- United States

- /

- Oil and Gas

- /

- NYSE:CNX

CNX Resources (CNX): Revisiting Valuation After Moody’s Upgrades Credit Outlook to Positive

Reviewed by Simply Wall St

Moody’s decision to shift CNX Resources (CNX) and its midstream arm to a positive outlook puts a spotlight on the company’s balance sheet discipline, cash generation plans, and long term debt reduction story.

See our latest analysis for CNX Resources.

That brighter outlook from Moody’s comes after a strong run, with CNX’s 90 day share price return of 25.74 percent helping build momentum on top of a hefty 5 year total shareholder return of 250.87 percent, even as the stock has cooled slightly in the very short term.

If CNX’s improving credit story has you rethinking your energy exposure, it might be a good moment to see what else is out there and discover fast growing stocks with high insider ownership.

With credit momentum building and years of market beating returns already banked, the key question now is whether CNX’s shares still trade at a meaningful discount or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 14.7% Overvalued

With CNX Resources last closing at $38.49 against a widely followed fair value of about $33.57, the current share price bakes in a premium that hinges on ambitious long term cash flow and margin assumptions.

Favorable policy and regulatory shifts towards cleaner burning natural gas including programs like 45Z tax credits and renewable energy attribute markets are creating new, high margin revenue streams (e.g., RMG sales, environmental credits), potentially enhancing both net margins and free cash flow.

Curious how robust demand, surging margins, and aggressive buybacks all combine into that punchy valuation? The narrative rests on bold compounding assumptions. See what they are.

Result: Fair Value of $33.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer gas realizations and tougher eligibility for tax credits could undercut the bullish cash flow story and force a rethink on today’s premium pricing.

Find out about the key risks to this CNX Resources narrative.

Another Take: Earnings Multiple Sends a Different Signal

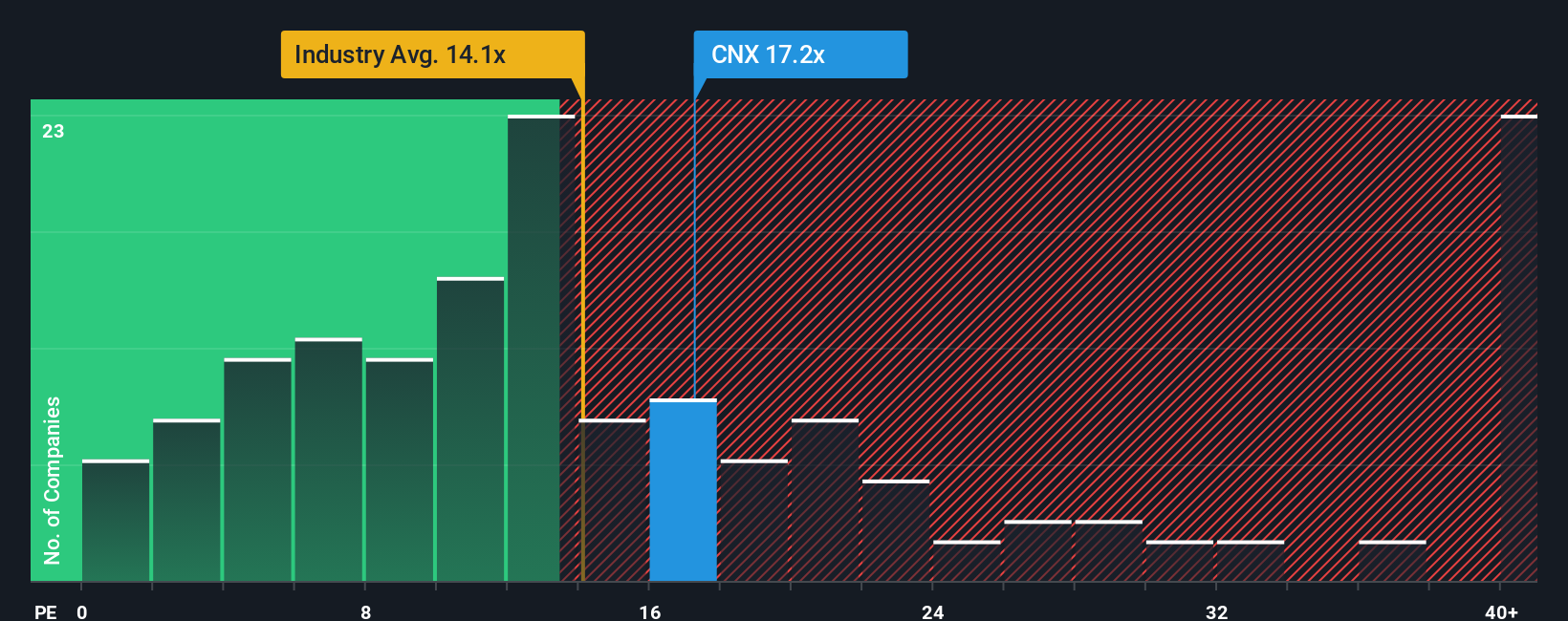

While the narrative points to CNX trading around 14.7 percent above fair value, its current price to earnings ratio of 17.8 times looks cheaper than both a 20.5 times fair ratio and peers at 51 times, even though it is richer than the 13.3 times industry average. Is the market mispricing the risk or the opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CNX Resources Narrative

If this perspective does not quite fit your view, or you prefer to run the numbers yourself, you can craft a custom narrative in minutes: Do it your way.

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work so you do not miss high conviction opportunities that match your strategy and risk profile.

- Capture turnaround potential by scanning these 3613 penny stocks with strong financials that pair low share prices with financial foundations that may support future growth potential.

- Explore structural shifts in medicine by reviewing these 30 healthcare AI stocks where intelligent diagnostics and data driven therapies are influencing long term growth trajectories.

- Identify reliable cash flow candidates with these 13 dividend stocks with yields > 3% that combine yields above 3 percent with balance sheets designed for durability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)