- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources (CRK): Exploring Valuation as Options Activity Signals Investor Anticipation and Earnings Estimates Shift

Reviewed by Simply Wall St

If you are following Comstock Resources (CRK), you have probably noticed a new sense of anticipation in the air. The real trigger appears to be elevated activity in the options market, with the September 19, 2025, $6.00 Call enjoying some of the highest implied volatility among equity options. That kind of options buzz often means traders are bracing for a big move in either direction, possibly tied to a catalyst not yet in the headlines. In addition, earnings forecasts for the current quarter have recently been downgraded, creating a landscape where near-term risk and opportunity seem tightly intertwined.

Looking back, Comstock Resources’ stock has seen its share of ups and downs. Despite a slight dip over the past month and a sharp slide in the last three months, the longer-term numbers are eye-catching: the stock is up 71% over the past year, though still down over the last three years. Recent company results have shown strong revenue and net income growth, but the shift in sentiment hinted at by the downward earnings revisions is hard to ignore. All this means momentum may be shifting, and investors are keenly watching for the next move.

With all this action under the surface, is Comstock Resources setting up for a major breakout, or have market expectations for growth already run ahead of reality?

Most Popular Narrative: 16.5% Undervalued

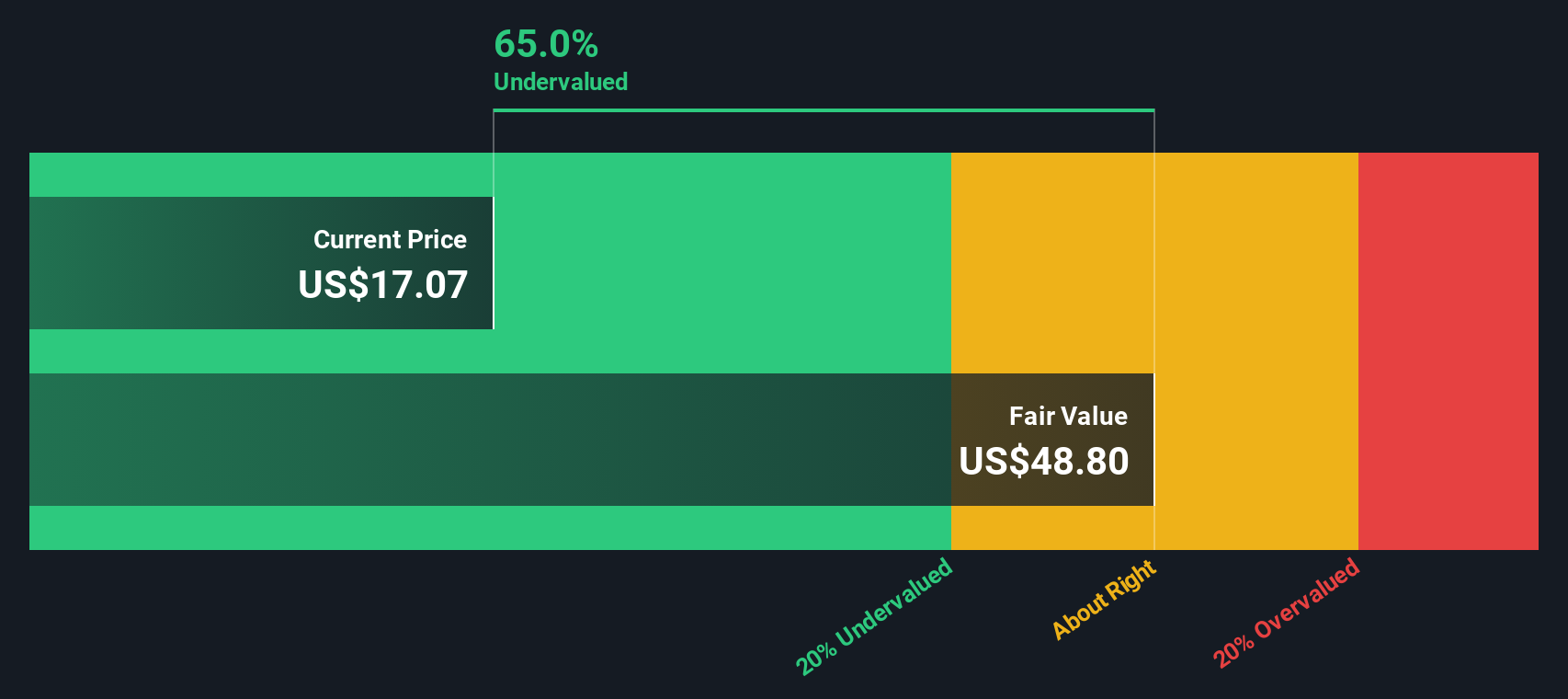

According to the most widely followed narrative, Comstock Resources is trading at a significant discount to its estimated fair value. Analysts believe the stock remains undervalued, with future growth catalysts that could reshape the story in coming years.

The company's proactive development of Western Haynesville-specific midstream infrastructure, such as a major new gas treating plant, is expected to allow for higher production levels, improved price realizations, and increased ability to capitalize on expanding U.S. LNG export capacity. This would help support revenue growth.

What is behind this eye-catching valuation? There is a bold assumption about revenue surge, rising margins, and a major turnaround in future earnings. Want to know which forecasts and numbers make this stock a hot topic? Find out what aggressive financial targets are wired into this fair value estimate.

Result: Fair Value of $19.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent production slowdowns or a rapid downturn in natural gas prices could quickly undermine the upside case for Comstock Resources.

Find out about the key risks to this Comstock Resources narrative.Another View: Our DCF Model Weighs In

While many see Comstock Resources as undervalued based on long-term growth projections, our DCF model offers a fresh perspective. This approach suggests the market may be mispricing future cash flows. This raises another important question for investors.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Comstock Resources Narrative

If the story or numbers do not quite line up with your view, remember that you have the tools to dig deeper and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock even more smart investment opportunities today. See what else is possible for your portfolio by tapping into specialized collections tailored for unique strategies and market trends.

- Target greater returns by scanning for undervalued gems powered by solid cash flow. Start with undervalued stocks based on cash flows.

- Capture the explosive potential of AI’s next winners and pinpoint fast-moving leaders among cutting-edge companies with AI penny stocks.

- Put yourself ahead in the hunt for reliable income by searching for proven companies that consistently deliver strong yields using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)