- United States

- /

- Banks

- /

- NasdaqGS:BSRR

Sierra Bancorp And 2 More Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.1%, contributing to an impressive 11% climb over the past year, with earnings forecasted to grow by 14% annually. In this context of robust market performance, selecting dividend stocks like Sierra Bancorp can be a strategic way to enhance your portfolio by potentially providing steady income and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.72% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.76% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.72% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.15% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.83% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.80% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.85% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 4.85% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.33% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.96% | ★★★★★☆ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

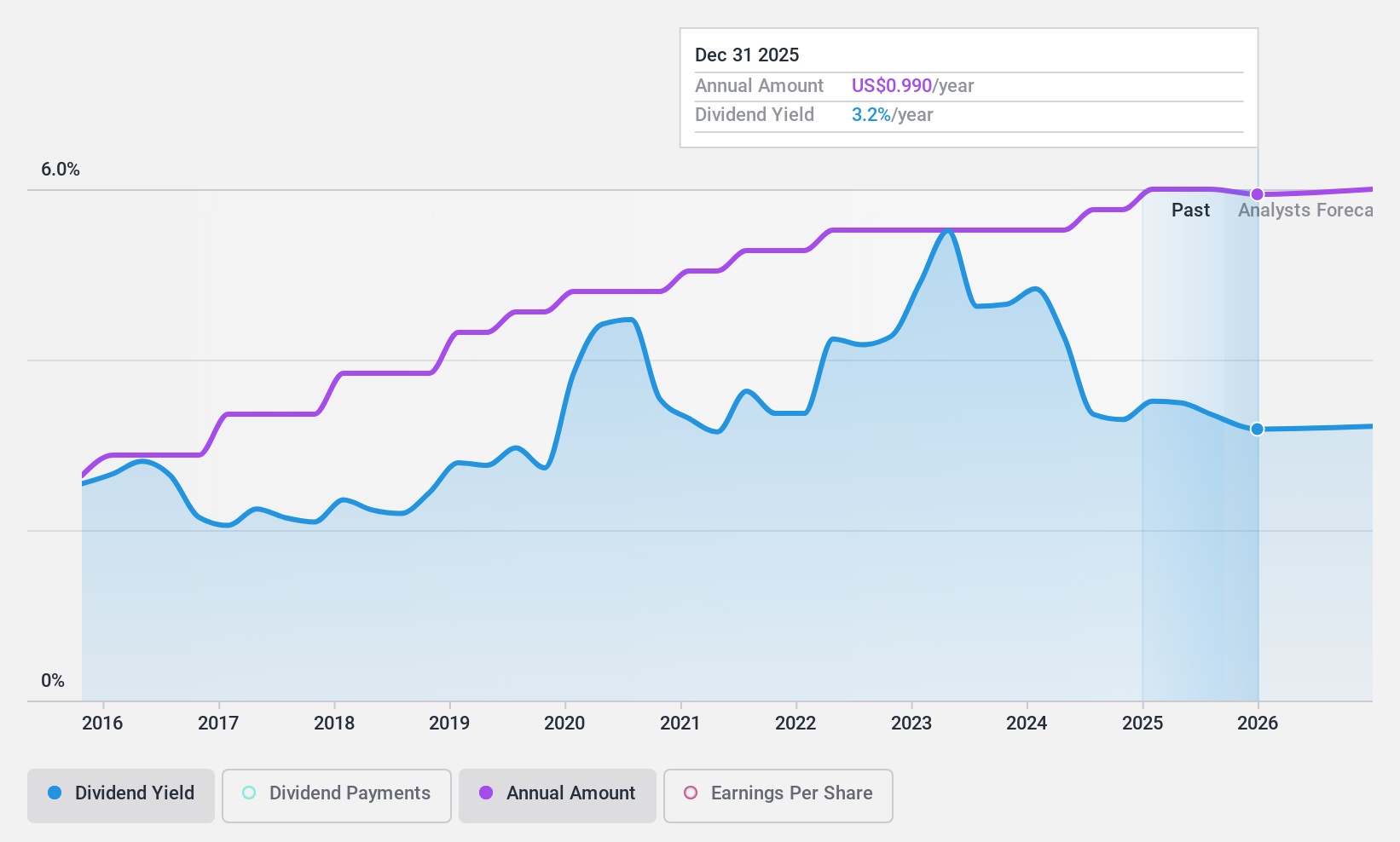

Sierra Bancorp (NasdaqGS:BSRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sierra Bancorp, with a market cap of $386.66 million, is the bank holding company for Bank of the Sierra, offering retail and commercial banking products and services to individuals and businesses in California.

Operations: Sierra Bancorp generates its revenue primarily through its banking segment, which accounts for $144.26 million.

Dividend Yield: 3.5%

Sierra Bancorp has a stable dividend history, with consistent payments over the past decade and a current quarterly dividend of $0.25 per share. Despite trading at 45.7% below its estimated fair value and offering dividends covered by earnings with a payout ratio of 34.3%, its yield of 3.5% is lower than the top quartile in the U.S. market. Recent buybacks totaling $20 million reflect strategic capital management, though profitability growth remains modest at 13.9%.

- Click here to discover the nuances of Sierra Bancorp with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sierra Bancorp's current price could be quite moderate.

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $5.75 billion.

Operations: Chord Energy Corporation generates revenue primarily from its exploration and production activities of crude oil, NGLs, and natural gas, totaling approximately $5.04 billion.

Dividend Yield: 6.8%

Chord Energy's dividend, with a yield of 6.8%, ranks in the top quartile among U.S. dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 42.7% and 35.6%, respectively. However, its four-year dividend history is marked by volatility and recent shareholder dilution may concern investors seeking stability. Recent financial results show increased revenue at US$1.22 billion, though earnings per share have declined compared to last year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Chord Energy.

- Insights from our recent valuation report point to the potential undervaluation of Chord Energy shares in the market.

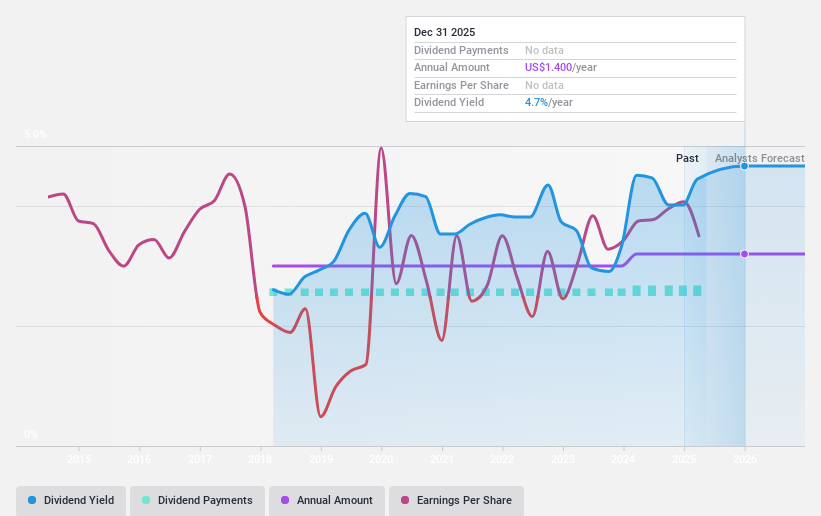

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Indemnity Group, LLC operates through its subsidiaries to offer specialty property and casualty insurance and reinsurance products in the United States, with a market cap of approximately $426.53 million.

Operations: Global Indemnity Group's revenue primarily derives from its specialty property and casualty insurance and reinsurance offerings across the United States.

Dividend Yield: 4.7%

Global Indemnity Group's dividend yield of 4.67% places it among the top U.S. dividend payers, with payouts well-covered by earnings and cash flows at ratios of 52.4% and 51.5%, respectively. Despite a reliable growth in dividends over its seven-year history, recent financial performance showed a net loss for Q1 2025, contrasting with prior profitability, which may raise concerns about future stability for dividend investors.

- Dive into the specifics of Global Indemnity Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, Global Indemnity Group's share price might be too optimistic.

Make It Happen

- Dive into all 141 of the Top US Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sierra Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSRR

Sierra Bancorp

Operates as the bank holding company for Bank of the Sierra that provides retail and commercial banking products and services to individuals and businesses in California.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives