- United States

- /

- Oil and Gas

- /

- NYSE:DINO

Is Now The Time To Put HF Sinclair (NYSE:DINO) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like HF Sinclair (NYSE:DINO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide HF Sinclair with the means to add long-term value to shareholders.

Check out our latest analysis for HF Sinclair

HF Sinclair's Improving Profits

In the last three years HF Sinclair's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. HF Sinclair's EPS shot up from US$8.87 to US$12.93; a result that's bound to keep shareholders happy. That's a fantastic gain of 46%.

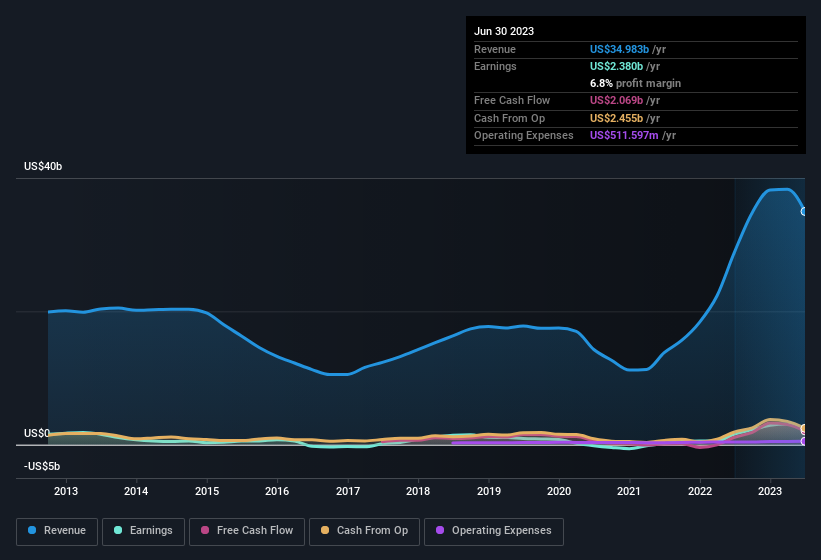

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note HF Sinclair achieved similar EBIT margins to last year, revenue grew by a solid 21% to US$35b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for HF Sinclair's future EPS 100% free.

Are HF Sinclair Insiders Aligned With All Shareholders?

Owing to the size of HF Sinclair, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. As a matter of fact, their holding is valued at US$35m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.3%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations over US$8.0b, like HF Sinclair, the median CEO pay is around US$12m.

The CEO of HF Sinclair only received US$5.9m in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add HF Sinclair To Your Watchlist?

You can't deny that HF Sinclair has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that HF Sinclair has underlying strengths that make it worth a look at. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HF Sinclair (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Although HF Sinclair certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HF Sinclair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DINO

HF Sinclair

Operates as an independent energy company in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives