- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As major stock indexes in the United States continue their upward trajectory, buoyed by stronger-than-expected GDP growth and a surge in consumer spending, investors are increasingly looking for stable opportunities amid this economic optimism. In such a dynamic market environment, dividend stocks stand out as an attractive option for those seeking regular income and potential long-term growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.64% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.30% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.71% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.21% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.91% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 5.09% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.96% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.35% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.69% | ★★★★★☆ |

Click here to see the full list of 115 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CareTrust REIT (CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing skilled nursing, senior housing and other healthcare-related properties in the United States and the United Kingdom with a market cap of $8.11 billion.

Operations: CareTrust REIT generates revenue of $428.48 million from its investments in healthcare-related real estate assets.

Dividend Yield: 3.7%

CareTrust REIT recently declared a quarterly dividend of $0.335 per share, maintaining its stable 10-year dividend history, though its high payout ratio suggests dividends are not well-covered by earnings. The company acquired three senior living communities in Texas for $40 million, enhancing growth prospects. Despite a significant earnings increase of 163.8% over the past year and coverage by cash flows, shareholder dilution and a subpar dividend yield compared to top-tier payers remain concerns.

- Dive into the specifics of CareTrust REIT here with our thorough dividend report.

- According our valuation report, there's an indication that CareTrust REIT's share price might be on the cheaper side.

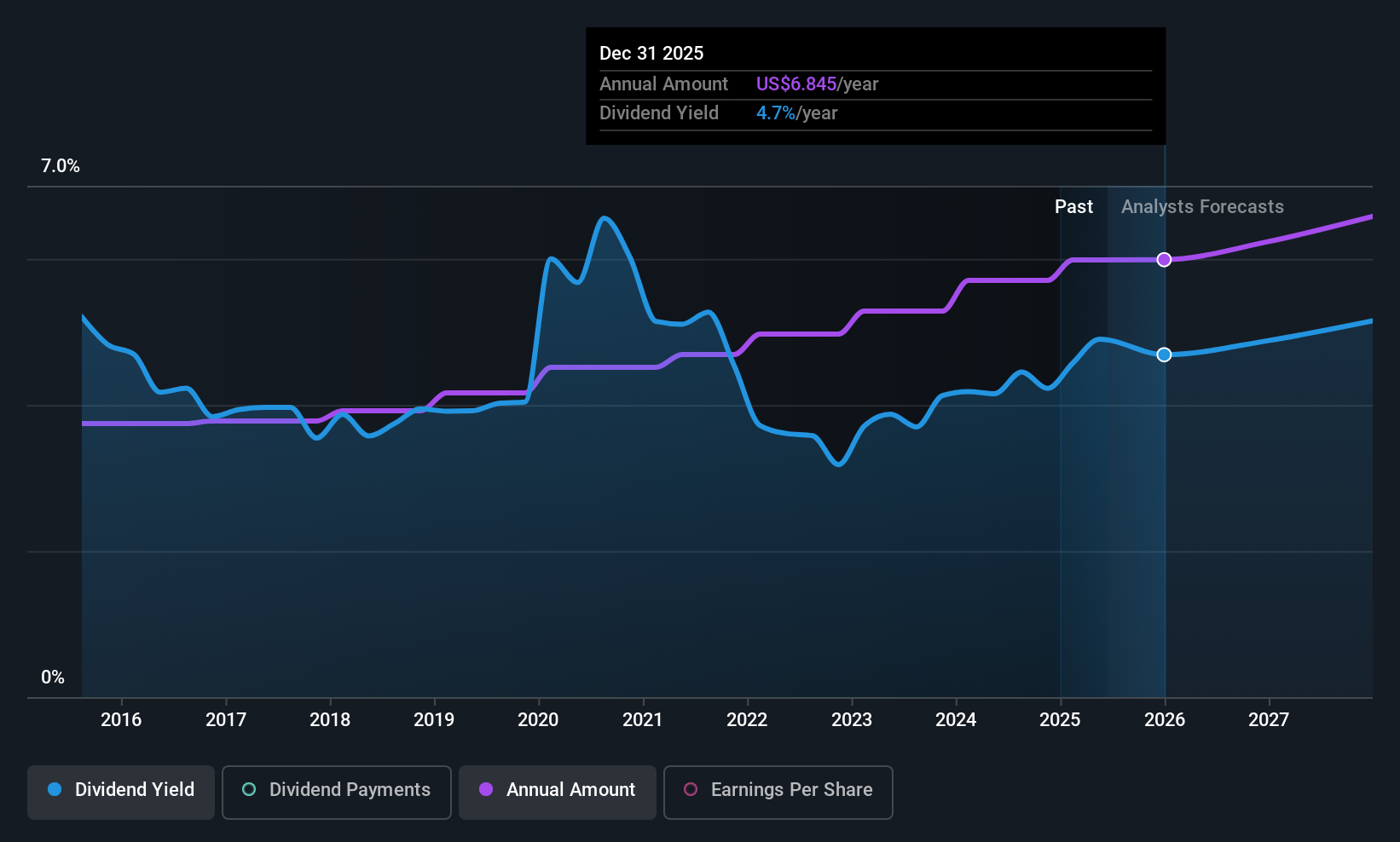

Chevron (CVX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chevron Corporation, with a market cap of $297.50 billion, operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally.

Operations: Chevron Corporation's revenue segments include $45.33 billion from International Upstream, $45.80 billion from United States Upstream, $72.32 billion from International Downstream, and $74.38 billion from United States Downstream operations.

Dividend Yield: 4.6%

Chevron's dividend of US$1.71 per share, payable December 2025, remains stable with a decade-long history of reliability and growth. However, the high payout ratio of 95% indicates dividends are not well-covered by earnings. Recent changes in company bylaws aim to modernize operations, while executive shifts include appointing Amit R. Ghai as Controller. Despite a significant buyback program completing US$35.47 billion in repurchases, legal issues from an El Segundo refinery incident pose potential risks.

- Delve into the full analysis dividend report here for a deeper understanding of Chevron.

- Our valuation report unveils the possibility Chevron's shares may be trading at a discount.

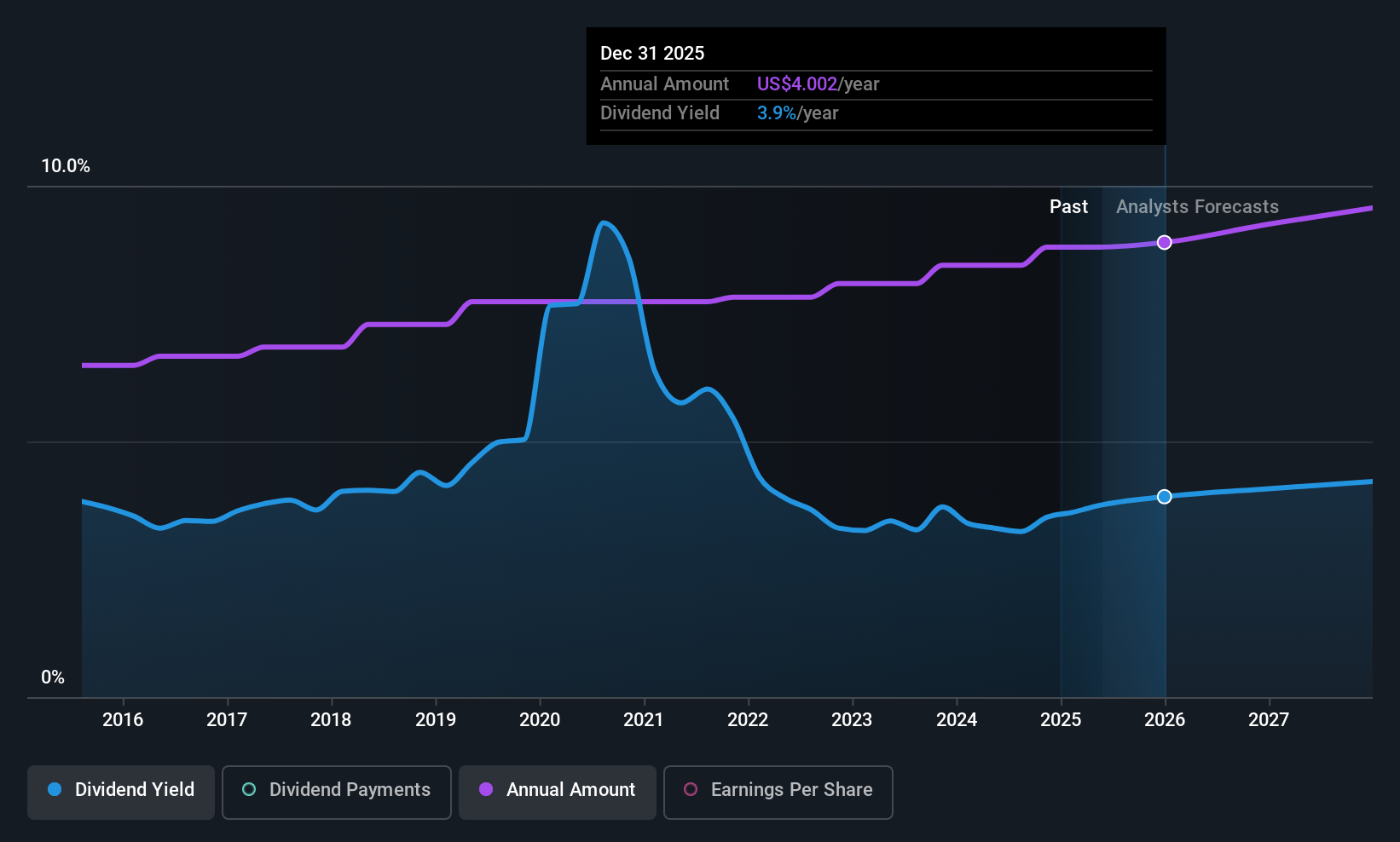

Exxon Mobil (XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across several countries including the United States, Guyana, Canada, and others, with a market cap of approximately $492.10 billion.

Operations: Exxon Mobil Corporation's revenue is primarily derived from its Upstream operations in the United States ($53.16 billion) and internationally ($52.57 billion), Energy Products in the United States ($118.27 billion) and internationally ($170.89 billion), Chemical Products in the United States ($14.55 billion) and internationally ($17.48 billion), as well as Specialty Products in the United States ($7.82 billion) and internationally ($12.68 billion).

Dividend Yield: 3.5%

Exxon Mobil continues its steady dividend growth, recently increasing its quarterly payout to US$1.03 per share. While the dividend yield of 3.49% trails behind top-tier payers, it is well-supported by earnings and cash flows with a payout ratio of 57.5%. The company remains financially robust despite recent executive changes and strategic collaborations like advancing methane pyrolysis technology with BASF, aiming for sustainable energy solutions in the future.

- Click to explore a detailed breakdown of our findings in Exxon Mobil's dividend report.

- Our expertly prepared valuation report Exxon Mobil implies its share price may be lower than expected.

Turning Ideas Into Actions

- Get an in-depth perspective on all 115 Top US Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion