Last Update 28 Sep 25

Clean Energy Fuels’ valuation outlook remains stable, with only marginal improvements in net profit margin and future P/E, leaving the consensus analyst price target unchanged at $4.49.

What's in the News

- Clean Energy Fuels awarded a contract to design, build, and maintain a second hydrogen fueling station for Foothill Transit, supporting its growing hydrogen fuel cell and RNG bus fleet; the $11.3 million project is partially grant-funded and construction is scheduled to begin in mid-2026.

- Broke ground on three renewable natural gas (RNG) production facilities in partnership with Maas Energy Works, expected to produce approximately three million gallons of RNG annually and cost $80 million, targeting completion in 2026.

- Announced a strategic partnership with Hexagon Agility and Cummins Inc. to launch Pioneer Clean Fleet Solutions, an independent company focused on leasing low-carbon heavy-duty commercial vehicles bundled with trucks, fuel, and service.

- Provided 2025 earnings guidance, expecting a net loss of $217.2 million to $212.2 million.

- Completed the repurchase of 14,301,158 shares (6.75% of outstanding) for $31.33 million under the existing buyback program.

- Secured multiple new RNG supply and infrastructure deals with transit fleets and municipalities, including LA Metro, The Rapid (Grand Rapids), Loudoun County, Union City, Gillig LLC, and Kings County Area Public Transit Agency, supporting fleet transitions to RNG and clean fuels nationwide.

Valuation Changes

Summary of Valuation Changes for Clean Energy Fuels

- The Consensus Analyst Price Target remained effectively unchanged, at $4.49.

- The Net Profit Margin for Clean Energy Fuels remained effectively unchanged, moving only marginally from 14.76% to 14.89%.

- The Future P/E for Clean Energy Fuels remained effectively unchanged, moving only marginally from 16.64x to 16.51x.

Key Takeaways

- Expanded regulatory support and emerging subsidies are positioning RNG as a key decarbonization tool, boosting Clean Energy Fuels' recurring revenue and profit margins.

- Rising RNG production capacity, supply chain control, and strategic partnerships with major fleet operators are driving stable growth and higher-margin sales.

- Uncertain RNG vehicle adoption, project delays, volatile credit markets, reliance on government incentives, and rising competition from zero-emission alternatives threaten growth and profitability.

Catalysts

About Clean Energy Fuels- Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

- Recent and expected regulatory developments (such as expanded recognition of negative-emissions RNG via the One Big Beautiful Bill Act and tightening emissions regulations in key states like California) are increasing policy support for RNG as a decarbonization tool, which should drive higher fleet conversions and increase Clean Energy Fuels' long-term recurring revenue from both existing and new customers.

- The forthcoming activation of the 45Z production tax credit, recognition of investment tax credits (ITCs), and stronger subsidy environments are set to reduce effective RNG production costs and boost project returns, supporting potential margin expansion and increasing future net earnings.

- Steady expansion in RNG supply capabilities-evident in the ramp-up of several new dairy RNG production facilities-should enhance vertical integration and supply security, increasing the share of high-margin RNG sales and driving revenue growth as production scales.

- Strategic partnerships and long-term contracts with major fleet operators (including Amazon, waste haulers, and transit agencies) are underpinning consistent volume increases at proprietary fueling stations, supporting stable top-line growth, higher asset utilization, and the potential for improved EBITDA margins.

- Tight supply/demand conditions at fueling stations-especially as heavy-duty trucking and logistics customers return to equipment purchases amid regulatory clarity-are likely to support improved fueling margins, leading to higher baseline operating margins and supporting earnings improvement as demand accelerates.

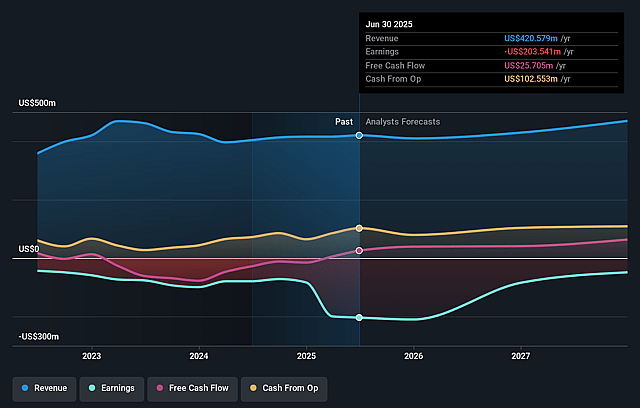

Clean Energy Fuels Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clean Energy Fuels's revenue will grow by 4.1% annually over the next 3 years.

- Analysts are not forecasting that Clean Energy Fuels will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Clean Energy Fuels's profit margin will increase from -48.4% to the average US Oil and Gas industry of 14.8% in 3 years.

- If Clean Energy Fuels's profit margin were to converge on the industry average, you could expect earnings to reach $70.1 million (and earnings per share of $0.34) by about September 2028, up from $-203.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, up from -2.7x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 1.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.81%, as per the Simply Wall St company report.

Clean Energy Fuels Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demand growth in the heavy-duty trucking segment for RNG vehicles remains uncertain due to slower than anticipated adoption of the Cummins X15N engine, ongoing regulatory ambiguity, and macro headwinds (such as significantly depressed new truck sales and acquisition rates in California and nationwide), presenting a risk to revenue growth and station utilization rates.

- Ramp-up delays and operational challenges at several new dairy RNG projects, with extended timelines and ongoing losses at five of six operating projects, increase the risk that near

- and mid-term production and monetization targets won't be met, putting pressure on margins, earnings, and cash flow.

- The company's profitability remains highly sensitive to the volatility of RIN and LCFS credit pricing; persistent fluctuations (noted 20% drop in LCFS prices and lower RIN pricing year-on-year) could disrupt predictable earnings streams and compress net margins despite growth in fuel volumes.

- A meaningful portion of Clean Energy's recent and anticipated cash flow improvement is supported by government-backed incentives and investment tax credits (ITCs); changes in policy, delays in Treasury guidance, or over-reliance on one credit/tax regime could negatively impact future cash generation and increase capital intensity risk.

- Battery electric and hydrogen-fueled alternatives continue to receive increasing policy support and subsidies for zero-emission solutions in core Clean Energy markets (like California), heightening competitive threats over the longer term and potentially diminishing the future addressable market for RNG-fueled vehicles, which would ultimately weigh on long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.494 for Clean Energy Fuels based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $2.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $474.7 million, earnings will come to $70.1 million, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 7.8%.

- Given the current share price of $2.5, the analyst price target of $4.49 is 44.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Clean Energy Fuels?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.