- United States

- /

- Specialty Stores

- /

- NYSE:BWMX

3 Prominent US Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge following a robust jobs report, with major indices like the Dow Jones Industrial Average reaching record highs, investors are increasingly focused on opportunities that offer reliable returns amidst fluctuating economic conditions. In this vibrant market environment, dividend stocks stand out as appealing options for their potential to provide steady income and stability, making them worthy considerations for those looking to balance growth with income generation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.90% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.46% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.73% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.38% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.84% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.43% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.38% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.33% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.32% | ★★★★★★ |

Click here to see the full list of 176 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation operates as an independent exploration and production company in the United States with a market cap of approximately $8.44 billion.

Operations: Chord Energy Corporation generates revenue of approximately $4.15 billion from the exploration and production of crude oil, NGLs, and natural gas.

Dividend Yield: 8.2%

Chord Energy's dividend appeal is mixed, with a high yield of 8.22% placing it in the top 25% of U.S. dividend payers, supported by a reasonable payout ratio of 52.7%. However, its dividends have been volatile and only paid for four years, raising sustainability concerns despite being covered by earnings and cash flows. Recent earnings show stable revenue growth but declining net income margins, potentially impacting future dividend reliability amid ongoing share dilution efforts.

- Click here to discover the nuances of Chord Energy with our detailed analytical dividend report.

- The analysis detailed in our Chord Energy valuation report hints at an deflated share price compared to its estimated value.

Betterware de MéxicoP.I. de (NYSE:BWMX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Betterware de México, S.A.P.I. de C.V. is a direct-to-consumer selling company operating in the United States and Mexico with a market cap of $496.46 million.

Operations: Betterware de México, S.A.P.I. de C.V. generates its revenue through direct-to-consumer sales in the United States and Mexico.

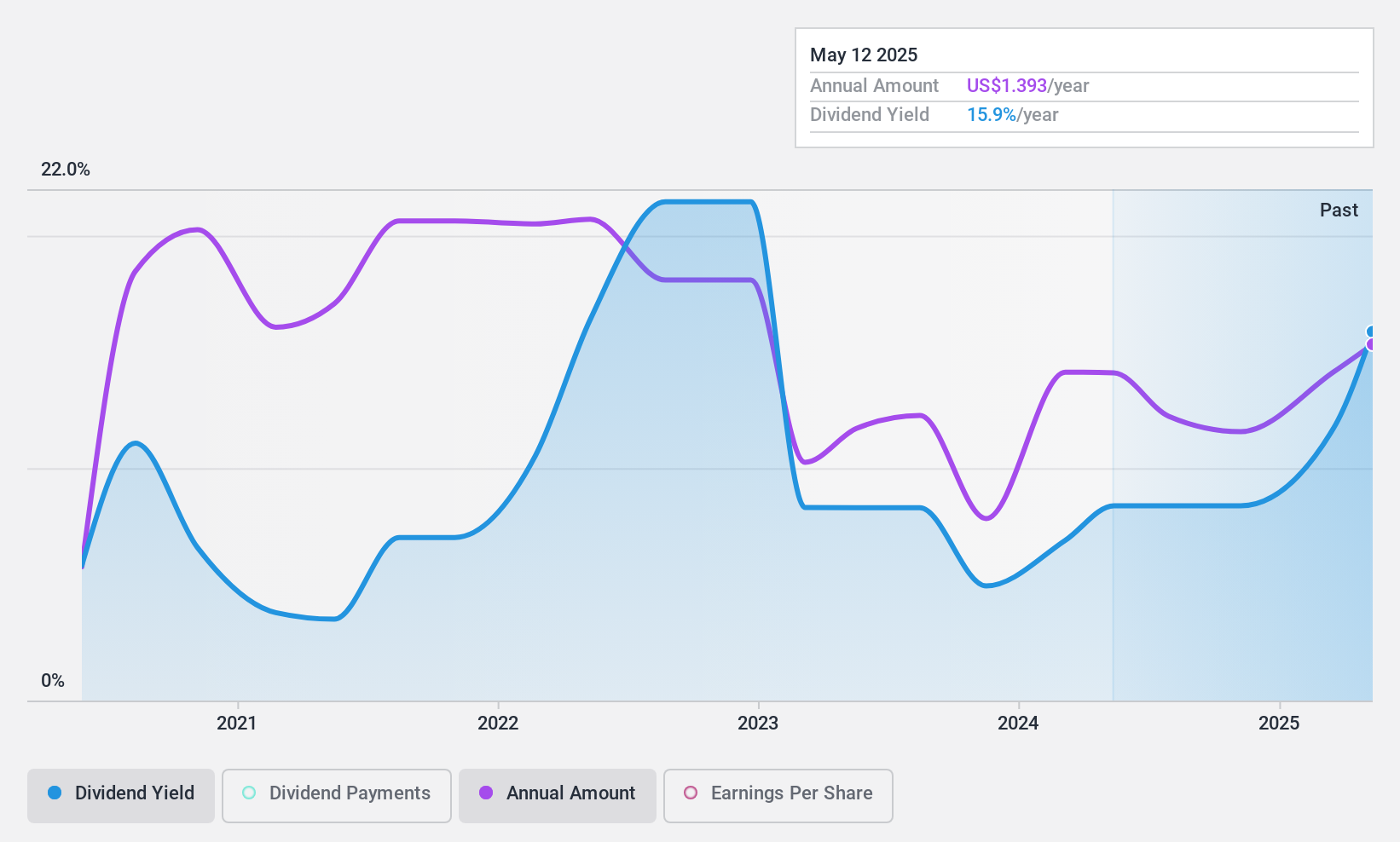

Dividend Yield: 8.3%

Betterware de México offers a strong dividend yield of 8.34%, ranking in the top 25% of U.S. dividend payers, with dividends well-covered by earnings (payout ratio: 39.7%) and cash flows (cash payout ratio: 45.5%). Despite trading at good value, concerns arise from its high debt levels and volatile dividend history over four years. Recent earnings growth supports potential stability, but the recent decrease in declared dividends highlights sustainability challenges for investors seeking reliable income streams.

- Navigate through the intricacies of Betterware de MéxicoP.I. de with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Betterware de MéxicoP.I. de is priced lower than what may be justified by its financials.

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas primarily in the United States and Trinidad and Tobago with a market cap of approximately $75.69 billion.

Operations: EOG Resources generates revenue of $24.11 billion from its crude oil and natural gas exploration and production activities.

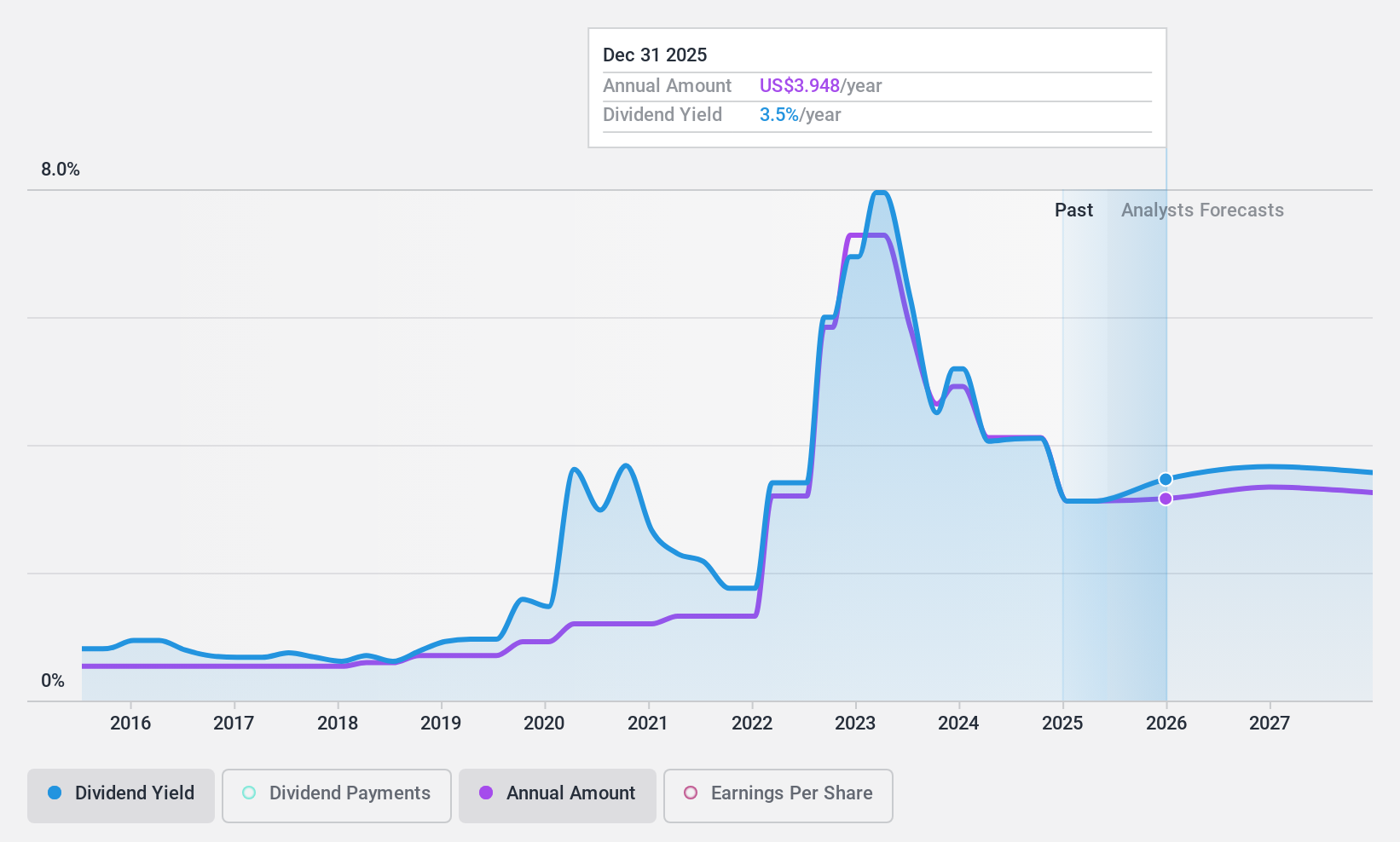

Dividend Yield: 3.9%

EOG Resources' dividend yield of 3.86% is lower than the top 25% of U.S. dividend payers, but its payout ratio of 27.3% and cash payout ratio of 57.8% indicate dividends are well-covered by earnings and cash flows. The company has a history of volatile dividends over the past decade, raising concerns about reliability despite recent increases in payments. EOG trades at a significant discount to estimated fair value, enhancing its appeal for value-focused investors.

- Unlock comprehensive insights into our analysis of EOG Resources stock in this dividend report.

- According our valuation report, there's an indication that EOG Resources' share price might be on the cheaper side.

Key Takeaways

- Delve into our full catalog of 176 Top US Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Betterware de MéxicoP.I. de, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Betterware de MéxicoP.I. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWMX

Betterware de MéxicoP.I. de

Operates as a direct-to-consumer selling company in the United Staes and Mexico.

Undervalued with moderate growth potential.

Market Insights

Community Narratives