- United States

- /

- Banks

- /

- NasdaqGS:ESSA

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market navigates through trade negotiations and economic data releases, the S&P 500 remains just shy of its all-time high, reflecting investor optimism amid recent fluctuations. In this dynamic environment, dividend stocks can offer a reliable income stream and potential stability for portfolios, making them an attractive consideration for investors seeking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.92% | ★★★★★☆ |

| Universal (UVV) | 5.36% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.00% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.85% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.77% | ★★★★★★ |

| Ennis (EBF) | 5.34% | ★★★★★★ |

| Dillard's (DDS) | 6.45% | ★★★★★★ |

| CompX International (CIX) | 4.81% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.09% | ★★★★★★ |

| Chevron (CVX) | 4.72% | ★★★★★★ |

Click here to see the full list of 147 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

ESSA Bancorp (ESSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc. is a bank holding company for ESSA Bank & Trust, offering various financial services to individuals, families, and businesses in Pennsylvania with a market cap of $190.88 million.

Operations: ESSA Bancorp, Inc. generates its revenue primarily from its Thrift / Savings and Loan Institutions segment, which accounts for $66.35 million.

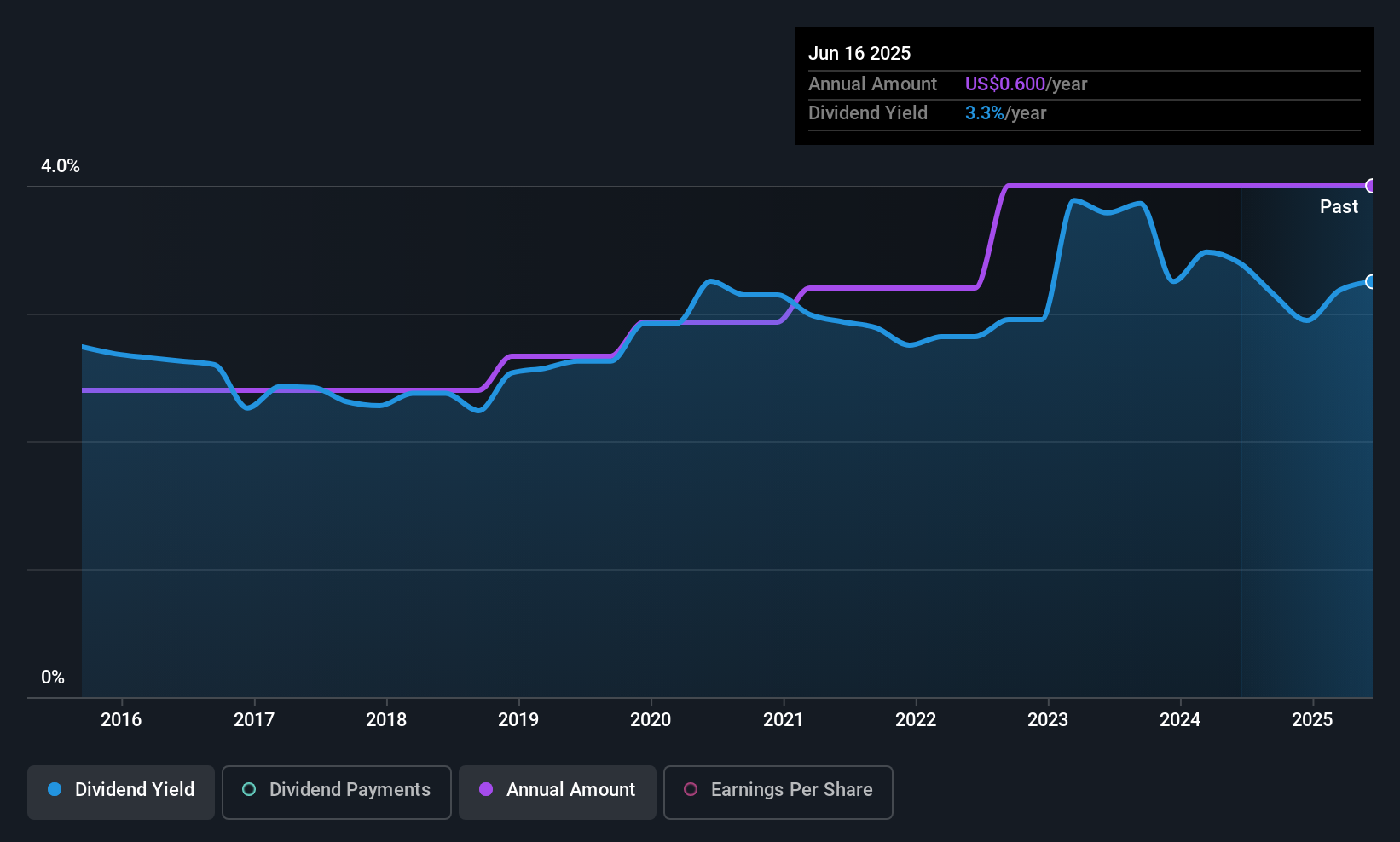

Dividend Yield: 3.2%

ESSA Bancorp maintains a reliable dividend yield of 3.19%, supported by a low payout ratio of 38.7%, ensuring coverage by earnings despite recent declines in net income and earnings per share. The dividend has been stable and growing over the past decade, though it remains below top-tier yields in the US market. Recent affirmations include a quarterly dividend of US$0.15 per share, payable on June 30, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of ESSA Bancorp.

- According our valuation report, there's an indication that ESSA Bancorp's share price might be on the cheaper side.

CNH Industrial (CNH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNH Industrial N.V. is an equipment and services company involved in the design, production, marketing, sale, and financing of agricultural and construction equipment across various regions including North America, Europe, the Middle East, Africa, South America, and the Asia Pacific with a market cap of approximately $16.09 billion.

Operations: CNH Industrial's revenue segments include $13.22 billion from Industrial Activities - Agriculture, $2.89 billion from Industrial Activities - Construction, and $2.74 billion from Financial Services.

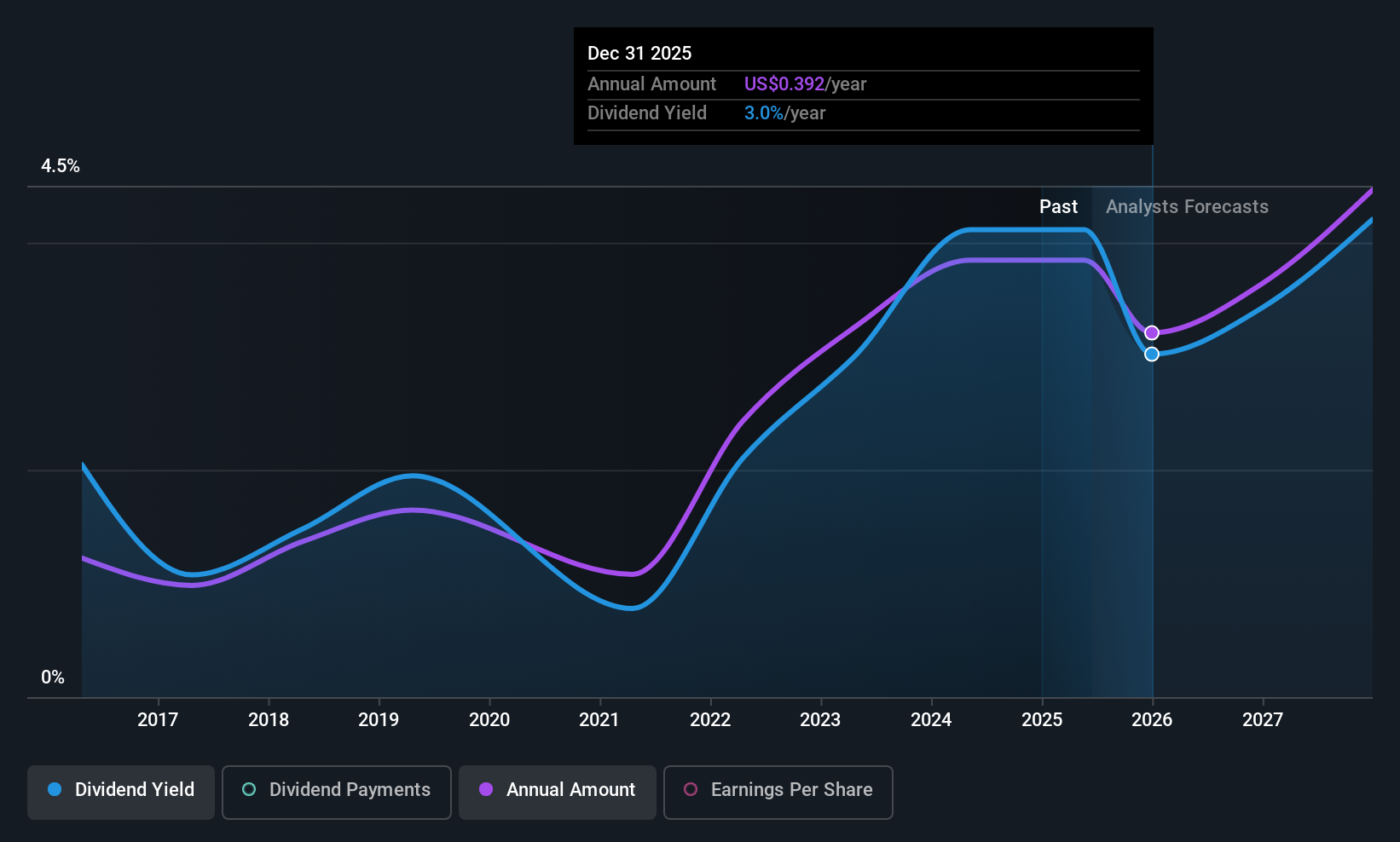

Dividend Yield: 3.6%

CNH Industrial's dividend yield of 3.63% is below the top US market payers, with a low payout ratio of 36.8%, ensuring coverage by earnings and cash flows. Despite past volatility, dividends have grown over the last decade. Recent financials show decreased revenue and profit margins, impacting earnings per share. The company prioritizes strategic M&A and plans to return free cash flow to shareholders through dividends and buybacks, supported by a robust balance sheet strategy.

- Get an in-depth perspective on CNH Industrial's performance by reading our dividend report here.

- Our valuation report here indicates CNH Industrial may be undervalued.

Chevron (CVX)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chevron Corporation, with a market cap of approximately $250.35 billion, operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally.

Operations: Chevron Corporation's revenue segments include $45.00 billion from International Upstream, $44.96 billion from United States Upstream, $76.69 billion from International Downstream, and $79.20 billion from United States Downstream operations.

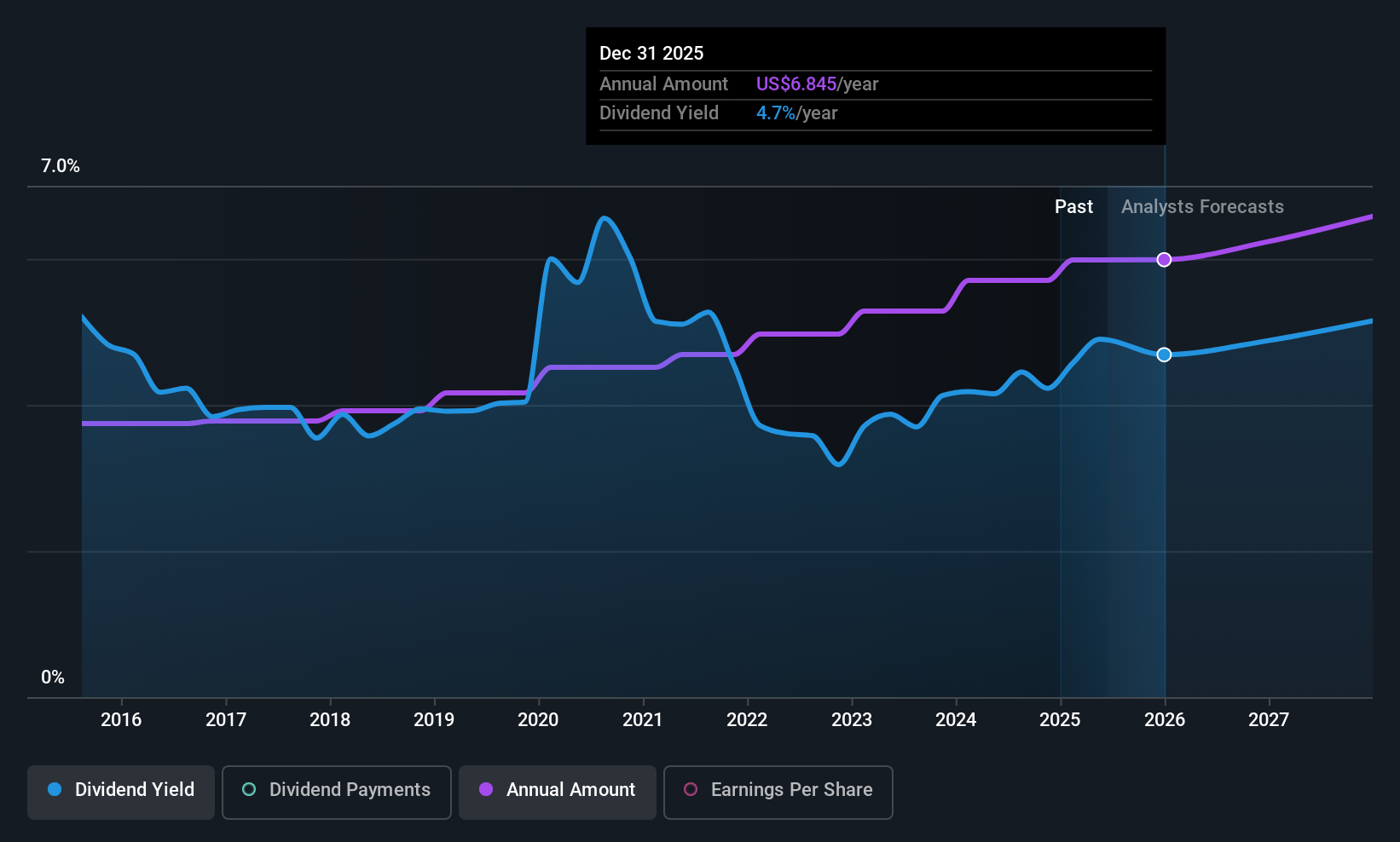

Dividend Yield: 4.7%

Chevron's dividend yield of 4.72% ranks in the top 25% of US market payers, with a payout ratio of 75.3%, ensuring coverage by earnings and cash flows. Despite recent financial performance dips, dividends have been stable and growing over the past decade. The company recently declared a quarterly dividend of $1.71 per share and completed significant share buybacks worth $30.31 billion, supporting shareholder returns amidst ongoing strategic evaluations like potential M&A activities with Phillips 66's chemical joint venture stake.

- Click here to discover the nuances of Chevron with our detailed analytical dividend report.

- The analysis detailed in our Chevron valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Reveal the 147 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESSA Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ESSA

ESSA Bancorp

Operates as a bank holding company for ESSA Bank & Trust that provides a range of financial services to individuals, families, and businesses in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives