates revenue primarily from oil and natural gas development, exploration, and production. The company's cost of goods sold (COGS) for the latest period is $204.47 million, contributing to a gross profit margin of 83.10%. Operating expenses include significant allocations to depreciation and amortization, which amounted to $508.83 million in the most recent quarter.

PE: 12.6x

HighPeak Energy, a smaller company in the energy sector, has shown mixed financial performance recently. For Q2 2024, revenue increased to US$275.27 million from US$240.76 million year-on-year, though net income dipped slightly to US$29.72 million from US$31.83 million. Despite lower profit margins at 12.6%, insider confidence is evident with recent share repurchases totaling 978,989 shares for US$14.55 million by June's end under a buyback plan initiated in February 2024. The company's updated production guidance for the full year suggests an average rate of up to 49,000 Boe/d, hinting at potential operational improvements ahead despite challenges like high-risk funding sources and interest payments not fully covered by earnings.

- Click to explore a detailed breakdown of our findings in HighPeak Energy's valuation report.

Assess HighPeak Energy's past performance with our detailed historical performance reports.

BJ's Restaurants (NasdaqGS:BJRI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BJ's Restaurants operates a chain of casual dining company-owned restaurants with a market capitalization of approximately $0.75 billion.

Operations: BJ's Restaurants generates revenue primarily from its company-owned casual dining establishments, with a recent reported revenue of $1.33 billion. The company's cost structure includes significant costs of goods sold and operating expenses, impacting its profitability. Notably, the gross profit margin has shown an upward trend recently, reaching 14.21%.

PE: 26.6x

BJ's Restaurants, known for its diverse menu and innovative brews, has shown insider confidence through recent share purchases. From April to July 2024, the company repurchased 255,000 shares for US$8.8 million. Despite relying on external borrowing for funding, BJ's earnings are projected to grow nearly 12% annually. Recent leadership changes include Lyle D. Tick as President and Chief Concept Officer since September 2024, aiming to drive strategic growth following his success with Buffalo Wild Wings and On the Border Mexican Grill & Cantina.

- Navigate through the intricacies of BJ's Restaurants with our comprehensive valuation report here.

Review our historical performance report to gain insights into BJ's Restaurants''s past performance.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector with a focus on refining, logistics, and retail operations, and has a market capitalization of approximately $1.68 billion.

Operations: The company generates revenue primarily from its Refining segment, which contributes significantly more than the Retail and Logistics segments. Over recent periods, the gross profit margin has shown fluctuations, reaching a high of 13.48% in mid-2019 and experiencing lower points such as 2.63% in late 2020. Operating expenses have consistently been a substantial part of costs, with general and administrative expenses forming a notable portion of these operating costs across various periods.

PE: -12.4x

Delek US Holdings, navigating the energy sector's challenges, signals potential as a smaller company with insider confidence. Recent insider purchases underscore belief in its prospects despite financial hurdles. While interest payments exceed earnings coverage, reliance on external borrowing adds risk. The company reported a net loss of US$37.2 million for Q2 2024 against last year's figures and adjusted its buyback plan by US$400 million to US$1.07 billion in September 2024, reflecting strategic optimism amidst fluctuating sales and production expectations.

- Unlock comprehensive insights into our analysis of Delek US Holdings stock in this valuation report.

Understand Delek US Holdings' track record by examining our Past report.

Next Steps

- Explore the 50 names from our Undervalued US Small Caps With Insider Buying screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HPK

HighPeak Energy

An independent oil and natural gas company, engages in the exploration, development, and production of crude oil, natural gas, and natural gas liquids reserves in the Permian Basin in West Texas and Eastern New Mexico.

Good value with questionable track record.