- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLNE

Could Clean Energy Fuels’ (CLNE) New Hydrogen Bet Redefine Its Low-Carbon Growth Story?

Reviewed by Sasha Jovanovic

- Clean Energy Fuels Corp. recently announced it will construct a US$11.3 million hydrogen fueling station for Foothill Transportation and has begun building three renewable natural gas production plants expected to yield three million gallons of RNG per year from 2026.

- This expansion, supported in part by federal grants, underlines the company's approach to scaling clean fuel infrastructure and diversifying its low-carbon energy portfolio.

- We'll now explore how this renewed investment in hydrogen and renewable natural gas infrastructure may influence Clean Energy Fuels' investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Clean Energy Fuels Investment Narrative Recap

For Clean Energy Fuels shareholders, confidence often rests on strong policy support for renewable fuels, ongoing regulatory incentives, and increased demand for low-carbon transport solutions. The recent hydrogen fueling station contract and new RNG production plants mark operational momentum but are unlikely to materially shift the most pressing short-term catalyst: improved RNG vehicle adoption rates amid uncertainty around new engine take-up. Persistent ramp-up delays and operational challenges at new RNG sites remain the biggest near-term risks, especially with ongoing losses in this area.

Among recent developments, the August 2025 strategic alliance with Hexagon Agility stands out. This initiative, aimed at accelerating heavy-duty commercial fleet conversions to natural gas, directly addresses adoption rates, one of the company's most important near-term growth drivers in light of the latest hydrogen and RNG projects moving forward.

Yet, while Clean Energy Fuels expands on multiple fronts, investors should know that regulatory ambiguity and slow customer transitions continue to present...

Read the full narrative on Clean Energy Fuels (it's free!)

Clean Energy Fuels' narrative projects $474.7 million revenue and $70.1 million earnings by 2028. This requires 4.1% yearly revenue growth and a $273.6 million increase in earnings from -$203.5 million currently.

Uncover how Clean Energy Fuels' forecasts yield a $4.49 fair value, a 54% upside to its current price.

Exploring Other Perspectives

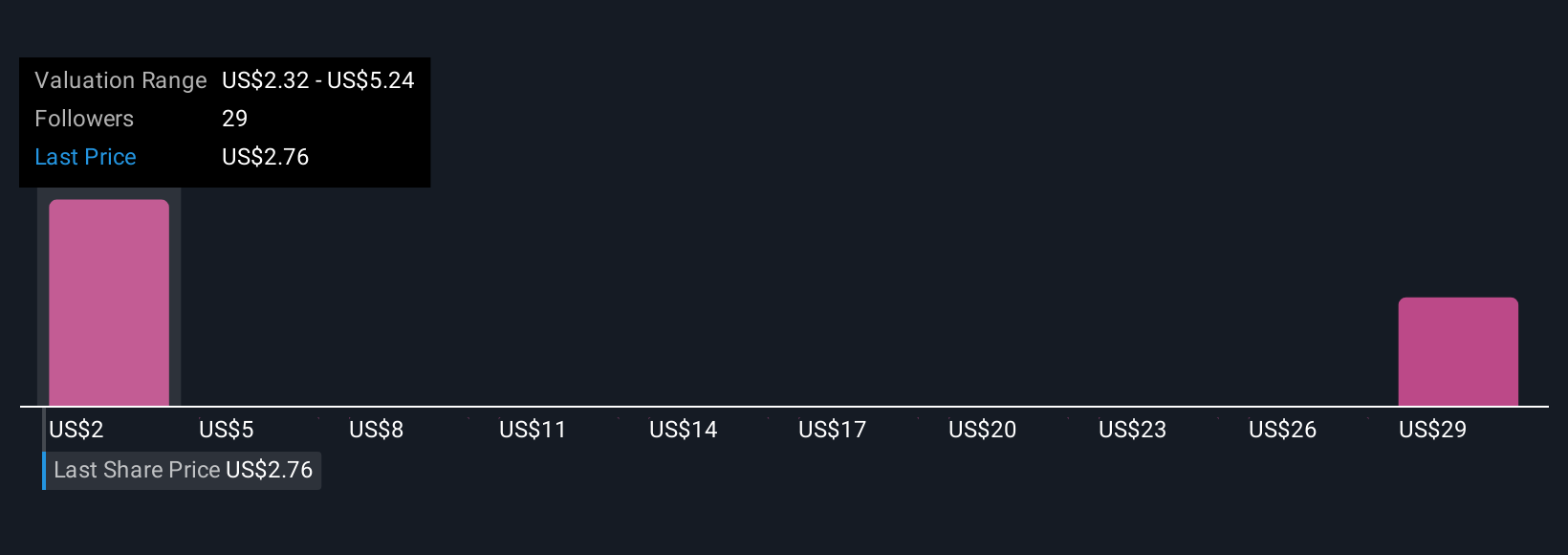

Four community members from Simply Wall St estimated fair values for Clean Energy Fuels between US$2.32 and US$31.57. With operational execution risks still top of mind, these wide-ranging outlooks show just how much opinions on the company's future can diverge; explore several viewpoints to better inform your own.

Explore 4 other fair value estimates on Clean Energy Fuels - why the stock might be worth 21% less than the current price!

Build Your Own Clean Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clean Energy Fuels research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Clean Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clean Energy Fuels' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLNE

Clean Energy Fuels

Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives