- United States

- /

- Oil and Gas

- /

- NasdaqGS:GPRE

Green Plains Inc. (NASDAQ:GPRE) Might Not Be As Mispriced As It Looks

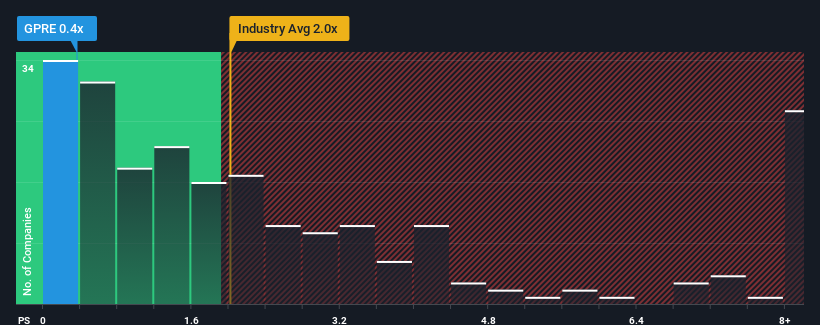

Green Plains Inc.'s (NASDAQ:GPRE) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in the United States have P/S ratios greater than 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Green Plains

What Does Green Plains' Recent Performance Look Like?

Green Plains' negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue performance to degrade further, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Green Plains.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Green Plains' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 66% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.7% per year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 2.6% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Green Plains' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Green Plains currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 1 warning sign for Green Plains that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GPRE

Green Plains

Produces low-carbon fuels in the United States and internationally.

Undervalued with excellent balance sheet.