- United States

- /

- Capital Markets

- /

- NYSE:NOAH

3 Reliable Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

The market has stayed flat over the past week but is up 13% over the past year, with earnings forecast to grow by 15% annually. In this environment, selecting reliable dividend stocks can provide a steady income stream and potential for growth, making them an attractive option for investors seeking stability and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.59% | ★★★★★☆ |

| Universal (UVV) | 5.61% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.63% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.99% | ★★★★★★ |

| Ennis (EBF) | 5.33% | ★★★★★★ |

| Dillard's (DDS) | 5.95% | ★★★★★★ |

| CompX International (CIX) | 4.65% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.72% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.54% | ★★★★★☆ |

| Carter's (CRI) | 9.66% | ★★★★★☆ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

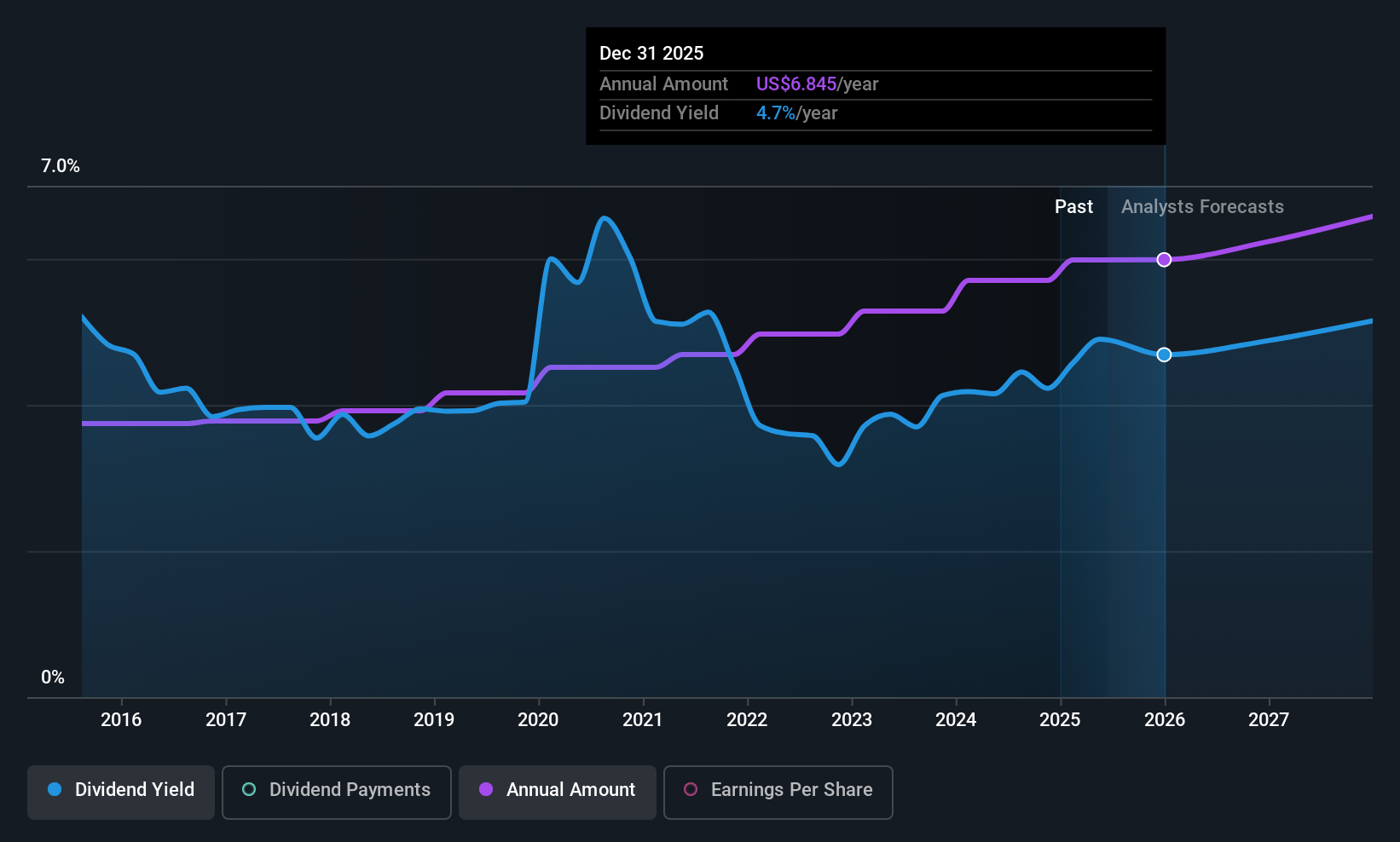

Chevron (CVX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chevron Corporation operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally, with a market cap of $267.23 billion.

Operations: Chevron's revenue segments include $45.00 billion from Upstream - International, $44.96 billion from Upstream - United States, $76.69 billion from Downstream - International, and $79.20 billion from Downstream - United States.

Dividend Yield: 4.4%

Chevron has maintained stable and reliable dividend payments over the past decade, with a current yield of 4.44%. The dividends are covered by earnings, with a payout ratio of 75.3%, and cash flows, at an 88% cash payout ratio. Despite trading significantly below estimated fair value, Chevron's dividend yield is slightly lower than the top quartile in the U.S. market. Recent restructuring efforts include potential asset sales in Asia to streamline operations and reduce costs.

- Navigate through the intricacies of Chevron with our comprehensive dividend report here.

- Our valuation report unveils the possibility Chevron's shares may be trading at a discount.

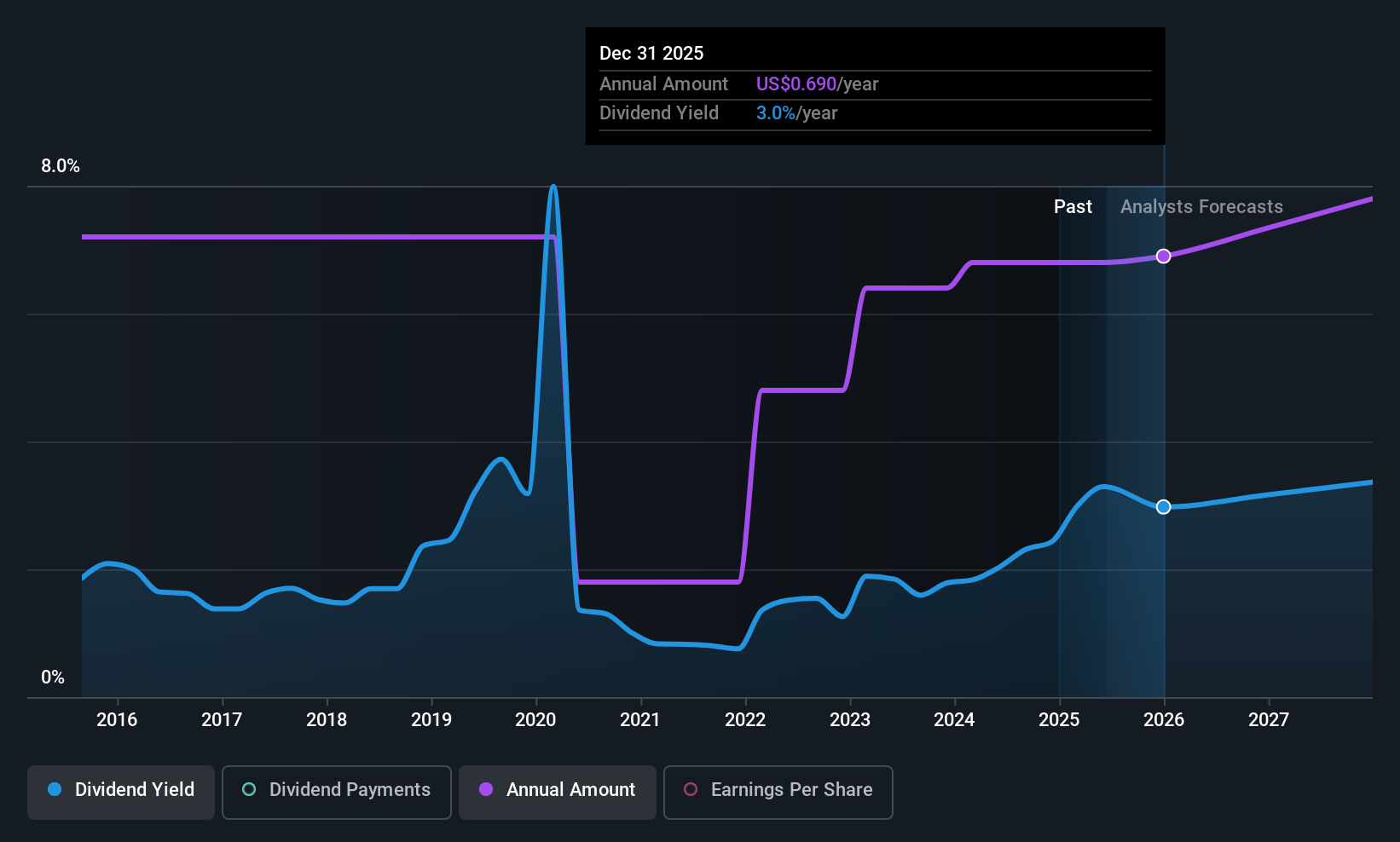

Halliburton (HAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Halliburton Company offers products and services to the global energy industry, with a market cap of approximately $18.95 billion.

Operations: Halliburton's revenue is primarily generated from its Drilling and Evaluation segment, which accounts for $9.56 billion, and its Completion and Production segment, contributing $12.99 billion.

Dividend Yield: 3.1%

Halliburton's dividend yield of 3.07% is below the top quartile in the U.S. market, and its dividend history has been volatile over the past decade. However, dividends are well-covered by earnings and cash flows with payout ratios of 28.4% and 25%, respectively, suggesting sustainability despite a high debt level. The company trades at a significant discount to estimated fair value and recently announced strategic collaborations aimed at technological advancements in subsurface modeling and reservoir management.

- Click here and access our complete dividend analysis report to understand the dynamics of Halliburton.

- Our comprehensive valuation report raises the possibility that Halliburton is priced lower than what may be justified by its financials.

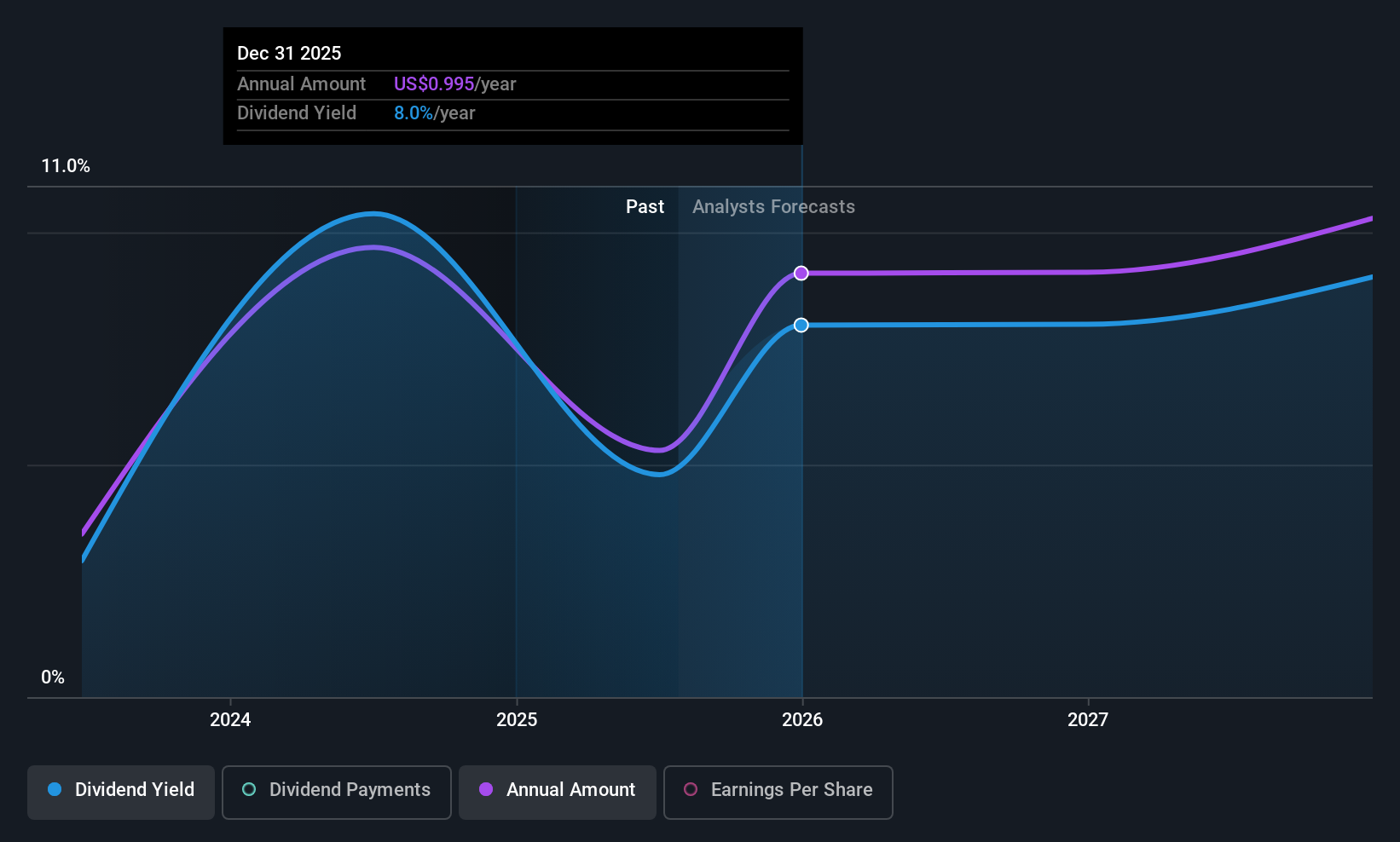

Noah Holdings (NOAH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noah Holdings Limited is a wealth and asset management service provider focusing on investment and asset allocation for high net worth individuals and corporate entities in Mainland China, Hong Kong, and internationally, with a market cap of approximately $776.74 million.

Operations: Noah Holdings Limited generates revenue primarily through its Wealth Management Business, which accounts for CN¥1.77 billion, and its Asset Management Business, contributing CN¥765.38 million.

Dividend Yield: 4.8%

Noah Holdings offers a dividend yield of 4.8%, placing it in the top 25% of U.S. dividend payers, yet its track record is unstable with only two years of payments and recent volatility. The company announced a final and special dividend totaling US$76.6 million, covered by earnings (59% payout ratio) but strained by cash flows (89.5% cash payout ratio). Trading below estimated fair value, Noah presents a mixed picture for dividend sustainability amidst declining profit margins and insider selling activities.

- Take a closer look at Noah Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Noah Holdings shares in the market.

Turning Ideas Into Actions

- Access the full spectrum of 135 Top US Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noah Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOAH

Noah Holdings

Operates as a wealth and asset management service provider with the focus on investment and asset allocation services for high net worth individuals and corporate entities in Mainland of China, Hong Kong, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives