- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (NYSE:COP) Faces Shareholder Proposal To Remove Emissions Targets

Reviewed by Simply Wall St

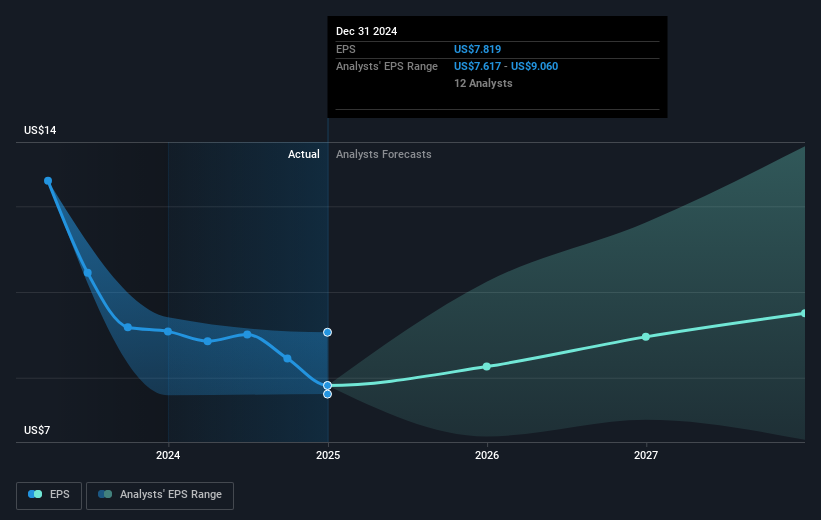

ConocoPhillips (NYSE:COP) recently received a shareholder proposal from the National Legal and Policy Center, requesting the removal of greenhouse gas emissions reduction targets, which the company advised voting against. Over the last quarter, ConocoPhillips's share price increased by 6.5%, during a period where broader market indices exhibited mixed performance amid economic uncertainties. Key drivers of the price move likely include a strong buyback program, with nearly 18.4 million shares repurchased, and a solid ordinary dividend declared at $0.78 per share. The company's Q4 earnings showed declines compared to the previous year, but production levels improved with a notable increase in barrels of oil equivalent per day. These developments occurred as the market experienced an 8.1% growth over the past 12 months. This context highlights ConocoPhillips's ability to navigate its strategic landscape amidst broader market challenges.

Buy, Hold or Sell ConocoPhillips? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ConocoPhillips has delivered substantial total shareholder returns of 280.48% over the past five years. This impressive performance, despite recent underperformance against the US Oil and Gas industry and broader market over the past year, can be attributed to several key factors. The company's earnings have grown significantly, with an average annual increase of 27.1%, underlining its strong financial performance. The share repurchase program has been another major factor, enhancing shareholder returns with 432.58 million shares repurchased since November 2016, totaling over US$34.27 billion.

Moreover, consistent dividend payments have bolstered returns, with recent affirmations of ordinary dividends at US$0.78 per share. While earnings in 2024 faced some declines, strong production levels offered stability. The company also engaged with environmental concerns, having advised against a shareholder proposal to remove emissions targets, reflecting its commitment to sustainable practices amidst investor scrutiny.

Our valuation report here indicates ConocoPhillips may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Undervalued with excellent balance sheet and pays a dividend.