- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Ituran Location and Control And 2 Other High-Quality Dividend Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 8.0% over the past year with earnings forecasted to grow by 14% annually. In such a climate, high-quality dividend stocks like Ituran Location and Control can offer investors a reliable income stream while potentially benefiting from overall market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.02% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.97% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.22% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.27% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.94% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.99% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 4.99% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.07% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.53% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.37% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products across several countries, including Israel, Brazil, and the United States, with a market cap of $729.10 million.

Operations: Ituran Location and Control Ltd. generates revenue from two main segments: Telematics Products, contributing $93.77 million, and Telematics Services, accounting for $242.49 million.

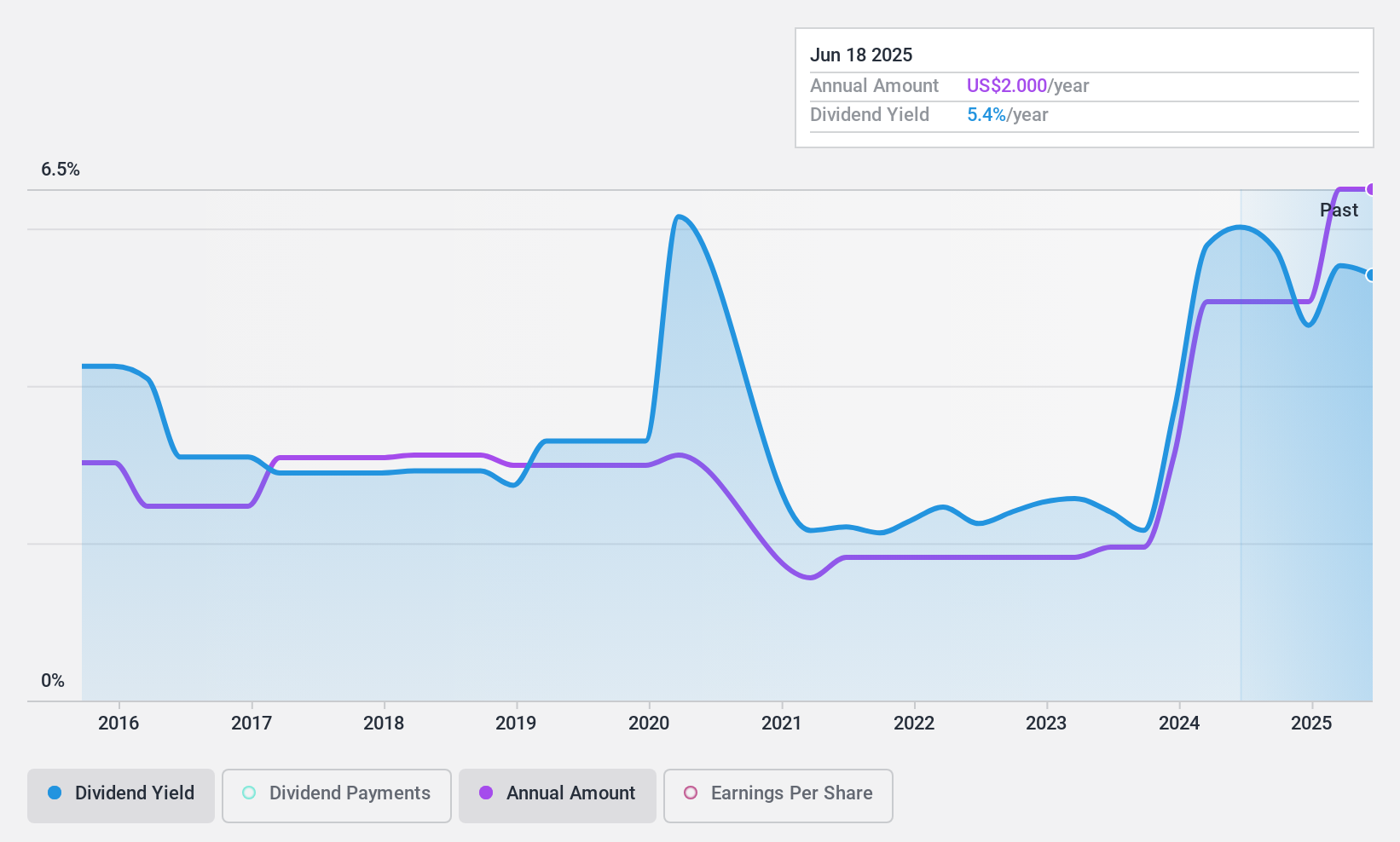

Dividend Yield: 5.5%

Ituran Location and Control's dividend payments have been volatile over the past decade, but recent increases suggest a commitment to growth. The company announced a 25% increase in its quarterly dividend policy to at least $10 million, supported by strong earnings and cash flow coverage with payout ratios of 61.9% and 65.6%, respectively. Trading slightly below fair value, Ituran offers a competitive dividend yield in the top quartile of US market payers.

- Unlock comprehensive insights into our analysis of Ituran Location and Control stock in this dividend report.

- The analysis detailed in our Ituran Location and Control valuation report hints at an deflated share price compared to its estimated value.

Chevron (NYSE:CVX)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chevron Corporation operates in integrated energy and chemicals sectors both in the United States and internationally, with a market cap of approximately $241.86 billion.

Operations: Chevron Corporation's revenue segments consist of Upstream operations generating $45.00 billion internationally and $44.96 billion in the United States, along with Downstream operations contributing $76.69 billion internationally and $79.20 billion in the United States.

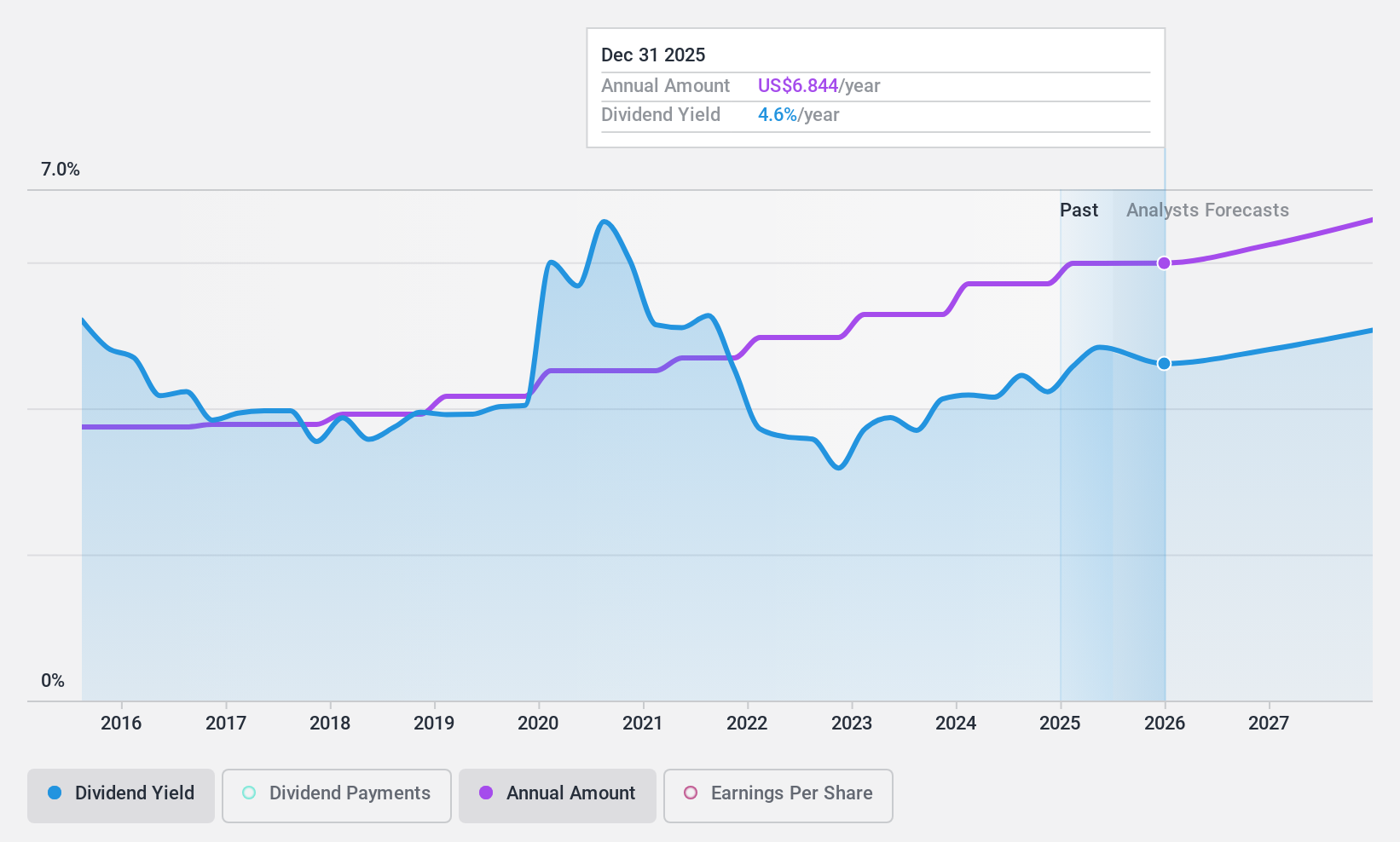

Dividend Yield: 4.9%

Chevron's dividend, yielding 4.94%, is among the top 25% in the US market and has shown stable growth over the past decade, supported by a payout ratio of 75.3% from earnings and 88% from cash flows. Despite recent declines in net income to US$3.5 billion for Q1 2025, Chevron maintains its quarterly dividend at US$1.71 per share. The company also completed significant share buybacks worth US$30.31 billion since January 2023.

- Click here to discover the nuances of Chevron with our detailed analytical dividend report.

- Our valuation report unveils the possibility Chevron's shares may be trading at a discount.

Polaris (NYSE:PII)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Polaris Inc. designs, engineers, manufactures, and markets powersports vehicles globally, with a market cap of approximately $2.04 billion.

Operations: Polaris Inc.'s revenue segments consist of Marine at $472.80 million, On-Road at $932.40 million, and Off-Road at $5.57 billion.

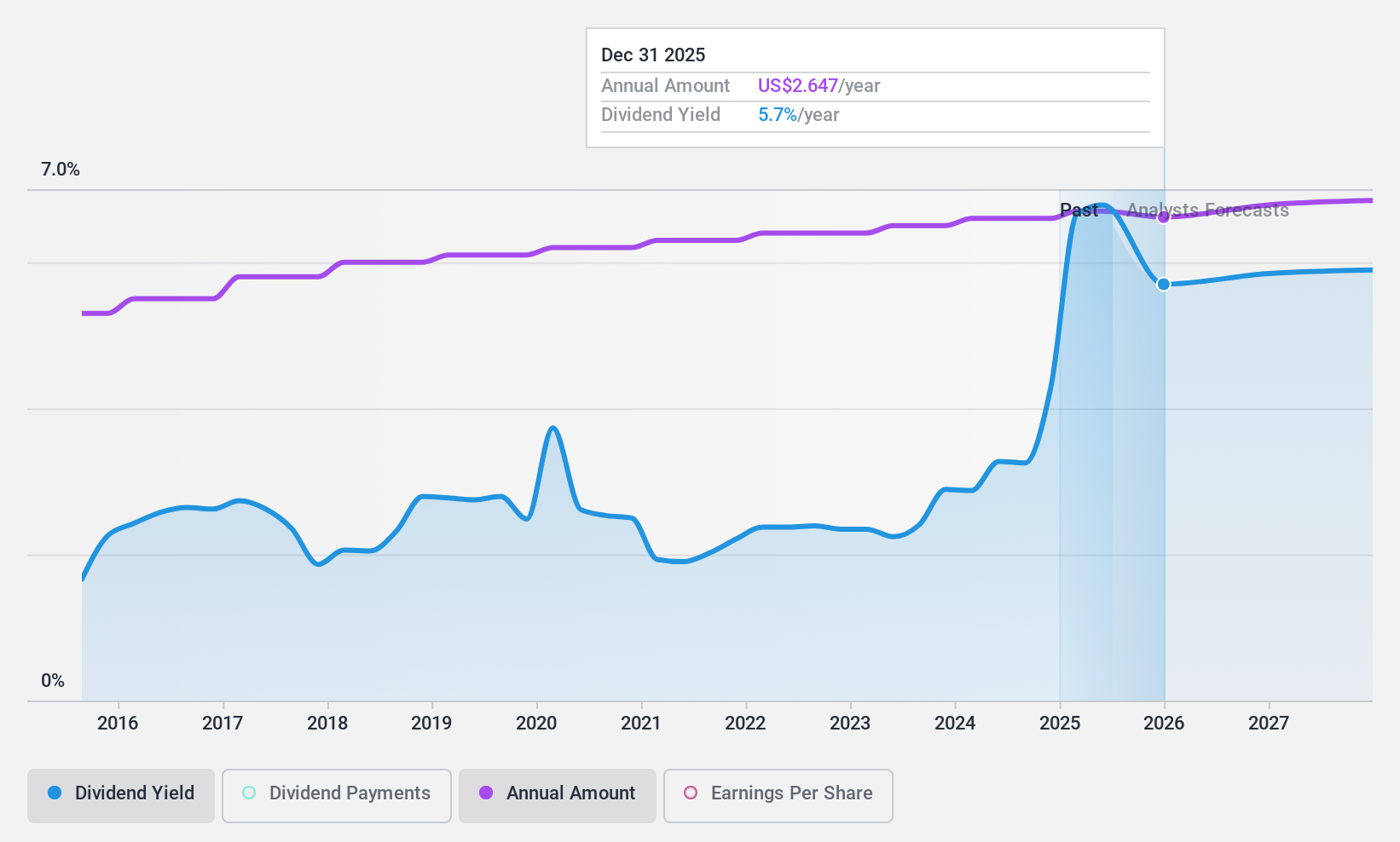

Dividend Yield: 7.4%

Polaris offers a dividend yield of 7.37%, ranking in the top 25% of US dividend payers, with stable growth over the past decade. However, its high payout ratio of 372.5% indicates dividends are not well covered by earnings, though cash flows cover them at an 89.2% cash payout ratio. Recent Q1 results showed a net loss of US$66.8 million, contrasting with previous profitability, while regular quarterly dividends continue at $0.67 per share as affirmed on May 1, 2025.

- Dive into the specifics of Polaris here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Polaris is trading beyond its estimated value.

Turning Ideas Into Actions

- Reveal the 145 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRN

Ituran Location and Control

Provides location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives