- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLMT

Investing in Calumet (NASDAQ:CLMT) five years ago would have delivered you a 506% gain

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. To wit, the Calumet, Inc. (NASDAQ:CLMT) share price has soared 506% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 23% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 14% in 90 days). It really delights us to see such great share price performance for investors.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

See our latest analysis for Calumet

Given that Calumet didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Calumet can boast revenue growth at a rate of 10% per year. That's a fairly respectable growth rate. However, the share price gain of 43% during the period is considerably stronger. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

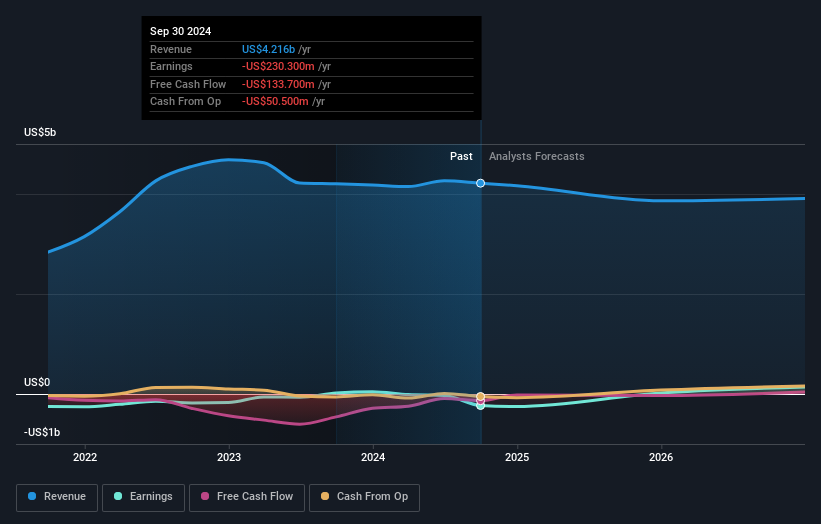

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Calumet stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Calumet shareholders are up 27% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 43% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Calumet better, we need to consider many other factors. Take risks, for example - Calumet has 4 warning signs (and 1 which is significant) we think you should know about.

We will like Calumet better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLMT

Calumet

Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives